Navigating Today’s Housing Market: Could Co-Buying Be Your Solution?

Buying a home in today’s market can feel overwhelming. Rising home prices and high mortgage rates are stretching budgets thin, leaving many prospective buyers feeling stuck. If that sounds familiar, co-buying might be the solution to help you take the first step toward homeownership.

Freddie Mac suggests:

“If you are an aspiring homeowner, buying a home with your family or friends could be an option.”

Before you dive in, it’s important to understand what co-buying entails and why it’s becoming a popular choice for many. Let’s break it down and see if it could work for you.

What Is Co-Buying?

Co-buying is when you purchase a home with another person—or even a group of people—such as a friend, sibling, or family member. Given the challenges of today’s market, this approach is gaining traction as a practical and creative way to make homeownership more accessible.

A recent survey by JW Surety Bonds reveals that nearly 15% of Americans have already co-purchased a home, and an additional 48% would consider doing so in the future.

Why Consider Co-Buying?

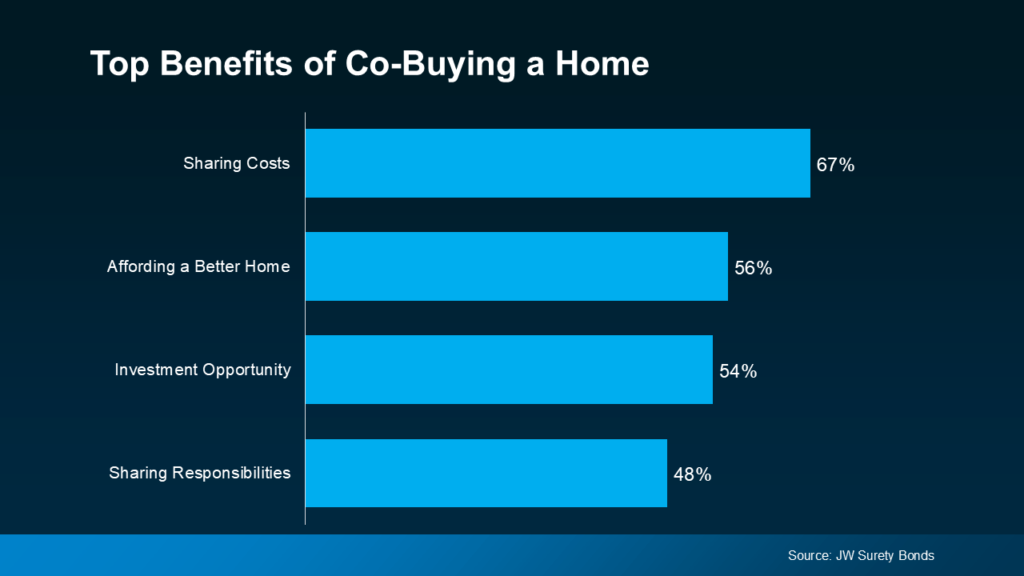

The same survey highlights the benefits of co-buying, with respondents sharing several key advantages. Here are some of the top reasons people are choosing this path (see graph below):

The Benefits and Considerations of Co-Buying a Home

Co-buying a home can be a smart way to achieve homeownership in today’s challenging market. Here are some of the top reasons why people are embracing this option:

Key Benefits of Co-Buying

1. Sharing Costs (67%)

Buying a home is a significant financial commitment, from saving for the down payment to covering monthly mortgage payments. Co-buying allows you to split these costs, making homeownership more attainable.

2. Affording a Better Home (56%)

Combining financial resources with a co-buyer can help you afford a larger, better-quality home. This might mean upgrading to an extra bedroom, a spacious backyard, or even a home in a more desirable neighborhood.

3. Investment Opportunity (54%)

Co-buying isn’t just about finding a place to live—it can also be a strategic investment. For example, purchasing a property to rent out with a co-buyer can generate passive income while building equity.

4. Sharing Responsibilities (48%)

Owning a home comes with plenty of responsibilities, from regular maintenance to unexpected repairs. Co-buying allows you to share these duties, lightening the workload for everyone involved.

What to Consider Before Co-Buying

While co-buying offers significant benefits, it’s a decision that requires careful planning. As Rocket Mortgage puts it:

“Buying a house with a friend or multiple friends might be a great way for you to achieve homeownership, but it’s not a decision you should make lightly. Before diving in, make sure you understand the financial and logistical hurdles you’ll face, as well as the human and emotional elements that might affect the purchase or, more importantly, your relationship.”

Here are a few key considerations:

- Cost Splitting: Decide upfront how expenses like the down payment, mortgage payments, and maintenance costs will be divided.

- Roles and Responsibilities: Clarify who will handle tasks such as upkeep, bill payments, or property management.

- Exit Strategy: Agree on what happens if one party wants to sell their share of the home in the future.

Consulting with a real estate expert can help guide these discussions and ensure everyone is aligned before moving forward.

Bottom Line

If rising costs are holding you back from homeownership, co-buying could be a viable solution to help you take that first step. However, it’s essential to approach the process thoughtfully and ensure clear communication between all parties. If you’re considering co-buying, let’s connect to explore whether it’s the right move for you.