You may find the process of buying a home challenging, especially with the unique financial circumstances many medical professionals face. Physician loan programs are designed specifically for individuals in the healthcare field, offering advantages like lower down payments and flexible qualification criteria. This blog post will explore how these specialized loan programs can simplify your home buying journey, allowing you to focus more on your career and less on financial hurdles. Discover how you can leverage these benefits to secure your dream home with confidence.

Overview of Physician Loan Programs

To simplify the home buying process for medical professionals, Physician Loan Programs are specifically designed with your unique financial situation in mind. These programs provide favorable mortgage options that accommodate high student debt levels and fluctuating income during residency. By understanding these programs, you can navigate your home buying journey with greater ease and confidence.

Definition and Purpose

With an aim to assist medical professionals in acquiring home loans, Physician Loan Programs offer tailored financing solutions that consider your specific needs. These programs help bridge the gap between your current financial status and your home ownership goals, making it easier for you to transition into your new career while securing a place to call home.

Key Features

Behind the advantages of Physician Loan Programs are several key features that cater to your circumstances:

- No down payment options available.

- Lower interest rates compared to conventional loans.

- No private mortgage insurance (PMI) required.

- Flexible debt-to-income ratios.

- Loan amounts often higher, accommodating high-value properties.

Assume that utilizing these features can result in significant savings and a more manageable home buying experience for you as a medical professional.

Consequently, Physician Loan Programs emphasize aspects that directly address your challenges as a medical professional. These include:

- Special considerations for your education-related debt.

- Quicker closing timelines to expedite your home purchase.

- Access to a variety of loan types suitable for different situations.

- Guidance from lenders who understand the unique demands of your profession.

- Support for new and established physicians equally, making your transition easier.

Assume that taking advantage of these imperative features will empower you to make informed decisions when buying your first home, ensuring you can focus on what truly matters in your career.

Eligibility Criteria

The eligibility criteria for physician loan programs are tailored to accommodate the unique circumstances of medical professionals. Generally, you must be a licensed physician, dentist, or healthcare professional with a valid medical degree. Many programs also consider recent graduates or those in residency, providing you with the opportunity to secure financing even if you have not yet started your practice.

Medical Professionals Targeted

Across various physician loan programs, your status as a medical professional is a primary factor. These programs specifically target physicians, dentists, veterinarians, and other healthcare providers who may face challenges in securing conventional loans due to student debt or fluctuating income levels. By focusing on your profession, lenders understand your earning potential and the unique obstacles you face.

Documentation Requirements

Targeted documentation requirements make it easier for you to qualify for physician loan programs. Instead of the traditional documentation required for conventional loans, you may only need to provide necessary paperwork that demonstrates your current employment and income potential. Common documents you may need include your medical degree, employment contract, and proof of residency or fellowship.

Medical professionals typically have extensive educational backgrounds, which means streamlined documentation is advantageous. You may not be required to show detailed tax returns or extensive credit histories, allowing you to focus on securing your home without the usual red tape. Lenders are often more understanding of the financial challenges you face, making it easier for you to provide just the necessary documentation to move forward with your home-buying process.

