Over the course of your medical education, you likely accrued significant student debt that may feel overwhelming as you transition into your career. Effectively managing this debt is necessary for your financial health and overall well-being. In this blog post, we will explore best practices tailored to help you navigate your repayment options, prioritize financial goals, and make informed decisions that set you up for success in both your professional and personal life. Learn strategies that can alleviate your financial burden while allowing you to focus on your calling as a healthcare professional.

Understanding Student Debt

Before entering into managing your student debt, it is necessary to grasp what that debt entails. As a medical school graduate, you likely hold substantial student loans that can be daunting. Understanding the types of student loans you have, the terms associated with them, and the total amount owed will provide a foundation for your repayment strategy.

Types of Student Loans

Among the various types of student loans, you will commonly encounter federal and private loans. Each has distinct features that affect repayment and forgiveness options. Here’s a breakdown to help you understand the differences:

| Type of Loan | Description |

|---|---|

| Federal Direct Subsidized Loans | Loans that do not accrue interest while you are in school or during deferment periods. |

| Federal Direct Unsubsidized Loans | Loans that accrue interest from the time of disbursement, regardless of enrollment status. |

| Federal Grad PLUS Loans | Loans designed specifically for graduate students, allowing for higher limits but with higher interest rates. |

| Private Loans | Loans issued by banks or financial institutions, often with variable interest rates and fewer benefits. |

| Loan Consolidation | Combining multiple federal loans into one for simplified payments, potentially affecting interest rates. |

This insight into the types of loans will serve as a stepping stone toward effective debt management.

Interest Rates and Repayment Plans

Understanding the nuances of interest rates and repayment plans is necessary for effective debt management. Federal student loans typically have fixed interest rates set by legislation, while private loans may offer variable rates which can fluctuate over time. This variance can significantly impact your total repayment amount over the life of the loan, so it’s vital to pay attention to these rates as you formulate a repayment strategy.

A personalized repayment plan can be a game changer in managing your student debt. Options like income-driven repayment plans can reduce your monthly payments based on your earnings, allowing you to balance living expenses alongside debt obligations more feasibly. Additionally, if you find yourself struggling, exploring options such as loan forgiveness programs or deferment might provide financial relief tailored to your unique circumstances.

Creating a Budget

Assessing Monthly Income and Expenses

Behind every effective budget lies a clear understanding of your financial landscape. As a recent graduate, it’s important to start by assessing your monthly income, which may include your salary as a resident or any other side income. Compile all your sources of income to create a realistic picture of your financial situation. Next, take a detailed inventory of your monthly expenses. This should encompass fixed costs such as rent or mortgage, utilities, groceries, insurance, and discretionary expenses like entertainment and dining out. Categorizing your expenses will enable you to identify areas where you can make adjustments.

Prioritizing Loan Payments

To effectively manage your student debt, you must prioritize your loan payments within your budget. Start by categorizing your loans based on their terms, interest rates, and repayment plans. Federal loans often offer more flexible repayment options compared to private loans. Make sure to account for the minimum payments required, but also consider making additional payments on high-interest loans to cut costs in the long run. Evaluating your financial situation regularly will help you decide if you can afford to accelerate payments or if you need to adjust your budget further.

A structured approach to prioritizing loan payments not only helps in managing your debt but also provides peace of mind as you navigate the complexities of your financial responsibilities. You can consider strategies such as the avalanche or snowball method in tackling your loans, which can further enhance your motivation and focus. Ultimately, staying organized and setting clear payment goals will empower you to reduce your debt and enhance your overall financial health.

Exploring Loan Forgiveness Programs

Many medical school graduates find themselves grappling with significant student debt, which is why loan forgiveness programs can offer a viable avenue for relief. These programs are designed to alleviate part or all of your student loan burden as a reward for your service in specific careers, particularly in public service sectors. Understanding the various loan forgiveness options available can be the first step in effectively managing your debt after completing your education.

Public Service Loan Forgiveness

Before you can benefit from Public Service Loan Forgiveness (PSLF), you need to ensure that you meet certain requirements. This program is tailored for those who work in qualifying public service jobs, which include positions in government organizations, non-profit entities, and other public service roles. After making 120 qualifying monthly payments under a qualifying repayment plan, you may have the remaining balance of your Direct Loans forgiven. This applies to various types of loans and provides a significant opportunity to reduce your debt.

