You are about to initiate on one of the most significant investments of your life: buying a home. As a physician, your busy schedule and unique financial considerations can make this journey feel overwhelming. This guide will provide you with a clear, step-by-step approach to help you navigate the home-buying process smoothly. From understanding your financing options to closing the deal, you’ll gain the insights you need to make informed decisions that fit your lifestyle and financial goals.

Understanding the Home Buying Process

As a physician looking to purchase a home, it’s important to familiarize yourself with the ways in which properties are categorized. Understanding the various types of properties available can help you make informed decisions based on your housing needs and financial objectives. You’ll find properties listed in several classifications, each with its own features and potential investments.

Types of Properties

| Property Type | Overview |

|---|---|

| Single-family homes | Standalone buildings ideal for families. |

| Condos | Units in a larger building often with shared amenities. |

| Townhouses | Attached homes that share one or more walls with neighbors. |

| Multi-family homes | Buildings that accommodate multiple families, often as rental properties. |

| Vacant land | Land that can be developed based on zoning regulations. |

After familiarizing yourself with the types of properties, you can proceed to evaluate which category best fits your lifestyle and budget. Understanding these distinctions can prepare you for discussions with real estate agents and set clear expectations for your home search.

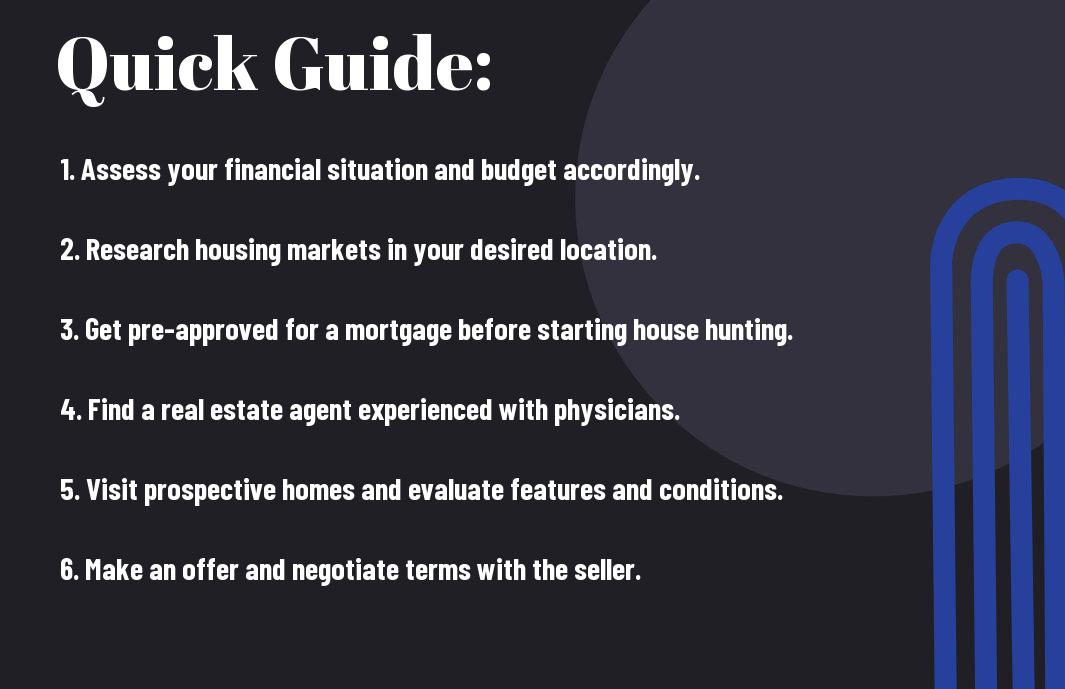

Step-by-Step Home Buying Timeline

Properties often require a structured approach when navigating the purchase process. A timeline will allow you to manage your time effectively and ensure you are aligned with financial and personal goals throughout the various stages of buying a home. By breaking down each phase of the home-buying process, you will be able to track your progress and milestones more efficiently.

| Home Buying Phase | Description |

|---|---|

| Pre-approval | Obtain a mortgage pre-approval to understand your budget. |

| House hunting | Search for homes matching your criteria and schedule viewings. |

| Offer submission | Submit an offer on the property you wish to purchase. |

| Home inspection | Conduct a detailed inspection to identify any potential issues. |

| Closing | Finalize the purchase agreement, mortgage, and close on the property. |

Buying a home is a significant undertaking that typically unfolds in several well-defined steps. Following this timeline closely will help you stay organized and informed throughout the process. Ensuring that each phase is thoroughly completed sets you up for a successful home purchase, paving the way for a seamless transition into what could be your new living space.

