With the rising costs of medical education and the hefty financial burdens that come with it, navigating home financing can be daunting for you as a medical professional. Fortunately, physician loan programs offer tailored solutions that can help you acquire your dream home without the typical hurdles many borrowers face. These unique financing options are designed to address your specific needs, allowing you to secure lower down payments, flexible credit requirements, and favorable terms. Understanding the benefits of these programs can make a significant difference in your journey toward homeownership.

Understanding Physician Loan Programs

Before you explore homeownership options as a medical professional, it’s imperative to grasp the fundamentals of physician loan programs. These specialized financial offerings are designed to cater specifically to the unique needs of doctors, allowing them to transition from medical school or residency to homeownership more easily. With accommodating terms and conditions, physician loans alleviate common financial barriers, ultimately making it easier for you to secure your dream home.

Definition and Purpose

Above all, a physician loan program is a mortgage product specifically tailored for medical professionals. Its primary purpose is to facilitate home buying for doctors who may be facing increased financial burdens due to student loan debt and inconsistent income early in their careers. By addressing these challenges, physician loans promote stability and enable you to invest in your future sooner rather than later.

Key Features and Benefits

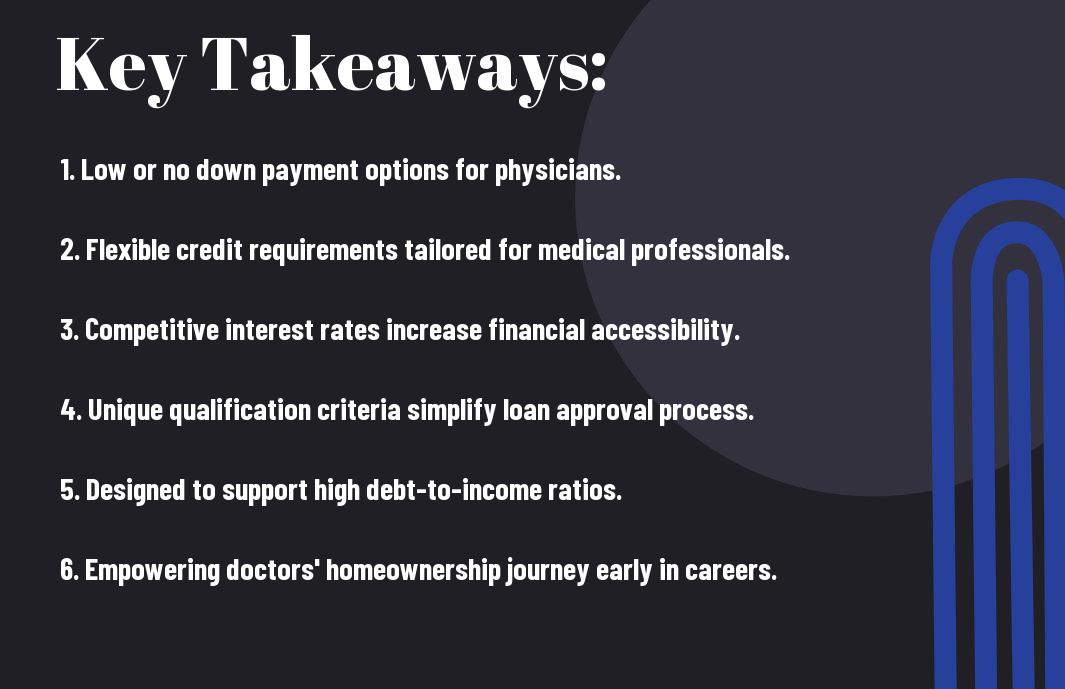

On top of defining what physician loan programs are, it’s important to highlight their distinctive features and benefits. These programs offer several advantages that make them a formidable choice for medical professionals:

- No private mortgage insurance (PMI), even with low down payments

- Flexible debt-to-income ratios that accommodate student loans

- Lower down payment options, often starting at 0% to 10%

- Higher loan limits to accommodate the cost of homes in various markets

- Tailored repayment plans aligning with your income trajectory

Perceiving these features as significant benefits can empower you to make well-informed decisions about homeownership.

It’s equally important to understand how these key features translate into real benefits for you. Aside from the obvious financial flexibility, physician loans permit you to focus on building your career rather than worrying about skyrocketing housing costs or excessive debt burdens. Additional benefits include:

- Low upfront costs due to reduced down payment options

- Streamlined approval processes tailored to your unique circumstances

- Pathways to equity ownership much earlier in your career

- Access to a diverse range of properties and neighborhoods

- Support from lenders experienced in working with medical professionals

Perceiving these advantages can help you take confident steps toward homeownership during your formative years as a medical professional.

Financial Advantages for Medical Professionals

Now, as a medical professional, you have unique financial opportunities that can significantly ease your journey toward home ownership. Physician loan programs provide tailored solutions that recognize your earning potential and financial challenges, allowing you to secure financing on favorable terms that traditional lenders may not offer.

Low Down Payment Options

Between the challenges of student loans and starting your medical career, low down payment options offered through physician loan programs make home buying accessible. Many of these programs allow you to put down as little as 0% to 10%, enabling you to invest in a home without depleting your savings or compromising your financial stability.

Competitive Interest Rates

After evaluating your loan options, you’ll find that physician loan programs often come with highly competitive interest rates. These rates can save you thousands over the life of your loan and directly impact your monthly mortgage payments, making your investment in a home more financially viable.