Income-Driven Repayment Plans

The Income-Driven Repayment (IDR) plans are another imperative option for managing your student debt effectively. These plans calculate your monthly payments based on your income and family size, making your payments more manageable during the early years of your career when you may not yet be earning a high salary. There are several types of IDR plans available, each with its conditions, but they typically extend the repayment period to 20 or 25 years. After fulfilling the terms, any remaining balance can be forgiven.

Hence, selecting an IDR plan may also position you to take advantage of eventual loan forgiveness after a specified period of consistent payments. This option not only aligns your repayment with your income but also offers flexibility in case your financial situation changes over time. Evaluating these factors carefully will help ensure that you’re placing yourself in the best situation to manage your student debt while pursuing your goals in the medical field.

Strategies for Managing Debt

Once again, tackling student debt can feel overwhelming, but having a strategic approach will help you regain control of your financial future. By implementing effective strategies, you can effectively manage your debt and reduce the long-term financial burden it imposes. Whether you choose to consolidate your loans or make extra payments, understanding your options will empower you to make informed decisions that suit your financial situation.

Consolidation vs. Refinancing

Refinancing is an option that allows you to take out a new loan to pay off one or more existing student loans. This approach can result in a lower interest rate, potentially saving you a significant amount over the life of the loan. It is particularly beneficial if your credit score has improved since you first borrowed or if interest rates have generally decreased. However, refinancing federal loans into a private loan will result in the loss of federal protections and benefits, so it’s important to carefully assess your priorities and needs before making the decision.

Making Extra Payments

Behind every debt management strategy should be a keen awareness of how making extra payments can hasten your journey toward becoming debt-free. By paying more than the minimum required on your loans, you can significantly reduce the principal amount, which in turn decreases the overall interest you’ll pay. You may want to consider allocating any bonuses, tax refunds, or financial windfalls towards your debt to make additional payments and accelerate your repayment timeline.

The key to making extra payments effectively lies in your ability to stay organized and consistent. Set a budget that allows for a portion of your income to be funneled toward your debt each month. You can even automate these extra payments to ensure they occur regularly, which removes the temptation to spend that money on other expenses. Over time, these extra contributions can lead to a substantial reduction in your debt burden and help you achieve financial stability sooner than you may have anticipated.

Building a Financial Safety Net

Now that you have completed medical school and are stepping into your professional life, building a financial safety net is crucial for managing your student debt effectively. This safety net helps you navigate unexpected expenses and protects your financial well-being as you establish your career. By prioritizing a strong financial foundation, you can focus on your practice and the needs of your patients without the constant worry of financial instability.

Emergency Funds

Along your journey in building a financial safety net, establishing an emergency fund should be one of your first steps. This fund serves as a financial buffer that can cover unexpected expenses, such as car repairs or emergency medical bills, without derailing your budget. Ideally, aim to save three to six months’ worth of living expenses, allowing you to handle unforeseen circumstances with ease and maintain peace of mind as you manage your debt.

Insurance and Protection

To safeguard your financial future, it’s crucial to prioritize insurance and protection strategies. Health insurance, disability insurance, and life insurance can provide a safety net for you and your loved ones, ensuring that you are covered against unexpected events that could otherwise jeopardize your finances or your ability to repay student loans. Choosing the right policies and coverage levels can help you navigate the uncertainties of both your personal and professional life.

Indeed, it is wise to assess your insurance needs regularly, especially as your financial circumstances evolve throughout your medical career. As your income increases and your family situation shifts, you may want to revisit your coverage levels and adjust your policies accordingly. Understanding your options and selecting appropriate coverage will not only protect you from financial setbacks but also contribute to your overall peace of mind regarding your student debt management strategy.

Long-term Financial Planning

Keep in mind that managing your student debt is just one aspect of your financial journey. For a truly sustainable financial future, you should engage in long-term financial planning that includes investing for the future. This involves developing a clear strategy for building wealth over time, enabling you to not only pay off your debts but also reach your broader financial goals. Creating a diversified investment portfolio can provide you with additional avenues for growth that may mitigate some of the financial challenges posed by your educational loans.