Key Factors to Consider

If you are gearing up to purchase your first home, it’s imperative to take several key factors into account to ensure a smooth process. Some vital elements that will affect your home buying journey include:

- Your budget and financial readiness

- The location of your desired property

- Current market trends in real estate

- Home features and amenities that matter to you

- Your future plans and potential for resale value

Any of these factors can significantly impact your experience and success in finding the right home for you.

Financial Preparation

Now that you’ve acknowledged the fundamental aspects of the home-buying process, financial preparation is paramount. You must first assess your budget, determine how much you can afford, and prepare for any additional costs that may arise. Consider obtaining mortgage pre-approval, which will give you a clearer idea of your price range and strengthen your position when making offers on homes.

Additionally, think about your down payment options, potential closing costs, and ongoing expenses that come with home ownership, such as property taxes and maintenance. A detailed financial plan will help you understand your capabilities and prevent any surprises down the line in the home-buying journey.

Location and Market Trends

Location is another significant factor when you’re considering a home purchase. The area where your home is situated can influence not only its value but also your overall living experience. You should research local amenities, such as schools, hospitals, shopping centers, and recreational facilities while also examining the proximity to your workplace.

Understanding the current market trends is also imperative. Look at recent sales data, average home prices, and how quickly homes are selling in your desired area. This information can inform you about the housing market’s competitiveness and help you strategize your offers and timing. By being well-informed about the location and its market trends, you can make a more educated decision, enhancing your long-term satisfaction with your home purchase.

Tips for First-Time Home Buyers

Despite the excitement that comes with buying your first home, the process can feel overwhelming and complex at times. Here are some tips to help you navigate the journey more smoothly:

- Establish your budget and get pre-approved for a mortgage.

- Research different neighborhoods before settling on a location.

- Focus on your important needs versus wants in a home.

- Don’t skip the home inspection; it can save you future headaches.

- Stay patient and don’t rush into a decision; this is a significant investment.

Knowing these tips can empower you as you make informed decisions throughout the home buying process.

Working with Real Estate Agents

With so many aspects to consider, partnering with a knowledgeable real estate agent can be a game-changer for your home-buying experience. They can help guide you through the local market’s nuances, assist in finding properties that fit your criteria, and provide valuable insights on pricing. Their expertise can make the process not only easier but also more efficient.

Additionally, a skilled agent can negotiate on your behalf, advocating for your interests and ensuring you get the best deal possible. Look for an agent who specializes in working with first-time buyers and who understands your unique needs as a physician, taking into account your lifestyle and the areas that may work best for you.

Navigating Mortgage Options

Working through the various mortgage options can be one of the more daunting aspects of buying a home. It’s important to familiarize yourself with the different financing types available, including conventional loans, FHA loans, and VA loans, each having its benefits and requirements. Assess your financial situation and long-term plans to determine which type of mortgage aligns best with your goals.

The mortgage landscape is ever-evolving, and rates can fluctuate significantly. Staying informed will enable you to differentiate between fixed-rate and adjustable-rate mortgages, ultimately ensuring you select the best option for your budget and investment strategy. Don’t hesitate to leverage the expertise of your real estate agent or a financial advisor; they can provide guidance tailored to your specific situation and can help you navigate any complexities that arise.

Pros and Cons of Home Ownership

Now, assessing the pros and cons of home ownership is crucial as you navigate the buying process. Each side carries weight and can significantly impact your financial situation and lifestyle. Below is a breakdown to help you weigh your options:

| Pros | Cons |

|---|---|

| Build equity over time | Upfront costs can be significant |

| Stable housing costs with fixed-rate mortgage | Ongoing maintenance and unexpected repairs |

| Tax benefits, including mortgage interest deductions | Less flexibility to relocate |

| Control over your living space and design choices | Market fluctuations can affect property value |

| Potential for rental income from additional space | Time and effort required for property management |

Benefits of Buying vs. Renting

Little is often said about the long-term benefits that come from owning a home as opposed to renting. When you buy a home, you’re not just making a living space investment; you’re also building financial stability. Over time, as market values appreciate, you create equity, which can later be leveraged for other financial opportunities. Additionally, the consistency of a fixed-rate mortgage allows you to plan your budget more effectively compared to the uncertainty of rising rents.

This financial security is particularly appealing in the context of a physician’s career, where a significant investment in education often leads to a stable and lucrative career. Owning a home can become a part of your retirement portfolio, providing you a place to live in your later years while simultaneously generating potential retirement funds through its appreciation or rental income.

