There’s a unique financial tool designed specifically for you, the medical professional, that can ease your home-buying journey: physician loans. These specialized loans offer benefits tailored to your unique financial situation, including flexibility with student debt and favorable terms. In this post, we’ll unveil the top five advantages of physician loans that you may not have been aware of, empowering you to make informed decisions as you launch on your homeownership journey.

Understanding Physician Loans

For many aspiring and established physicians, financing a home purchase can be a daunting challenge, especially when faced with unique financial situations. Physician loans are designed specifically to cater to the needs of medical professionals, providing them with an alternative path to homeownership. These special mortgage products take into account your future earning potential rather than your current debt-to-income ratio, making it easier for you to secure funding when traditional loans may not be as accessible.

What Are Physician Loans?

After completing medical school and residency, many physicians find themselves in a position where they’ve accrued significant student debt, yet possess a bright future as high earners. Physician loans are mortgage options tailored exclusively for healthcare professionals, accommodating the complexities of your financial landscape. Typically, these loans allow you to borrow 100% of the home’s value without the need for private mortgage insurance (PMI), giving you an advantage when entering the housing market.

How They Differ from Conventional Loans

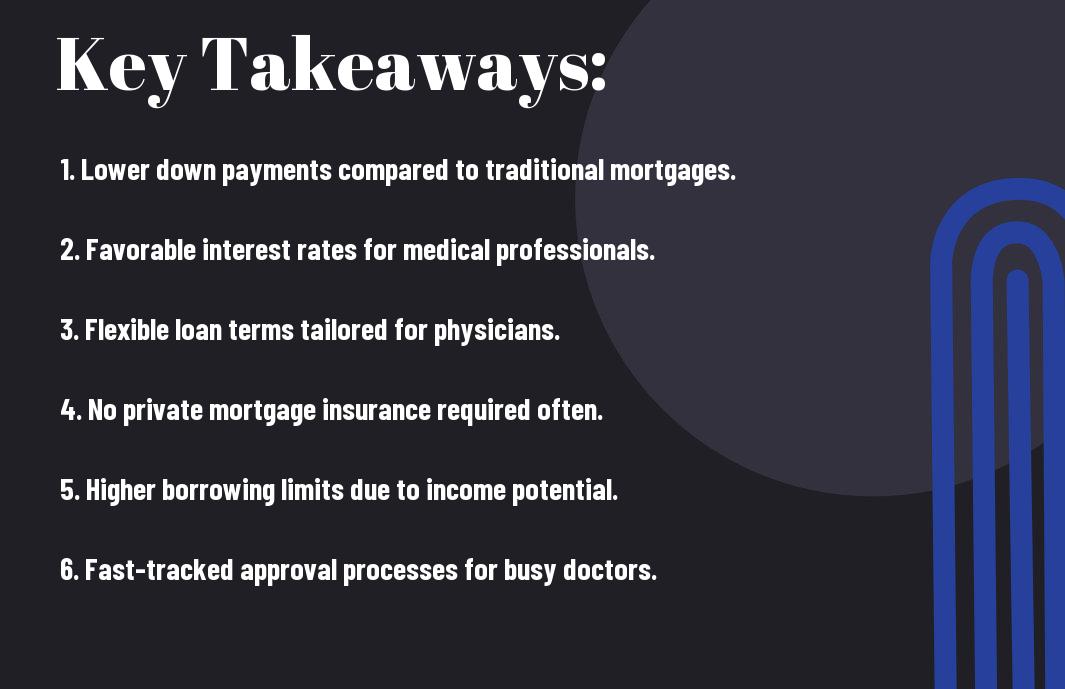

Besides the absence of PMI, physician loans come with several other benefits that set them apart from conventional loans. Conventional mortgages often require a substantial down payment, often ranging from 10% to 20%, which isn’t always feasible for you as a new physician burdened by student loans. Additionally, these specialized loans are more lenient regarding debt-to-income ratios and allow for a more straightforward approval process.

They also tend to offer more flexible underwriting guidelines, which can help you secure a mortgage despite the heavy student loans that might hinder your application for a conventional loan. Many lenders understand that a physician’s earning potential greatly surpasses that of other professions, allowing for more favorable terms and conditions tailored to your unique situation. This makes physician loans an attractive option if you’re looking to buy a home and establish your roots as a medical professional while managing your financial obligations effectively.

