You are launching on a unique financial journey as a medical professional, and navigating the world of doctor loan programs can be daunting. This comprehensive guide will provide you with imperative insights into what these specialized loans entail, helping you understand their benefits, eligibility criteria, and how they differ from conventional mortgage options. By arming yourself with this knowledge, you can make informed decisions that will pave the way for your homeownership goals while managing your student debt and financial responsibilities effectively.

Types of Doctor Loan Programs

Before exploring the specifics, it’s imperative to understand the different types of doctor loan programs available to you. Each program offers unique benefits tailored to medical professionals.

- Conventional Loans

- FHA Loans

- VA Loans

- Physician Loans

- State-Specific Loans

This guide will help you navigate your options effectively.

| Type | Features |

| Conventional Loans | Standard mortgages not insured by the government |

| FHA Loans | Loans backed by the Federal Housing Administration, ideal for low down payments |

| VA Loans | Loans available to veterans and active-duty military members with favorable terms |

| Physician Loans | Tailored for doctors with no PMI and flexible debt-to-income ratios |

| State-Specific Loans | Programs designed to meet the needs of specific states |

Conventional Loans

Loans are standard mortgage options that aren’t backed by any government agency. They typically require a higher credit score and a substantial down payment but can provide flexibility for seasoned professionals looking to invest in real estate.

FHA Loans

On the other hand, FHA loans are government-backed mortgage options that cater to individuals with lower credit scores or limited savings. They allow for smaller down payments, making them a great choice for those entering the medical profession.

Programs under FHA loans can help you purchase a home with as little as 3.5% down. This is particularly beneficial if you’re transitioning into practice and may not yet have a substantial income or savings. FHA loans typically have lenient credit requirements, allowing you to secure financing despite student loan debt or other financial burdens.

VA Loans

Types of VA loans are specifically designed for veterans, active service members, and qualified surviving spouses. These loans offer significant advantages, including no down payment and no private mortgage insurance requirements, making homeownership more accessible for those who have served the country.

A VA loan can provide you with favorable loan terms, including lower interest rates and reduced closing costs. With these loans, you can invest in your future without the burdensome financial requirements found in traditional loans, allowing you to focus on your medical career and personal goals.

Key Factors to Consider

Clearly, navigating doctor loan programs requires careful consideration of several key factors that can impact your eligibility and loan terms. Take note of these critical elements:

- Credit score requirements

- Debt-to-income ratio

- Loan amounts and types

- Down payment options

Knowing these factors will empower you to make informed decisions as you explore financing options tailored for your medical career.

Credit Score Requirements

You may be wondering about the credit score needed to qualify for a doctor loan. Typically, lender requirements vary, but a score of 680 or higher is often recommended to secure favorable terms. Some lenders may accommodate lower scores depending on other financial strengths, such as income and employment stability.

Debt-to-Income Ratio

If you’re considering a doctor loan, it’s necessary to evaluate your debt-to-income ratio. This metric compares your monthly debt payments to your gross monthly income and is a critical factor lenders use to assess your ability to repay the loan.

Plus, maintaining a low debt-to-income ratio will enhance your eligibility for better loan terms. Lenders generally prefer a DTI of 43% or lower, though some may provide flexibility for medical professionals with higher DTI ratios, particularly if you have a stable income from a residency or established practice. By strategically managing your debt, you can improve your chances of securing a loan that aligns with your financial goals.