Benefits of Physician Loan Programs

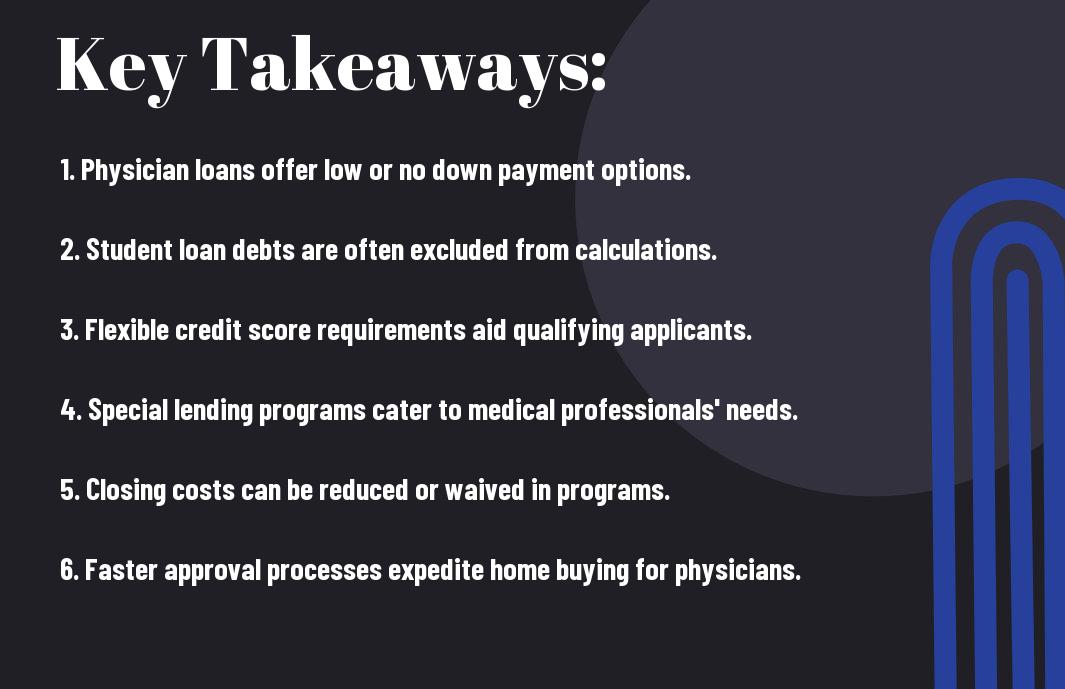

Keep in mind that physician loan programs offer several advantages tailored specifically for medical professionals. These programs are designed to ease the home buying process, allowing you to focus more on your career while securing your dream home. From low or no down payment options to favorable interest rates and flexible debt-to-income ratios, these benefits enable you to make a smooth transition into homeownership without the typical barriers faced by other buyers.

Low or No Down Payment

Against traditional home loans, many physician loan programs allow you to purchase a home with little to no down payment. This can alleviate the financial stress often associated with saving for a substantial down payment, enabling you to invest your resources elsewhere, whether that’s toward your practice or personal savings. This benefit is especially advantageous for newly graduated physicians who may still be paying off student debt.

Favorable Interest Rates

Favorable interest rates are another compelling feature of physician loan programs. These rates often come in lower than conventional loans, providing you with the opportunity to save significantly over the life of your mortgage. Lower monthly payments allow you to maintain better control over your finances while simultaneously investing in your future.

A low interest rate means that your overall financial burden is lessened, which is particularly beneficial for those just starting their careers. The savings accrued from a lower rate can be redirected toward personal investments, further education, or simply enjoying a more comfortable lifestyle. You gain both immediate and long-term benefits, making homeownership more accessible.

Flexible Debt-to-Income Ratios

Ratios for debt-to-income assessments tend to be more flexible within physician loan programs, meaning you may qualify for a loan even if your debt levels appear higher than typical qualifications allow. This understanding recognizes the unique financial circumstances that medical professionals often encounter, such as student debt, allowing you to pursue homeownership more freely.

Interest in flexible debt-to-income ratios can be incredibly beneficial, especially for those with substantial student loans. By allowing you to qualify for a mortgage that may otherwise be out of reach, these programs provide an avenue for financial mobility. This flexibility acknowledges your potential for future earnings, enabling you to make informed decisions about your home purchase while minimizing immediate pressure.

Common Misconceptions

After exploring the benefits of physician loan programs, it’s important to address some common misconceptions that may deter you from considering them. Many medical professionals are unaware of how these loans can be tailored to suit their unique financial situations. Additionally, there’s often confusion surrounding eligibility requirements and loan terms, leading to misconceptions about what you can and cannot afford when purchasing a home.