Potential Drawbacks to Consider

On the other side, potential drawbacks to consider include the financial strain that comes with home ownership. Unlike renting, where you generally have fewer responsibilities, owning a home means you are fully responsible for maintenance and repairs, which can be both time-consuming and costly. Additionally, upfront costs can be substantial, making it crucial to assess how they will fit into your current financial plan.

Another critical factor is the decreased flexibility that comes with owning property. If you decide to change jobs or relocate for any reason, selling a home takes time and effort. Market conditions may dictate your selling price, and you could end up in a situation where you are unable to sell your home quickly or at a desirable price. Evaluating these potential drawbacks will equip you with the necessary insights to make an informed decision regarding home ownership as you move forward in the buying process.

Closing the Deal

Finalizing the Purchase

Some of the most significant steps in your home buying journey take place during the closing process. This is where everything comes together, and you officially take ownership of your new property. To finalize the purchase, you will review and sign a multitude of documents, including the purchase agreement, loan documents, and various disclosures. It’s important to set aside ample time for this meeting, as you want to ensure that you fully understand each document and its implications. You should also have your funds ready for any required earnest money or down payments, as well as any additional fees that may arise during this process.

Some of the key players in your closing meeting will include your real estate agent, lender, and a title company representative. Their roles are to ensure that all paperwork is complete and that you have all the necessary copies for your records. Communication is important, so don’t hesitate to ask questions or seek clarification on any aspect of the documents you’re signing. Being well-informed will help streamline this process and ensure that you feel confident as you move forward in your homeownership journey.

Understanding Closing Costs

Finalizing your home purchase brings you face-to-face with closing costs, which can sometimes be overwhelming if you’re not prepared. These costs are typically associated with the exchange of ownership and can vary depending on the location of the property, the lender you choose, and the specifics of your sale. You can anticipate a combination of fees, such as appraisal fees, title insurance, attorney fees, and recording fees, among others. Being aware of these costs beforehand will help you budget appropriately and avoid any unwelcome surprises at the closing table.

Another important aspect to consider is that closing costs may add up to 2% to 5% of the home’s purchase price. While you should expect to cover these costs on your own, there are often ways to minimize them. Some lenders might allow you to roll these costs into your mortgage, or you might negotiate with the seller to cover part of them as a condition of the sale. It’s always beneficial to discuss potential options with your lender and real estate agent, ensuring you find the most advantageous approach for your particular situation.

Post-Purchase Considerations

Maintaining Your Investment

Your newly purchased home represents a significant investment, and it’s crucial to protect that investment through diligent maintenance. Clearly, regular upkeep not only preserves the property’s value but can also prevent costly repairs down the line. Begin by creating a maintenance schedule that includes seasonal tasks such as cleaning gutters, checking your HVAC system, and inspecting the roof for wear. By staying proactive, you can address minor issues before they escalate, ensuring your home remains a safe and comfortable space for you and your family.

Your commitment to maintaining the property can also enhance its appeal should you decide to sell in the future. Elevating curb appeal through landscaping and exterior updates can attract prospective buyers and even increase the resale value. Moreover, keeping accurate records of maintenance and improvements will serve as a valuable asset to showcase to potential buyers, assuring them of the home’s well-cared-for condition.

Future Selling Strategies

If you’re considering the future sale of your property, developing a thoughtful selling strategy early on will maximize your return on investment. Start by being aware of market trends in your area, as these can fluctuate and impact your selling price. You might also consider home improvements that attract buyers, such as updating a kitchen or bathroom, which are typically high-impact areas when it comes to resale value.

Maintaining your home with an eye toward the future may include tracking changes in your neighborhood and local amenities, as these factors can boost your property’s desirability when it’s time to sell. Consulting with a real estate agent early in your homeownership journey can also equip you with insights on what buyers are currently seeking, helping you to position your home favorably when the time to sell finally arrives.

Conclusion

Hence, navigating the home buying process as a physician can be both rewarding and challenging. By following the step-by-step guide outlined, you will be better equipped to make informed decisions that align with your lifestyle and career. From assessing your financial readiness to understanding the specifics of your market, each phase requires your careful attention and strategic thinking. Utilizing resources such as real estate professionals, mortgage advisors, and market research will further support you in this endeavor, ensuring that you find the right property that meets your personal and professional needs.

Your journey toward homeownership is not just about acquiring property; it’s an investment in your future. By being proactive in your approach, you position yourself for success. In reflecting on your priorities and engaging with experts, you not only simplify the process but also enhance your overall experience. With diligence and preparation, you will find a home that not only suits your needs today but also accommodates your evolving aspirations as a physician.