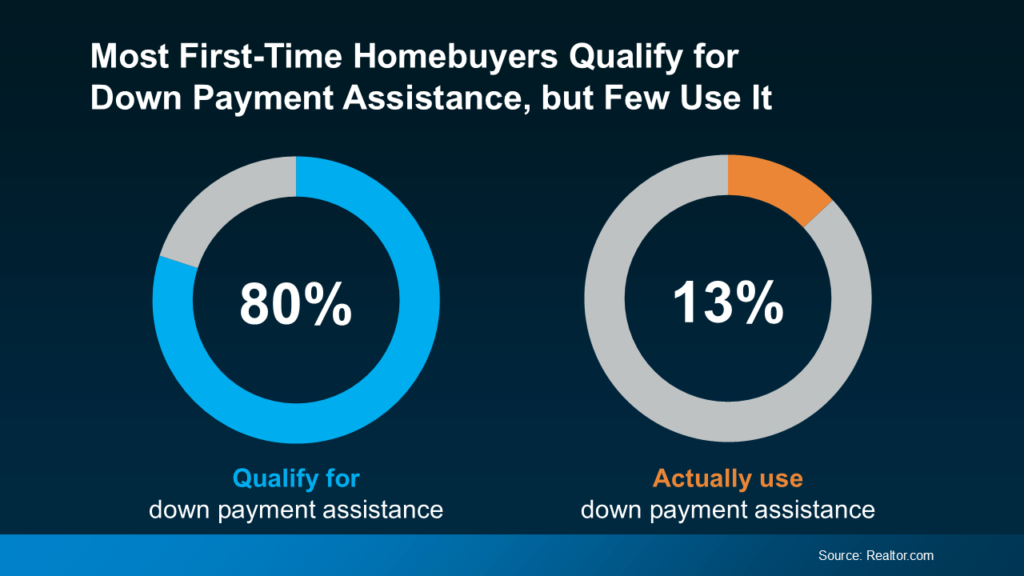

“Did you know that nearly 80% of first-time homebuyers qualify for down payment assistance, yet only 13% take advantage of it? If you’re planning to purchase a home, this is a crucial opportunity you can’t afford to miss (check out the graph below):”

Maximize Your Down Payment in Today’s Housing Market

Boost Your Down Payment Power For first-time buyers, the key to success is leveraging every resource available to you. Many programs are designed to fast-track your homebuying journey, often quicker than you’d expect.

There are loan options that require as little as 3% down—or even 0% for qualified borrowers like Veterans. Plus, there’s down payment assistance through grants and other programs that can help cover your upfront costs.

If you want to explore these options, connect with a trusted lender. Failing to do so could mean leaving money on the table and delaying your chance to become a homeowner. These programs can significantly increase your down payment, which might lower your monthly mortgage and even reduce fees like private mortgage insurance (PMI).

Don’t Let Headlines About Rising Down Payments Scare You You’ve probably seen headlines about increasing down payments. According to Redfin:

“The typical down payment for U.S. homebuyers hit a record high of $67,500 in June, up 14.8% from $58,788 a year earlier . . . This marked the 12th consecutive month of year-over-year increases.”

But don’t panic—higher averages don’t mean higher requirements. Many buyers are simply opting to put more down to offset rising mortgage rates. And current homeowners are using the equity from their existing homes to increase their down payments. As HousingWire explains:

“. . . buyers are putting down a higher percentage of the purchase price to lower their monthly mortgage payment.”

Here’s why:

Lower Monthly Payments: A bigger down payment means smaller monthly mortgage payments, which is crucial in today’s market where affordability is challenging.

Equity Advantage: Homeowners who are selling now have record levels of equity thanks to home price appreciation, allowing them to put down more on their next home.

Bottom Line What’s your best move? Talk to a lender who can guide you through your options. The help is out there—you just need the right partner to unlock it.