Over the years, finding the right mortgage option can be challenging for physicians, especially as you navigate the unique financial landscape of your profession. This blog post researchs into the key differences between doctor loans and traditional mortgages, helping you determine which option aligns best with your financial goals and lifestyle. By understanding the benefits and drawbacks of each choice, you can make an informed decision that sets you up for success as you launch on your homeownership journey.

Understanding Doctor Loans

For many physicians, navigating the world of home financing can be daunting. Doctor loans are specially designed mortgage products tailored to the unique financial situations of medical professionals. These loans typically offer favorable terms that can ease the burden of purchasing a home, allowing you to focus on your practice while enjoying the benefits of homeownership.

Definition and Features

After entering the mortgage market, you may discover that doctor loans are a unique hybrid product. These loans often feature low or no down payment options, flexible credit underwriting, and allow for the inclusion of future income from your residency or fellowship. This makes them an attractive choice if you are a physician looking to invest in a property early in your career.

Eligibility Criteria

Among the various eligibility requirements for doctor loans, you must typically hold a medical degree or be in a residency program. Lenders often consider your profession as a key factor in approving the loan. Additional aspects taken into account may include your credit score and overall debt-to-income ratio, ensuring you have the financial stability required for homeownership.

Features of doctor loans may vary by lender, but many consider your potential income as a physician, even if you have not begun working yet. This allows you to qualify for larger loan amounts than traditional mortgages might permit. Moreover, you might also benefit from reduced or eliminated private mortgage insurance (PMI) requirements, further lowering your monthly payments. Overall, these tailored features can significantly improve your homebuying experience compared to conventional options.

Traditional Mortgages Explained

Assuming you are a medical professional considering home financing options, it’s crucial to comprehend traditional mortgages. These loans have been the go-to for homebuyers for decades, offering a straightforward approach to purchasing a home. Typically, they require a down payment and involve fixed or adjustable interest rates. The mortgage term can usually range from 15 to 30 years, allowing you to finance your home in manageable monthly payments while building equity through your payments.

Definition and Features

An traditional mortgage is a loan secured by the property you purchase, where the lender holds the title until you repay the loan. Main features include the loan amount, interest rates, and repayment terms. You often must provide a down payment, which can influence your monthly payments and overall loan terms. These mortgages offer flexibility, allowing you to choose between fixed or adjustable rates based on your financial situation and preference.

Eligibility Criteria

Among the various requirements for traditional mortgages, lenders typically look at your credit score, income, debt-to-income ratio, and employment history. Each factor plays a significant role in determining your eligibility for financing and the terms you might receive.

This eligibility assessment means your creditworthiness is key when applying for a traditional mortgage. A higher credit score can help secure better interest rates and loan terms, while consistent income sources and a low debt-to-income ratio demonstrate your ability to repay the loan. Be prepared to submit documentation such as pay stubs, bank statements, and tax returns to substantiate your financial standing and increase your chances of approval.

Key Differences Between Doctor Loans and Traditional Mortgages

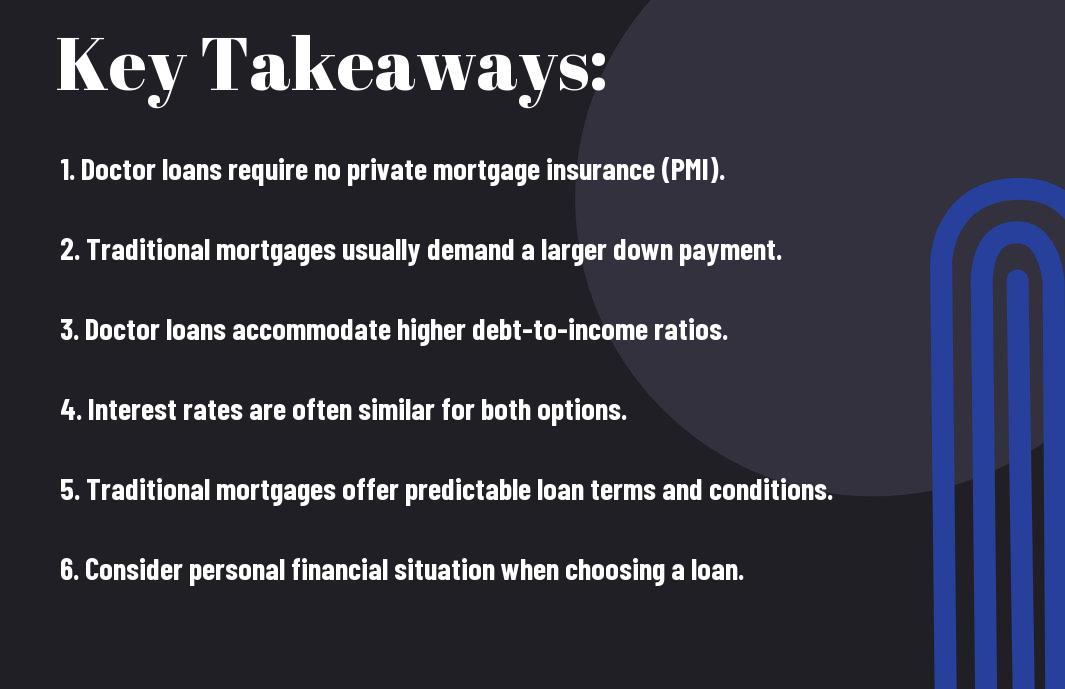

After analyzing financing options, understanding the key differences between doctor loans and traditional mortgages can help you make an informed choice. Doctor loans are tailored specifically for physicians, offering unique benefits like higher borrowing limits and no student loan debt consideration, while traditional mortgages are more conventional. Features such as down payment requirements and interest rates also vary, influencing your monthly payments and overall financial strategy.

