Most physicians find themselves at a crossroads when deciding on the right home loan program to suit their unique circumstances. With a variety of options available, understanding the specifics of each program can help you make an informed decision that aligns with your financial goals. This guide provides crucial tips and insights tailored specifically for you, ensuring you navigate the home loan process effectively while maximizing your benefits as a medical professional.

Understanding Home Loan Programs

For physicians navigating the home loan landscape, understanding different loan programs is necessary. With specific needs and financial situations, you must evaluate which program aligns best with your circumstances and long-term goals. Being well-informed about the various options will help you make sound decisions that can significantly impact your financial future.

Overview of Loan Types

Overview of loan types is vital since different programs cater to different borrower needs. You may explore options such as:

- Conventional Loans

- FHA Loans

- VA Loans

- Jumbo Loans

- Physician Loans

Thou must choose wisely based on your professional and financial profile.

| Loan Type | Key Features |

| Conventional Loans | Standard loans typically requiring 20% down payment. |

| FHA Loans | Government-backed loans with lower down payment requirements. |

| VA Loans | No down payment required for eligible veterans and active service members. |

| Jumbo Loans | Loans exceeding conforming loan limits, often with strict income verification. |

| Physician Loans | Specialized loans designed for medical professionals, often with favorable terms. |

Key Terms to Know

Loan terminology can be complex, but understanding key terms is vital in making informed decisions. Familiarizing yourself with these terms will empower you throughout the mortgage process.

A solid grasp of key terms such as interest rate, principal, down payment, and APR will provide you with the confidence to ask the right questions and negotiate effectively. Understanding these components can lead to better loan terms and financial savings over the life of your home loan. Always feel empowered to seek clarification on any terms that are unclear to you, as this is an important step in ensuring you choose the right loan program for your needs.

Factors to Consider When Choosing a Loan

Any physician looking to select the right home loan program should evaluate several important factors that may significantly influence your long-term financial stability. Consider the following:

- Interest rates

- Loan duration

- Down payment options

- Fees and closing costs

- Loan type (fixed vs. adjustable)

The right loan option will provide you with peace of mind and align with your financial goals.

Interest Rates

To make an informed decision, you should compare interest rates from multiple lenders. Lower interest rates can save you thousands over the course of your mortgage, so it’s necessary to shop around and understand both fixed and variable rate options available to you.

Loan Duration

The length of your loan, or loan duration, significantly impacts your monthly payments and the total interest you will pay over time. You typically have options for short-term (15 years) or long-term (30 years) mortgages, and each has its pros and cons.

This choice will affect not just your monthly cash flow but also your overall financial trajectory. While shorter loans mean higher monthly payments, they can save you money on interest in the long run. Conversely, longer loans often provide lower monthly payments, which can be a boon for your budget during your early career. Weigh your current needs against your long-term financial goals to determine which duration aligns best with your situation.

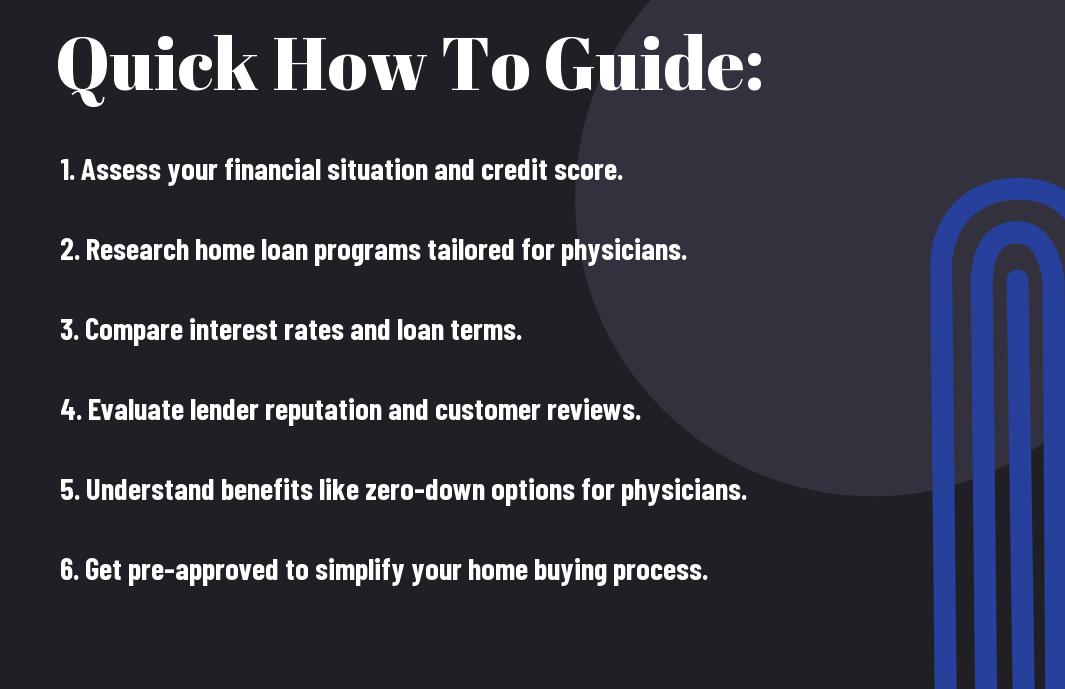

Tips for Physicians

Once again, you need to consider several factors when selecting a home loan program. Here are important tips to guide you:

- Research various loan programs specific to physicians.