Benefit 1: Low or No Down Payment

Some physicians are surprised to learn that one of the standout features of physician loans is the opportunity to secure financing with a low or even no down payment. As you venture into your medical career, this aspect can significantly alleviate the financial pressure often associated with purchasing a home. Many traditional loan programs typically require a down payment of anywhere from 10% to 20%, which can be a substantial financial obstacle for someone just starting in the medical field. However, physician loans cater specifically to your unique situation, allowing you to invest in a home without needing to divert extensive savings toward a down payment.

This flexibility not only makes homeownership more accessible but also empowers you to allocate funds for other vital areas such as student loan repayment or investing in your future. Additionally, the ability to finance 100% of the home’s value can open up opportunities to purchase a higher-value property or live in your preferred neighborhood. Ultimately, this benefit can set the stage for long-term financial stability and security as you transition into your new role as a physician, allowing you to focus on your practice without the added weight of hefty upfront costs.

Benefit 2: Favorable Interest Rates

Any savvy borrower understands that interest rates can make a significant difference in the overall cost of a loan. As a physician, you stand to benefit from specialized physician loans that often offer lower interest rates compared to standard mortgage loans. Lenders recognize the stability and earning potential associated with your profession, which can translate to financial advantages for you when securing a loan. This means that with physician loans, the overall cost of borrowing is diminished, allowing you to allocate more of your income toward building equity in your home and less toward interest payments.

Having access to favorable interest rates not only reduces your monthly payments but also gives you more strategic options for managing your finances. You may find that these savings can be redirected toward other important aspects of your life, such as repaying student debt or investing in retirement accounts. By tapping into the favorable interest rates offered through physician loans, you position yourself to achieve your financial goals more efficiently, which can be instrumental in your journey as a healthcare professional.

Benefit 3: Increased Borrowing Power

Even as a physician, navigating the world of loans can be daunting. However, one of the significant advantages of physician loans is the potential for increased borrowing power. Unlike conventional loans, which often impose strict limits based on your credit score or standard debt-to-income ratios, physician loans take into account your unique financial situation. Lenders understand the earning potential in your field, allowing you to qualify for larger amounts that can help you secure the home of your dreams without overwhelming financial strain.

By capitalizing on this enhanced borrowing power, you can leverage your future income against your current financial obligations, giving you the confidence to invest in a larger home or even enter a more favorable neighborhood. This flexibility allows you to establish a stable base for your family while also planning for your future. It’s necessary to assess how much you can responsibly borrow, but this increased capacity can significantly ease the process of purchasing a home, helping you make a sound investment in your professional and personal life.

Benefit 4: Flexibility with Income Verification

Now, one of the standout advantages of physician loans is the flexibility they offer regarding income verification. Unlike conventional loan products that often require you to provide extensive documentation of your earnings, physician loans can streamline this process. This is particularly beneficial for medical professionals who may be in residency or fellowship programs, where your income may be limited or temporarily variable. By accommodating different income structures, these loans allow you to qualify for the amount you need without being bogged down by exhaustive paperwork.

This flexibility not only eases the burden during the application process but can also pave the way for significant financial opportunities. You won’t have to worry about providing multiple years of tax returns or showing steady employment history as a practice requirement. Instead, lenders are more likely to consider your future earning potential—after all, you are on a promising career path. This recognition of your unique financial situation and earning trajectory enables you to secure your loan and focus on your career without the added stress of complicated income verification hurdles.

Benefit 5: Access to Special Loan Programs

Many financial institutions offer special loan programs tailored specifically for healthcare professionals like you. These programs are designed to accommodate the unique financial situation that many physicians face, including high debt from medical school and potentially lower income during residency. By taking advantage of these specialized programs, you can access competitive interest rates and flexible repayment options that fit your lifestyle better than traditional loan programs would.

Additionally, some lender initiatives may waive certain fees or provide perks such as down payment assistance, making it easier for you to move into your new home. With these tailored loan solutions, you are not just a number but rather a valued candidate who can benefit from terms that align with your journey as a medical professional. Exploring these options allows you to make informed decisions that set you up for financial success as you transition into your career.

Summing up

Summing up, understanding the top benefits of physician loans can significantly impact your financial future as a medical professional. These loans often feature competitive interest rates, reduced down payment requirements, and accommodate your unique situation as a physician, including student debt considerations. Additionally, physician loans streamline the approval process, helping you secure financing swiftly so you can focus on what matters most—your medical career and patients.

Furthermore, these loans provide you with the opportunity to purchase your dream home sooner than traditional mortgage options would allow. With the flexibility and advantages that physician loans offer, you can maximize your purchasing power and make informed financial decisions. Exploring this lending solution can be a vital step in securing a stable and prosperous life for you and your family while allowing you to thrive in your medical profession.