Interest Rates and Terms

At the heart of the financing decision are interest rates and the terms associated with each loan option. Generally, doctor loans may offer competitive interest rates, often with fixed-rate options. In contrast, traditional mortgages can vary widely based on your credit score, loan terms, and lender policies, which can significantly impact your long-term financial commitment.

Down Payment Requirements

Among the significant distinctions between doctor loans and traditional mortgages are their down payment requirements. Doctor loans typically require little to no down payment, making homeownership more accessible for physicians who may have significant student debt. Conversely, traditional mortgages often demand a higher down payment, which can hinder your ability to purchase a home quickly.

Between these two options, the reduced down payment that doctor loans offer can dramatically ease the burden on you as a new physician. By allowing you to finance a home without a hefty upfront cost, these loans enable you to retain more cash for emergencies or other investments. In contrast, traditional mortgages could require a 20% down payment or more, potentially delaying your homeownership journey and impacting your financial planning as you transition into your career.

Advantages of Doctor Loans for Physicians

Your path to home ownership as a physician is often smoother with doctor loans, which cater specifically to your unique financial situation. These loans typically offer benefits such as lower down payment requirements, flexible underwriting criteria, and higher debt-to-income ratios than traditional mortgages. As a result, you can secure a mortgage without the burden of private mortgage insurance (PMI), making home ownership more accessible during those early years of your medical career when student loans might still be a challenge.

Benefits and Incentives

Above all, doctor loans come with enticing benefits specifically designed for physicians. Many lenders offer competitive interest rates and allow 100% financing, which eliminates the need for a substantial down payment. Some loan programs even consider future earnings potential, which is invaluable when you’re just starting out. Additionally, you may find benefits like waived PMI and streamlined processing, allowing you to focus more on your career and less on financial hurdles.

Potential Drawbacks

Above the various advantages, it’s necessary to consider potential drawbacks of doctor loans. Some lenders impose strict eligibility requirements, which may limit your options. Also, the interest rates may be higher than traditional mortgages if you don’t meet specific criteria, impacting your long-term costs. Being mindful of these limitations will help you determine if a doctor loan truly fits your needs.

Plus, opting for a doctor loan might lead you to overlook other financing options that could be more beneficial in the long run. For instance, traditional mortgages may offer lower interest rates or better terms based on your overall financial history. Additionally, you may find that while doctor loans are tempting, their options may result in less favorable terms once you enter the repayment phase. Carefully evaluating both paths is necessary to ensure you make a well-informed decision that aligns with your financial goals.

Advantages of Traditional Mortgages

Many homebuyers, including physicians, find traditional mortgages appealing due to their competitive interest rates and straightforward application process. These loans typically offer a variety of terms, which can make it easier for you to budget and find a repayment schedule that aligns with your financial goals. Furthermore, the option for mortgage insurance can be more flexible, allowing you to navigate unexpected changes in your financial situation while still achieving homeownership.

Flexibility and Options

After weighing the benefits of traditional mortgages, you’ll discover that they often come with various loan types, length options, and additional features. This flexibility enables you to choose the best mortgage product that suits your unique circumstances and long-term plans. From adjustable-rate mortgages to fixed-rate options, you can tailor your financing to meet your specific needs.

Common Misconceptions

One common misconception concerning traditional mortgages is that they are not suitable for medical professionals with unique financial situations, such as student loans. Many believe you must have a substantial down payment to qualify, which can discourage you from exploring this financing option.

Common misunderstandings about traditional mortgages can lead to missed opportunities for you. It’s important to recognize that many lenders offer programs designed for various financial situations, including lower down payment options for those with student debt. Moreover, traditional mortgages can cater to your long-term financial goals, allowing you to invest in real estate without overly impacting your current budget. Understanding these nuances empowers you to make informed decisions that align with your financial objectives.

Choosing the Right Loan Option

Not all loan options are created equal. As a physician, you need to evaluate both doctor loans and traditional mortgages to determine which suits your unique financial landscape. Consider factors such as your credit score, income level, and debt-to-income ratio. Each option has its benefits and drawbacks, so carefully analyze how they align with your financial needs and lifestyle.

Assessing Financial Situations

After reviewing your current financial situation, you can better understand which loan option is most suitable for you. Look at your income stability, existing debt, and your overall credit profile. If you have a strong credit score but limited savings for a down payment, a doctor loan may be advantageous, while those with more traditional finances may find traditional mortgages appealing.

Consider Long-Term Goals

An important aspect of choosing the right loan is considering your long-term financial goals. Think about your career trajectory, potential relocations, or plans for family expansion. Your loan choice should not only address your current needs but also align with where you see yourself in the future, ensuring you can maintain financial stability down the road.

Situations that arise in your personal and professional life can significantly impact your mortgage choice. If you anticipate moving or changing jobs frequently, a doctor loan could provide you with more flexibility, such as lower down payment requirements. Conversely, if you plan to settle down and invest in a long-term residence, a traditional mortgage may be the ideal choice, potentially offering lower interest rates based on your credit profile. Evaluate where you envision your life heading and tailor your loan selection accordingly.

Summing up

Summing up, when evaluating Doctor Loans versus traditional mortgages, the best option for you largely depends on your unique financial situation and future goals. While Doctor Loans offer advantages like lower down payments and no private mortgage insurance (PMI), traditional mortgages may provide broader lender choices and potentially better long-term rates. Assess your financial health, consider your plans for homeownership, and weigh the benefits alongside any limitations to determine which option aligns best with your needs as a physician.