Considering the high salaries typically associated with medical professions, lenders recognize your capacity to repay loans, translating into more favorable interest rates. This advantage not only reduces your monthly payments but also allows you to build equity faster. By securing a lower interest rate, you can allocate more of your budget toward investments, savings, or even your lifestyle, enhancing your overall financial health.

The Impact on Homeownership

If you are a medical professional, physician loan programs can significantly enhance your journey towards homeownership. These specialized loans recognize your unique financial situation, often allowing you to bypass traditional hurdles and obtain a mortgage without the burden of a hefty down payment. This means you can become a homeowner sooner, establishing stability for your family and paving the way towards building your wealth.

Overcoming Common Barriers

Along your path to homeownership, physician loan programs address common barriers that you may face. These loans often come with flexible underwriting standards, making it easier for you to qualify despite substantial student debt or limited credit history. By focusing on your future earning potential, these programs empower you to achieve your homeownership goals without the usual constraints.

Building Equity Early

Across the board, participating in a physician loan program allows you to start building equity in your home much earlier than conventional financing might allow. As you invest in your property, you not only secure a place for yourself and your family but also create a tangible asset that can appreciate over time.

In addition to the psychological benefits of homeownership, building equity early can have substantial financial implications for you. The sooner you begin to pay down your mortgage, the more value you can unlock as home prices appreciate. This equity can serve as a foundation for future investments, such as expanding your property portfolio or funding your children’s education. By leveraging physician loan programs, you give yourself the opportunity to establish a secure financial future while reaping the rewards of homeownership sooner rather than later.

Eligibility and Application Process

All medical professionals should be aware of the eligibility criteria and application steps for physician loan programs. These programs are designed with your unique financial circumstances in mind, so understanding how to navigate the process can help you secure funding and achieve your homeownership goals more easily.

Who Can Apply?

For a physician loan, you typically need to be a medical doctor, dentist, or other healthcare professional. Most lenders require you to be in residency, fellowship, or established practice, ensuring that you qualify for the program that suits your stage in the medical career.

Steps to Secure a Physician Loan

Above all, it’s important to familiarize yourself with the steps involved in securing a physician loan. Beginning with gathering necessary documentation, you will move through the application process, making sure to meet the specific requirements set by your chosen lender.

Steps to secure a physician loan include researching lenders that offer favorable terms, collecting required financial documentation such as income statements and credit history, and completing the application form accurately. After submission, be prepared for a thorough review process where you may need to provide additional information. Finally, once approved, you’ll discuss terms with the lender, ensuring you understand your responsibilities before signing the agreement. This straightforward approach will make it easier for you to achieve homeownership while managing your busy medical career.

Case Studies and Success Stories

Once again, the transformative power of physician loan programs is evident through numerous success stories. These programs not only enable medical professionals to secure financing but also empower them to achieve their financial dreams more easily. Here are some notable examples:

- Dr. Smith, a newly graduated orthopedic surgeon, bought his first home worth $600,000 with only a 5% down payment, saving over $30,000 compared to traditional loans.

- Dr. Johnson, a family medicine resident, closed on a property valued at $400,000, overcoming student debt hurdles with a no-PMI loan option.

- Dr. Lee, an anesthesiologist, refinanced his previous home loan saving $200 monthly, allowing him to invest more in retirement savings.

Real-Life Examples

About the impact of physician loan programs, countless medical professionals have benefited greatly from the tailored offerings. For instance, many reported feeling more financially stable, with the power to buy homes despite significant student loan burdens. This real-world evidence illustrates how tailored financing options create pathways toward homeownership and long-term financial growth.

Long-Term Financial Impact

Studies show that utilizing physician loan programs can significantly enhance your long-term financial wellness. By facilitating low or no down payments and forgiving PMI, physician loans enable substantial savings that accumulate over time, allowing you more freedom to invest in your future.

Examples of this long-term impact include the ability to redirect savings into investments or retirement accounts, thus building wealth. Furthermore, many physicians in these programs report improved credit scores due to less stringent debt-to-income ratio requirements, which can further facilitate favorable terms on future loans and investments.

Future Trends in Physician Loan Programs

To stay relevant in a constantly evolving financial landscape, physician loan programs are anticipated to adapt, catering specifically to the unique needs of medical professionals. As you navigate these changes, you’ll find that lenders are increasingly offering tailored products and flexibilities, making it easier for you to secure funding and manage your student debt effectively.

Market Changes and Adaptations

Between shifting economic conditions and the growing demand for healthcare services, the market for physician loan programs is continuously adapting. As you seek financing options, you may notice lenders becoming more accommodating, offering varied terms and easing some restrictions traditionally associated with these loan programs.

Predictions for the Healthcare Industry

Predictions suggest significant shifts within the healthcare industry will lead to more tailored financial solutions for medical professionals like you. As healthcare demands rise and the workforce evolves, lenders are likely to expand their offerings and options, making it easier for you to access the funds necessary for your personal and professional growth.

Another important aspect to consider is that as technology and telemedicine become more prevalent, medical professionals may require new funding avenues to invest in practice enhancements or educational offerings. With these industry shifts, lenders are expected to create innovative products that align with the rapidly changing landscape, ensuring that you have access to financial tools that meet your unique needs as a healthcare provider.

Final Words

With this in mind, physician loan programs serve as a transformative solution for medical professionals like you, enabling easier access to home ownership without the burdens of hefty down payments or private mortgage insurance. By understanding and leveraging these specialized financial options, you can focus more on your medical career and less on financial obstacles. These programs not only ease the path to securing a mortgage but also empower you to build your wealth and establish stability in your personal life.