With the increasing complexity of financing options available, many physicians find themselves confused about doctor loans. You may have heard various myths about these specialized loan programs, which can lead to misconceptions that hinder your financial decisions. In this blog post, we’ll clarify the most common myths surrounding doctor loans and provide you with the factual information you need to make informed choices about your financial future as a physician.

Understanding Doctor Loans

For many physicians, navigating the world of financing can be challenging, especially when it comes to securing a mortgage. Doctor loans offer unique options tailored specifically for medical professionals, helping you leverage your earning potential while achieving homeownership goals.

Definition of Doctor Loans

Doctor loans are specialized mortgage products designed for physicians, dentists, and other medical professionals. These loans consider your future earning capacity rather than just your current income, enabling you to secure home financing with more advantageous terms than standard loans.

Key Features of Physician Financing

Across the spectrum of physician financing, several key features distinguish doctor loans from traditional mortgage options. Here are some of the standout benefits:

- Low to no down payment options

- No private mortgage insurance (PMI) requirement

- Flexibility regarding student loan debt calculations

- Competitive interest rates

- Loan amounts that cater to higher-priced properties

The combination of these features makes doctor loans an appealing financing solution for medical professionals looking to invest in real estate.

Definition and understanding of key features are vital when considering physician financing. By knowing what sets these loans apart, you can better assess whether they’re a fit for your financial needs. Moreover, key features include:

- Tailored solutions for residents and fellows

- Diverse funding options to accommodate various practices

- Streamlined application processes

- Eligibility regardless of current employment status

The advantages offered by physician financing can significantly ease the homebuying process for you.

Common Myths About Doctor Loans

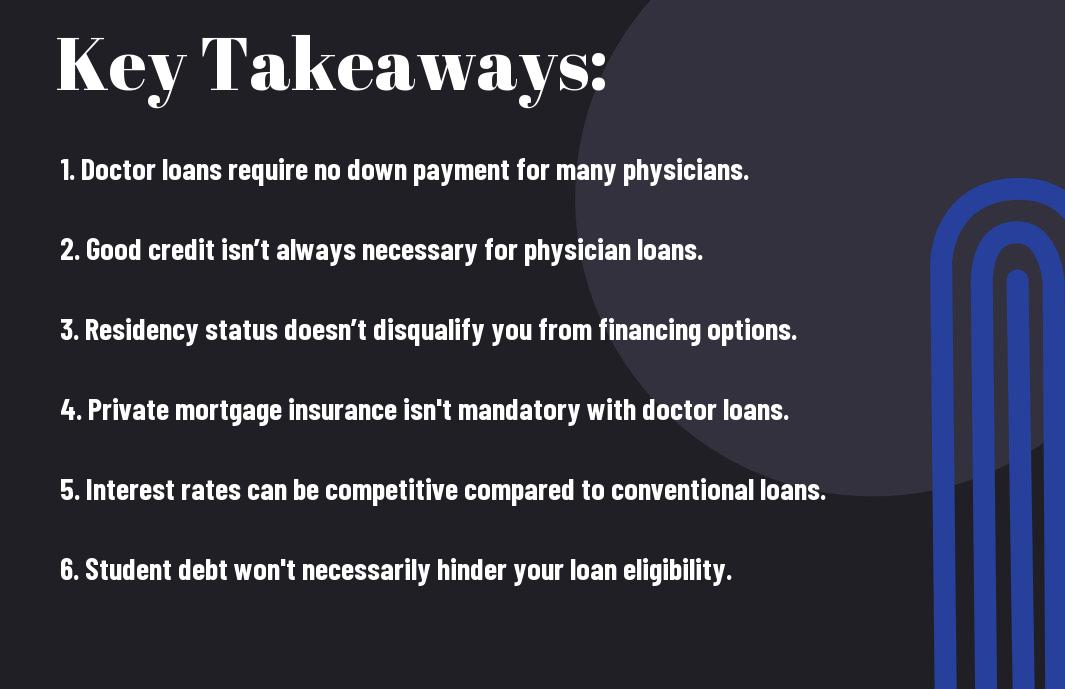

One of the biggest hurdles in understanding doctor loans is the myriad of myths surrounding them. These misconceptions can cloud your judgment and prevent you from making informed financial decisions. In this section, we’ll tackle some of the most common myths about doctor loans, helping you separate fact from fiction, and empower you in your financing journey.

Myth 1: Only Established Physicians Can Qualify

About many aspiring physicians believe that only those with established careers can qualify for doctor loans. In reality, many lenders consider the unique circumstances of recent graduates and residents, often providing favorable terms for you as long as you have a future income projection.

