Wondering what the housing market might look like in 2025?

Good news—experts are predicting some encouraging trends, especially in two crucial areas that could influence your next move: mortgage rates and home prices.

Whether you’re planning to buy or sell, here’s a breakdown of expert forecasts and what they mean for you.

Mortgage Rates Expected To Decline

If mortgage rates have been holding you back, there’s reason to feel optimistic. After significant spikes in recent years, experts anticipate that rates will gradually dip throughout 2025, offering a more favorable outlook for homebuyers. (Check out the graph below for more details.)

While mortgage rates are expected to decline, don’t expect a perfectly smooth ride. The trend may have a few ups and downs as it reacts to new economic data and inflation reports. But don’t get caught up in short-term market fluctuations. Instead, focus on the bigger picture.

What Does Lower Mortgage Rates Mean for You?

Falling mortgage rates translate to better affordability. As rates dip, your monthly mortgage payments decrease, giving you more financial breathing room when buying a home.

This shift could bring more buyers and sellers into the market. As Charlie Dougherty, Director and Senior Economist at Wells Fargo, points out:

“Lower financing costs will likely boost demand by pulling affordability-crunched buyers off of the sidelines.”

As demand picks up, both inventory and competition among buyers are likely to rise. The key takeaway? Get ahead of the competition now. Work with your agent to stay on top of how these shifts in rates are influencing demand in your local market.

Home Prices Expected to See Steady Growth

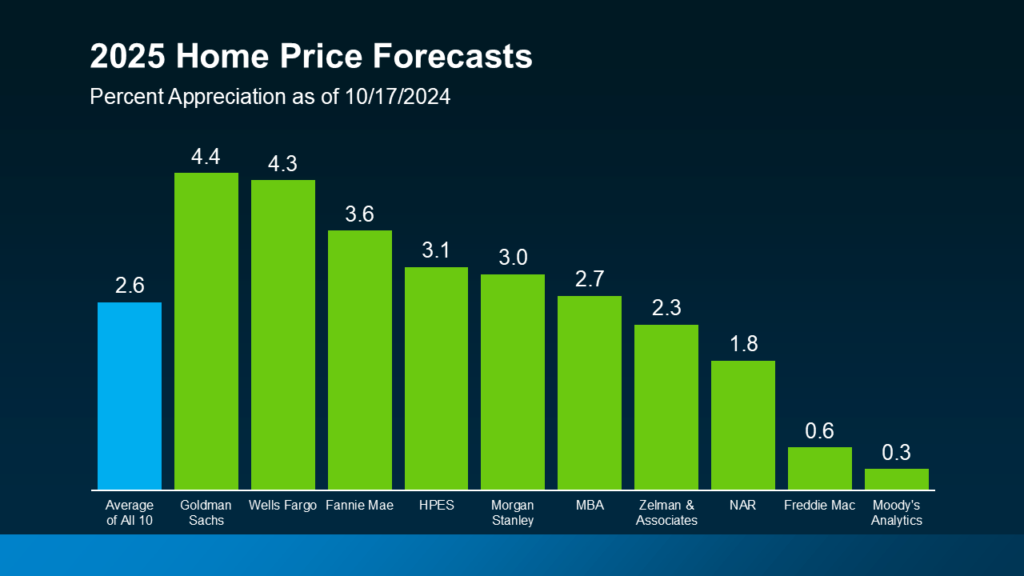

While mortgage rates may ease, home prices are projected to continue rising, but at a slower pace than in recent years. Experts predict home prices will increase by an average of 2.5% nationally in 2025 (check out the graph below)

The projected price growth for 2025 is far more manageable compared to the rapid, double-digit increases we saw in recent years.

What’s Driving Home Prices Up?

The answer lies in demand. As more buyers return to the market, demand will rise, but supply will also increase as sellers feel less locked in by high mortgage rates.

In markets where inventory remains tight, this heightened demand could push prices up. However, an increase in homes for sale should help balance things out, leading to slower, more sustainable price growth.

Of course, national trends may not mirror what’s happening in your local market. Some areas could experience faster growth, while others may see more modest gains. As Lance Lambert, Co-Founder of ResiClub, notes:

“Even if the average national home price forecast for 2025 is correct, some regional markets might experience slight price declines, while others could still see strong appreciation. That’s been the case this year, too.”

Even in markets where prices stay flat or dip slightly, recent years of appreciation mean this shift may not have a major impact. That’s why working with a local real estate expert is crucial—they’ll give you the most accurate insight into what’s happening in your area.

Bottom Line

With mortgage rates expected to ease and home prices projected to grow at a slower, more sustainable pace, 2025 could offer a brighter outlook for both buyers and sellers.