10 Things Doctors Should Know Before Applying For Physician Home Loan Programs

There’s a unique set of considerations you should keep in mind when exploring physician home loan programs. As you navigate this specialized financing option tailored for medical professionals, understanding the key factors can significantly impact your home buying experience. This list will outline vital insights that will empower you to make informed decisions and maximize […]

The Complete Guide To Doctor Mortgage Loan Programs – How They Work And Who Qualifies

Loan options tailored for medical professionals can simplify your path to homeownership, giving you the ability to secure financing that meets your unique needs. In this comprehensive guide, you will discover how doctor mortgage loan programs function, the benefits they offer, and the qualifications required for you to take advantage of these favorable terms. Understanding […]

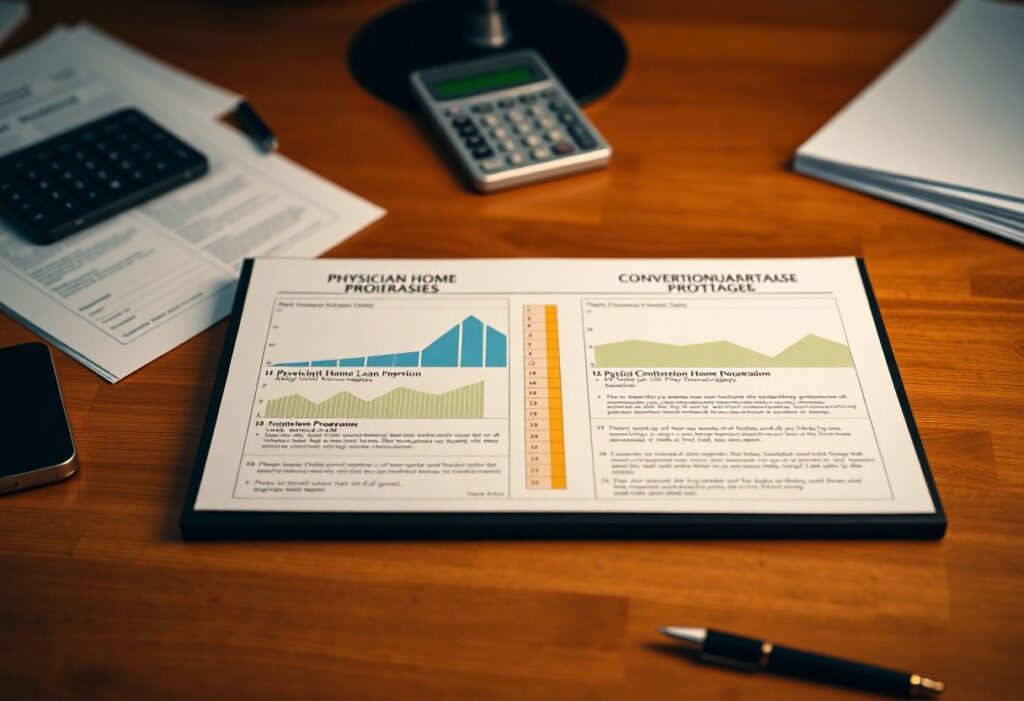

Physician Home Loan Programs Vs. Conventional Mortgages – What’s The Difference?

Many aspiring homeowners, particularly physicians, find themselves weighing the benefits of physician home loan programs against conventional mortgages. Understanding these two financing options is imperative for you to make informed decisions that align with your unique financial situation. This post will explore the key distinctions between these mortgage types, helping you determine which option might […]

Top Benefits Of Loan Programs For Doctors That Every Physician Should Explore

It’s vital for you to understand the unique financial advantages that loan programs for doctors offer. As a physician, navigating your financial landscape can be complex, but specialized loan options can provide favorable terms, lower interest rates, and flexible repayment plans tailored to your needs. These programs are designed to ease the burden of medical […]

Doctor Mortgage Loan Programs – How To Buy A Home Before Paying Off Student Debt

Many medical professionals face the challenge of balancing student debt with the desire to purchase a home. With specific mortgage programs designed for doctors, you can leverage your earning potential without waiting to pay off your loans. This guide will walk you through the unique benefits of doctor mortgage loan programs and provide actionable steps […]

Step-by-Step Process For Physicians Applying To Home Loan Programs

It’s crucial for physicians to understand the specific steps involved in applying for home loan programs tailored to their unique financial situations. This guide walks you through each stage of the application process, from assessing your eligibility to securing financing. By following this structured approach, you can effectively navigate the complexities of home loans and […]

Loan Programs For Doctors – How To Choose The Right Option For Your Career Stage

Over the years, various loan programs tailored for doctors have emerged, each designed to meet different career stages. Whether you are a medical student, a resident, or a seasoned practitioner, selecting the right loan option is vital for your financial success. This guide will help you navigate your choices, allowing you to assess your specific […]

Understanding Physician Home Loan Programs – Common Myths And Misconceptions

Loan programs tailored for physicians can be an excellent resource for securing your home financing; however, numerous myths and misconceptions surround them. You may encounter information suggesting these loans are too complicated or that they come with hidden costs. This post aims to clarify common misunderstandings, providing you with the vital facts you need to […]

Doctor Mortgage Loan Programs – Key Requirements, Terms, And Benefits Explained

With various financing options available, understanding Doctor Mortgage Loan Programs is necessary for you as a medical professional looking to purchase a home. These specialized loans cater to your unique financial situation, offering benefits like lower down payments and flexible credit qualifications. In this post, you will find detailed insights into the key requirements, terms, […]

Why Loan Programs For Doctors Are A Game-Changer For Residency And Beyond

Just as you launch on your medical career, understanding loan programs designed specifically for doctors can significantly impact your financial future. These tailored options empower you to navigate the expenses of residency and beyond with greater ease, offering benefits that standard loans may not provide. By leveraging these programs, you can focus on your education […]