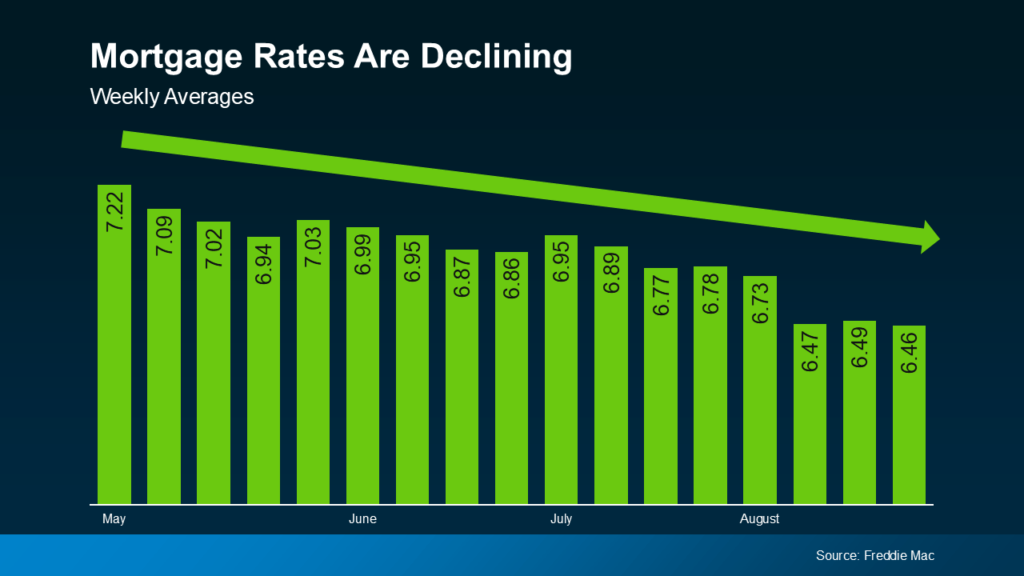

There’s no denying that mortgage rates have significantly influenced housing affordability in recent years. However, there’s a glimmer of hope. Rates have started to decline, and recently, they reached their lowest level of 2024, as reported by Freddie Mac (refer to the graph below):

If you’re considering buying a home, you might be asking yourself: just how much lower will mortgage rates go? To help you navigate this, here’s what experts are predicting.

Expert Projections for Mortgage Rates

The general consensus among experts is that mortgage rates will continue their downward trend as long as inflation and the economy cool down. However, expect some fluctuations as new economic reports come in.

The key takeaway is not to get distracted by these occasional spikes. The broader trend is clear: rates have dropped by nearly a full percentage point since their peak in May.

Looking ahead, many experts believe rates in the low 6% range are possible in the coming months. This will largely depend on economic developments and the Federal Reserve’s decisions.

Already, forecasts for 2024 are becoming more optimistic. For instance, Realtor.com has adjusted its projections:

“Mortgage rates have been revised slightly lower as signals from the economy suggest that it will be appropriate for the Fed to begin to cut its Federal Funds rate in 2024. Our yearly mortgage rate average forecast is down to 6.7%, and we revised our year-end forecast to 6.3% from 6.5%.”

Find Your Ideal Mortgage Rate

So, what does this mean for you and your plans to buy a home? If you’ve been waiting for rates to drop, know that it’s already happening. Now, it’s up to you to decide when the timing and rate are right for you. Sam Khater, Chief Economist at Freddie Mac, sums it up well:

“The decline in mortgage rates does increase prospective homebuyers’ purchasing power and should begin to pique their interest in making a move.”

Your next step? Determine the rate that would motivate you to start your home search again.

Maybe it’s 6.25%, 6.0%, or even 5.99%. This number is personal to you, and once you’ve decided, you don’t have to track rates obsessively.

Instead, connect with a local real estate professional. They’ll keep you informed about the market and let you know when rates hit your target.

Bottom Line

If you’ve paused your home-buying plans due to high mortgage rates, consider the rate you’re waiting for that would prompt you to re-enter the market.