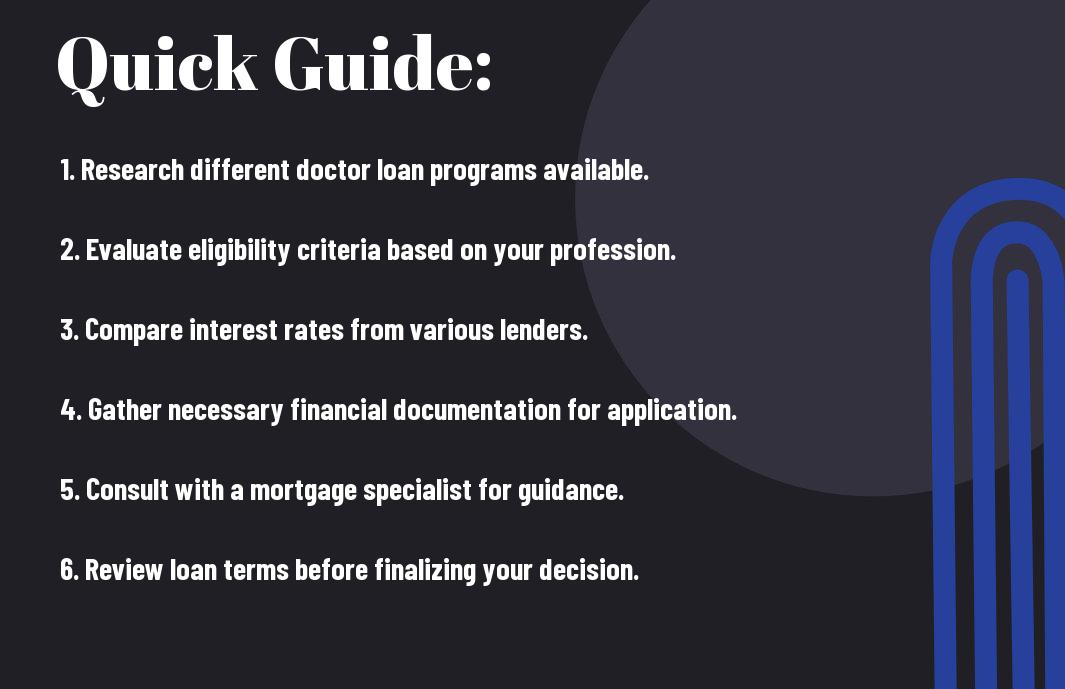

Step-by-Step Guide to Applying

To navigate the doctor loan application process effectively, follow these steps that break down each phase of the journey from application to approval.

Application Steps

| Step 1 | Research lender options and specific loan programs |

| Step 2 | Gather necessary documentation |

| Step 3 | Complete the loan application |

| Step 4 | Submit your application and await pre-approval |

| Step 5 | Review and finalize loan terms |

| Step 6 | Close on your new home |

Pre-Approval Process

One of the first steps in securing your doctor loan is obtaining a pre-approval, which gives you a clearer understanding of your borrowing capacity and strengthens your position as a buyer.

Document Requirements

Guide your application process by compiling necessary documents that mortgage lenders typically require to assess your financial standing and catch up on your income stability.

Another important aspect is to have a complete set of documents ready. These may include your professional licenses, proof of income (like W-2s or pay stubs), tax returns, and student loan information. Having these ready can expedite the review process and help clarify any questions your lender may have.

Closing the Loan

On reaching the final stage, you will go through the closing process which entails signing necessary documents and finalizing your new mortgage terms.

For instance, during the closing, you will review and sign the loan agreement, which outlines your payment obligations. It is also the time to settle any closing costs, which may include appraisal fees and title insurance, giving you ownership of your new property once all is complete.

Tips for Successfully Navigating the Process

Not many medical professionals realize the intricacies involved in securing a doctor loan. To help you successfully navigate the process, consider the following tips:

- Start your research early to understand different options available.

- Gather all necessary documents to streamline the application process.

- Be prepared to discuss your financial situation in detail with lenders.

- Consult with peers who have successfully obtained doctor loans.

Assume that being well-prepared will positively impact your borrowing experience.

Working with a Specialized Lender

Lender selection is pivotal in your loan journey. Choosing a lender who specializes in doctor loans can make the process smoother for you. They understand the unique financial situations faced by medical professionals, including high debt levels from medical school and potentially limited credit histories. Specialized lenders can also offer tailored loan products that meet your needs, making it easier for you to find the best fit.

Understanding Loan Terms

With any loan, it’s crucial to grasp the terms laid out by the lender. Familiarize yourself with interest rates, repayment periods, and any associated fees. Understanding these factors will empower you to make informed decisions regarding your financial commitments.

Specialized lenders often provide detailed breakdowns of loan terms, which can help clarify your obligations. Make sure to ask about specific features such as prepayment penalties, options for forbearance, and how your loan will interact with your future earnings. The more you know, the better equipped you will be to select a loan that aligns with your financial goals and situation.

Pros and Cons of Doctor Loan Programs

For medical professionals considering doctor loan programs, it’s crucial to weigh the advantages against the potential drawbacks. The following table outlines key pros and cons to help you make an informed decision.

| Pros | Cons |

|---|---|

| Low or no down payment options | Higher interest rates compared to conventional loans |

| No PMI (Private Mortgage Insurance) | Limited lender availability |

| Flexible credit requirements | Loan limits may be lower than conventional loans |

| Quick approval process | Potential for high debt-to-income ratio concerns |

| Specialized programs tailored for doctors | Not all property types may qualify |

Advantages of Using a Doctor Loan

Clearly, utilizing a doctor loan offers significant benefits that cater specifically to your financial situation as a medical professional. With options like minimal down payments and no need for PMI, these programs are designed to ease your journey towards homeownership, enabling you to access the housing market more fluidly and focus on your career.

Potential Disadvantages

For some, the potential disadvantages of doctor loan programs may outweigh the advantages. While these loans offer unique benefits, they also come with certain limitations that you should consider before making a decision.

Potential drawbacks include higher interest rates when compared to conventional loans, which could end up costing you more over the life of the mortgage. Additionally, the availability of lenders specializing in these programs may be limited, restricting your choices. Furthermore, if your debt-to-income ratio is high, qualifying for a loan could be challenging. Understanding these potential issues can help you determine the right path for your financial future.

Conclusion

Drawing together the insights from this guide on doctor loan programs, it is clear that these financial options can greatly enhance your journey toward homeownership. By understanding the unique benefits and requirements of these specialized loans, you can make informed decisions that align with your professional goals. As a medical professional, utilizing these programs can lead you to not just a house, but a home that supports both your career and personal life. Equip yourself with this knowledge to navigate the lending landscape confidently.