- Evaluate interest rates and repayment terms.

- Consider your future career and location stability.

- Consult with financial advisors familiar with physician needs.

The right approach can significantly ease your financial journey.

Benefits of Special Physician Loan Programs

Loans tailored for physicians often come with unique advantages, making them an attractive option. These programs frequently offer lower down payment requirements, eliminate private mortgage insurance (PMI), and provide competitive interest rates, which can save you money over time. Additionally, they may consider your future earning potential rather than just your current income, helping you qualify for a higher loan amount.

Negotiating Terms and Conditions

Any financial agreement involves some negotiation, and home loans are no exception. You should feel empowered to discuss terms, rates, and fees with lenders to secure the best deal for your situation.

Physicians often have unique financial circumstances, which means negotiating your loan’s terms and conditions can yield substantial benefits. Being prepared with documentation about your income and future earning potential can bolster your position in discussions. Don’t hesitate to compare offers from different lenders and express your needs clearly. With the right negotiation strategies, you can secure favorable terms that align with your financial goals.

Assessing Your Financial Situation

To choose the best home loan program for physicians, you must first assess your financial situation. This involves evaluating your income, expenses, credit score, and overall financial health. Understanding these elements will provide a clearer picture of what you can afford in terms of monthly payments and how much you need to borrow. A solid grasp of your financial status will guide you in selecting a loan program tailored to your needs.

Income and Debt Considerations

You should analyze your current income alongside your student loan debt and any other financial obligations. Lenders will look closely at your debt-to-income ratio, which compares your total monthly debt payments to your gross monthly income. This ratio will help determine how much you can borrow and the kind of loan terms you may receive.

Down Payment Options

Income plays a significant role in determining your down payment options for a home loan. Many programs allow for lower down payments, specifically tailored for physicians, which can make homeownership more accessible.

Payment options for down payments vary significantly across different loan programs. For many physician loans, down payments can be as low as 0% to 5%, making it easier for you to enter the housing market without needing to save large sums. Some programs may also offer assistance for closing costs or even no private mortgage insurance (PMI), allowing you to keep more of your savings for other investments or emergency funds. Understanding these options will help you optimize your mortgage strategy.

The Application Process

Your journey to securing the best home loan as a physician begins with a clear understanding of the application process. This entails gathering necessary documents, getting pre-approved, and being aware of various lending requirements that can impact your chances of approval. By preparing in advance, you can streamline your experience and increase your likelihood of a successful loan application.

Documentation Required

You will need to provide specific documentation when applying for a home loan. Commonly required documents include your last two years of tax returns, pay stubs, and proof of employment. Additionally, lenders may request details about your loans, assets, and other financial obligations to assess your qualifications accurately.

Common Pitfalls to Avoid

Some pitfalls include not understanding your credit score and failing to disclose all debts. It’s also a mistake to overlook the importance of maintaining stable finances during the application process, as changes in income or employment can lead to issues.

Plus, be cautious of applying for new credit or making large purchases before closing on your loan, as this can significantly impact your financial profile. Staying informed about all aspects of your application and maintaining communication with your lender can help you avoid delays and enhance your chances of securing the best terms for your home loan.

Comparing Lenders

Despite the variety of lenders available, comparing them is vital to securing the best home loan program suited to your needs. Factors to consider include interest rates, loan terms, and closing costs. Below is a simplified breakdown to aid in your comparison process:

| Factors | What to Look For |

|---|---|

| Interest Rates | Compare rates to find the most competitive offers. |

| Loan Terms | Assess the length and flexibility of repayment options. |

| Closing Costs | Review fee structures to identify any hidden costs. |

How to Evaluate Lender Offers

Offers from lenders may vary significantly, so it’s vital to assess them thoroughly. Look for transparency in terms, fees, and any special programs tailored to physicians. Assess the overall affordability of the loan, considering both monthly payments and long-term costs.

Importance of Reputation and Reviews

To find a reliable lender, you should research their reputation and read reviews from previous clients. This will give you insight into their customer service, responsiveness, and whether they honor their commitments.

Another approach is to ask colleagues or peers in the medical field for recommendations. Their experiences can guide you toward lenders known for providing exceptional services tailored to physicians. Additionally, checking online ratings and industry awards can further validate a lender’s credibility and trustworthiness, ensuring you make an informed choice.

To wrap up

So, as you navigate the world of home loans as a physician, keep these vital tips in mind. Assess your financial situation, research various loan programs designed specifically for healthcare professionals, and consider factors such as interest rates, terms, and benefits. Utilize resources like your employer’s lending programs and seek advice from financial experts to gain insights tailored to your needs. By making informed choices, you can secure a home loan that not only aligns with your financial goals but also supports your unique lifestyle as a physician.