Myths About Physician Loans

Before entering into the specifics, it’s crucial to debunk the myths surrounding physician loans. Some believe these loans come with steep interest rates or hidden fees, while others think they are only available to newly graduated doctors. In reality, physician loans offer competitive rates and flexible qualifications, making them a valuable resource for many medical professionals.

Clarifying Misunderstandings

Common misunderstandings about physician loans can lead to missed opportunities in your home buying journey. For instance, a prevalent thought is that you need a hefty down payment to qualify for a loan. On the contrary, many physician loan programs require little to no down payment, which significantly eases the financial burden of purchasing a home.

Physician loan programs are designed specifically for medical professionals, which means they often include features that traditional loans don’t offer. For example, these loans typically allow for higher debt-to-income ratios and do not penalize you for student loans, enabling you to qualify for larger amounts. By understanding how these loans work, you can make an informed decision that best suits your needs. It’s vital to clarify these aspects to ensure you’re not discouraged from utilizing a program that could greatly benefit you in achieving homeownership.

Comparing Physician Loans to Traditional Mortgages

Despite the similarities between physician loans and traditional mortgages, several key differences can impact your home buying experience. Understanding these distinctions can help you choose the mortgage option that best fits your financial situation and future plans.

Loan Features Comparison

| Feature | Physician Loans |

|---|---|

| Loan Amount | Higher limits for purchasing homes |

| Down Payment | Often $0 to 10% down |

| Credit Score | More flexible requirements |

| Debt-to-Income Ratio | Higher allowance |

| Employment Verification | Less strict for residents and fellows |

Key Differences

Comparing physician loans to traditional mortgages reveals advantages tailored specifically for medical professionals. Physician loans often offer more favorable down payment options, higher loan amounts, and less stringent credit requirements, allowing you to secure a mortgage even with limited credit history or debt levels due to student loans.

Pros and Cons

With any financial product, it’s imperative to weigh the positives and negatives. Below is a breakdown of pros and cons for physician loans that can help you make an informed decision.

Pros and Cons of Physician Loans

| Pros | Cons |

|---|---|

| No down payment | Higher interest rates compared to conventional loans |

| Less stringent credit requirements | Limited lender options |

| Higher loan limits | Possible PMI for some loan amounts |

| Consideration of future income | May not cover all property types |

| Helpful for residents and fellows | Less flexibility if you switch careers |

But when evaluating the pros and cons of physician loans, it’s imperative to consider your unique circumstances and long-term financial plans. For instance, while the ability to secure a loan without a significant down payment can be beneficial early in your career, higher interest rates may impact your monthly payments over time. Weigh these factors carefully as you determine the best path for your home buying journey.

Steps to Secure a Physician Loan

Many medical professionals may feel overwhelmed by the home-buying process, but securing a physician loan can be simpler than you think. Start by understanding your eligibility and the specific features of these loans. Once you have a clear idea of what you need, you can follow a series of steps to make the process smooth and successful, from finding the right lender to preparing your financial documents.

Finding the Right Lender

At this stage, it’s important to research lenders experienced in providing physician loans. Not all lenders offer the same terms or rates, so take the time to compare options. Look for lenders who understand the unique financial situations of medical professionals, as they often have tailored programs that can benefit you significantly.

Preparing Your Financial Documents

By gathering your financial documents early in the process, you can streamline your application. Lenders will typically require proof of income, employment letters, and tax returns, among others. Having these documents ready will not only expedite your loan acquisition but also give you a clearer picture of your financial standing.

For instance, you should collect pay stubs, bank statements, and any other documentation that verifies your financial health. Gathering this information upfront will not only speed up the process but also help you understand what you can afford. An organized file will allow you to present a strong case to your lender, showing that you are a responsible borrower and can handle your mortgage payments.

To wrap up

Following this, it’s clear that physician loan programs serve as a valuable resource for medical professionals navigating the home buying process. By offering unique benefits such as low down payments, the absence of private mortgage insurance, and flexible qualification criteria, these programs can help you secure the home of your dreams with ease. With a focus on your specific financial situation, take advantage of these options to make informed decisions that align with your career and lifestyle needs.