Myth 2: Doctor Loans Are Always More Expensive

Across the board, it’s a common belief that doctor loans come with high interest rates and unfavorable terms. However, that’s not always the case. Many lenders recognize the stability and earning potential of physicians, offering competitive rates tailored to your financial profile.

Also, it’s important to note that while some loan products may have higher fees, many doctor loans are designed to cater to your specific needs. They often come with benefits such as zero down payment options and no private mortgage insurance (PMI), which can lead to substantial savings over time. By comparing loan options and understanding their unique terms, you can secure financing that is not only accessible but also affordable.

The Truth Behind Income and Debt Considerations

Many physicians often worry that their student debt will hinder their financing options. However, lenders understand that medical professionals typically have high earning potential, which can offset existing debt. When evaluating your financial position, they consider your future income rather than merely focusing on your existing debt levels. This perspective allows you to access favorable loans that support your financial goals.

Impact of Student Loans on Financing

Debt can feel overwhelming, but it is important to understand how it interacts with your financing options. Many lenders take into account the specialized nature of your profession and the anticipated income after graduation, which can lead to more favorable financing terms than you might expect.

Income Potential vs. Financing Options

Income plays a significant role in your financing strategy. Lenders know that as a physician, your earning trajectory will improve significantly after residency. This potential influences your eligibility for loans, often granting you access to better interest rates and repayment options tailored to your future income.

Potential income is a compelling factor when lenders assess your financial situation. As a physician, your future earnings are typically higher than many other professions, which gives you leverage in securing financing. This understanding allows you to navigate the loan process with confidence, knowing that your income projections position you favorably for better loan conditions. Understanding this relationship can help you make informed decisions about your financing options and set you up for long-term financial success.

Misconceptions About Credit Scores

To secure a physician loan, many believe that a high credit score is mandatory. This misconception can discourage qualified applicants from exploring financing options available to them. Understanding the truth behind credit scores will empower you to make informed decisions about your financial future and effectively navigate the lending landscape.

Myth 3: High Credit Scores Are Required

By believing that only those with stellar credit scores can qualify for physician loans, you may overlook important financing opportunities. While credit scores play a role in the loan approval process, they are not the sole determining factor, allowing flexibility in the lending criteria.

Reality of Credit Criteria for Physician Loans

Above all, it’s vital to recognize that physician loans have specific criteria that go beyond just credit scores. Lenders consider various factors, including your income potential and professional experience, which can work in your favor despite a less-than-perfect credit history.

Due to the unique nature of physician loans, lenders often prioritize your earning potential and career trajectory over traditional credit score benchmarks. This means that even if your credit score isn’t as high as you’d like, you still may qualify for favorable loan terms. Moreover, lenders are aware that many medical professionals have recently graduated or are still in training, which can impact their credit scores but not their ability to repay loans effectively. By understanding these criteria, you can feel more confident in your financing journey.

Exploring Alternative Financing Options

Keep in mind that when exploring financing options, there are several alternatives beyond traditional methods. Physician-specific loans, often designed to cater to your unique financial situation, can provide affordable solutions for purchasing homes or funding practice startups. It’s crucial to weigh all options, including personal loans or government programs, to find the best fit for your circumstances and long-term financial goals.

Traditional Mortgages vs. Doctor Loans

Above all, it’s important to understand the differences between traditional mortgages and doctor loans. Traditional mortgages typically require a larger down payment and specific credit standards, whereas doctor loans are tailored for physicians and may allow for lower down payments and more flexible terms. This can significantly ease the financial burden as you begin on your medical career.

Advantages of Going with a Doctor Loan

Before entering into the specifics, it’s crucial to acknowledge the key advantages of choosing a doctor loan. These loans often feature lower down payments, no private mortgage insurance (PMI), and lenient credit requirements, making home ownership more accessible for physicians like you. Additionally, many lenders offer competitive interest rates, helping you save money over time.

Traditional financing options can impose high down payment requirements and PMI, which can strain your finances early in your career. Doctor loans provide an opportunity to overcome these obstacles, allowing you to focus on settling into your new life as a physician. The ability to secure financing without PMI not only reduces your monthly payments but also eases the transition into homeownership, letting you invest in your future without overwhelming debt pressure.

Conclusion

Presently, understanding the facts surrounding doctor loans can empower you to make informed financial decisions. By debunking common myths, you can better navigate the options available in physician financing. Recognizing the realities of loan requirements, interest rates, and repayment options ensures that you are equipped with the knowledge needed to secure the financing that best suits your career and life goals. Trust in the facts, and approach your financial future with confidence.