Investing for the Future

Above all, appreciating the power of compound interest can significantly impact your financial health in the long run. Start investing early, even if the amount seems small; it adds up over time. Seek out investment vehicles such as index funds or low-cost mutual funds that can complement your strategy. In addition, consider setting up a dedicated savings account for specific goals such as home ownership or starting a practice. By taking proactive steps now, you position yourself to enjoy better financial stability in the years ahead.

Retirement Savings

Against the backdrop of managing student loans, you might feel the urge to postpone your retirement savings, but doing so can have repercussions. Delaying contributions to your retirement accounts means you could miss out on significant employer matches and the benefits of compound growth. Engaging in regular contributions, even modest ones, can set the foundation for a secure retirement while you’re still paying down your loans. Ensuring that you’re participating in employer-sponsored plans or individual retirement accounts (IRAs) should be just as much a priority as your monthly debt payments.

Future contributions to retirement savings accounts not only provide tax advantages but also build a nest egg that can significantly enhance your financial security. Assess your budget to carve out a portion for retirement savings; even 10% of your income can add up over time. Paired with your investment strategy, retirement savings can free you from financial anxiety down the line, helping you maintain a comfortable lifestyle as you transition through various life stages. Prioritizing these savings now, even alongside debt repayment, can yield substantial benefits in the long run.

Summing up

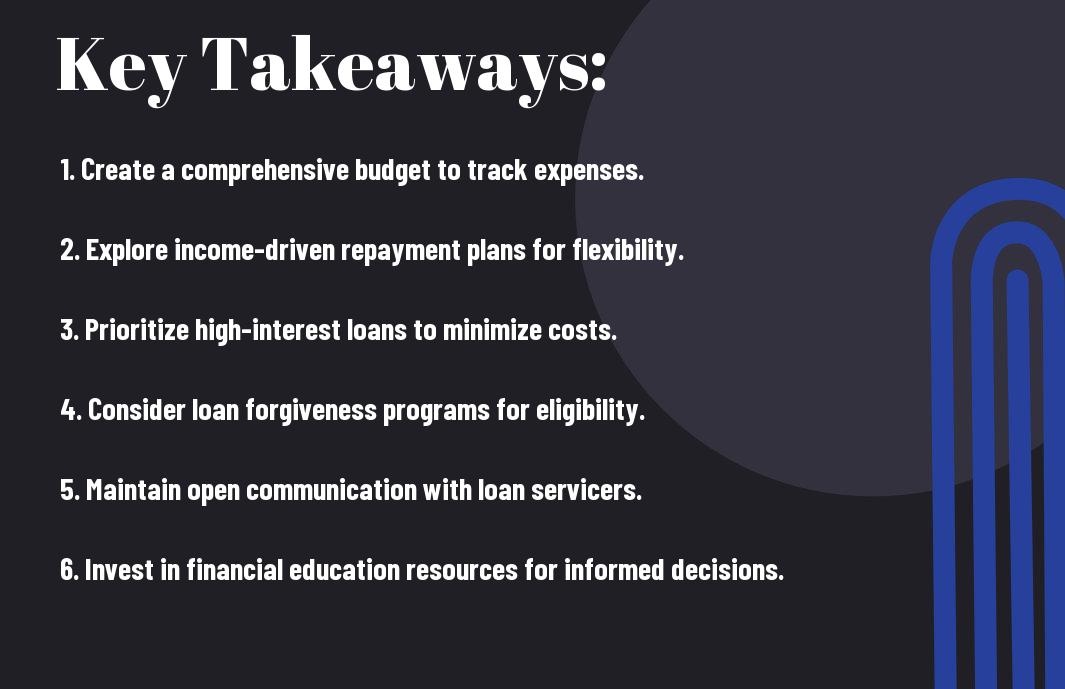

The journey through medical school often leaves you with a significant amount of student debt, but managing this financial burden effectively can help pave your way to a successful career. Start by exploring repayment options such as Income-Driven Repayment Plans, which adjust your monthly payments based on your income and family size. Additionally, consider consolidating your loans or refinancing them for potentially lower interest rates. Utilizing budgeting tools can help you track your expenses and savings as you navigate this period of financial adjustment.

Moreover, taking advantage of loan forgiveness programs offered for public service or working in underserved areas can substantially lessen your debt. Cultivating good financial habits, such as prioritizing savings and building an emergency fund, will further support your long-term financial health. By being proactive and informed about your options, you can take significant steps toward managing your student debt effectively and focusing on what truly matters—your career in medicine.