Most aspiring homeowners in the medical field often find themselves overwhelmed by the complexities of financing options available to them. Physician loan programs are specifically designed to help you navigate these challenges, offering advantages that can make homeownership more accessible. In this blog post, you will learn about the key benefits of these specialized loans and what important features you should consider when exploring your financing options. Understanding these elements can empower you to make informed decisions as you commence on your journey to owning a home.

Understanding Physician Loan Programs

For many healthcare professionals, navigating the world of financing can be daunting. Physician loan programs offer tailored solutions designed to accommodate the unique financial circumstances you may face as a medical professional. These programs not only facilitate home financing but also alleviate some of the common barriers associated with obtaining a mortgage.

Definition and Purpose

To put it simply, physician loan programs are specialized mortgage options created specifically for doctors, dentists, and other medical professionals. Their main purpose is to help you secure a home loan without the burdensome requirements typically associated with conventional loans, such as large down payments or private mortgage insurance (PMI).

Types of Physician Loan Programs

Programs can vary significantly, catering to specific needs and stages in your career. Here are some common types:

- Fixed-rate mortgages

- Adjustable-rate mortgages

- Conventional loans

- FHA loans

- VA loans

Knowing which type of program suits your financial situation will empower you to make informed decisions about your home loan.

| Type | Description |

|---|---|

| Fixed-rate mortgages | Stable monthly payments at a consistent interest rate. |

| Adjustable-rate mortgages | Lower initial interest rate that may vary over time. |

| Conventional loans | Standard and flexible options requiring good credit. |

| FHA loans | Government-backed loans with lower down payment requirements. |

| VA loans | Loans available for veterans with favorable terms. |

Plus, each program comes with its own set of benefits and qualifying criteria, which can greatly impact your home purchasing journey. Understanding their features will allow you to secure the best possible financing options for your dream home.

- Low or no down payment options

- No PMI requirements

- Interest-only payment options

- Flexible income documentation

- Eligibility for new graduates

Knowing the advantages of different programs helps you choose the right loan to fit your lifestyle and long-term goals.

| Benefit | Details |

|---|---|

| Affordable entry | Lower initial costs reduce barriers to homeownership. |

| Competitive rates | Potentially lower interest rates set by lenders. |

| Customized solutions | Financing tailored to your career timeline. |

| Professional support | Access to lenders who understand your unique needs. |

| Available even with debt | Options for those with student loans or other debts. |

Key Benefits of Physician Loan Programs

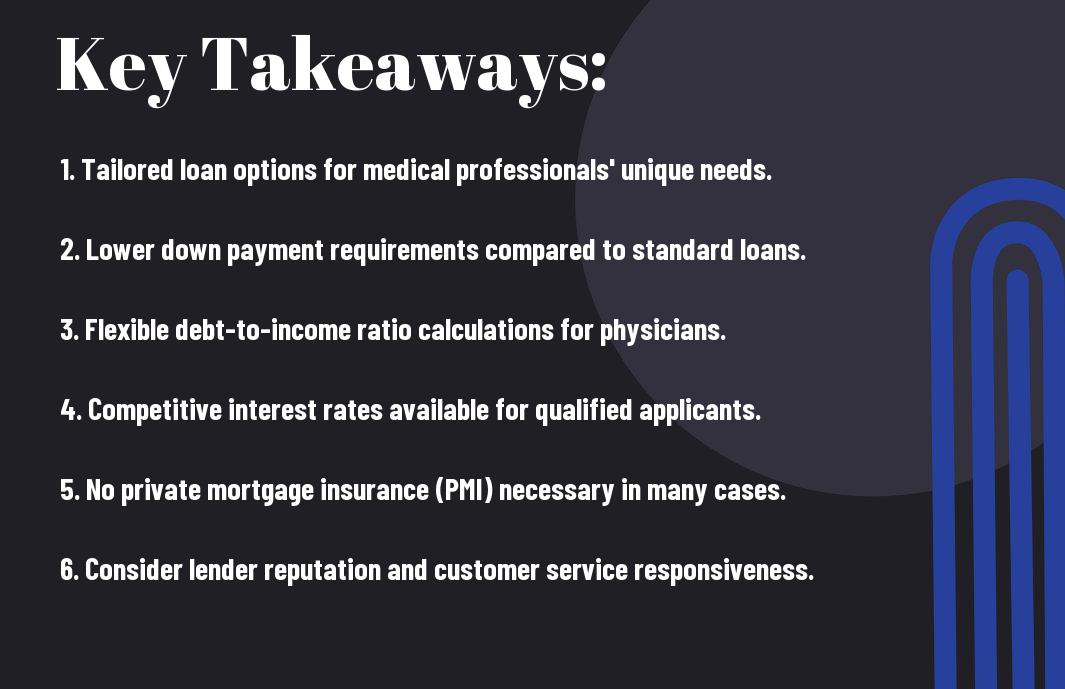

It’s imperative for you to understand the key benefits of physician loan programs, as they are specifically designed to accommodate the unique financial situations of medical professionals. These programs offer tailored solutions to help you transition smoothly into homeownership, recognizing the challenges you may face due to student debt and variable income during residency or fellowship years.

Low or No Down Payment Options

Behind traditional home loans that often require significant down payments, physician loan programs typically offer low or even no down payment options. This feature eases the financial burden on you, allowing you to invest in a home without depleting your savings or compromising your financial security.

Favorable Interest Rates

Behind many physician loan programs are competitive interest rates, which can offer significant savings over the life of your mortgage. Often, these rates are more favorable than conventional loans, making homeownership a more attainable prospect for you as a medical professional.

Physician loan programs not only offer favorable interest rates, but they also provide fixed-rate options that remain stable throughout the life of your loan. This predictability in payments can help you plan and budget effectively, allowing you to focus on your career rather than fluctuating mortgage costs.

Consideration of Student Loans

About physician loan programs often factoring in your student loans, which is an imperative consideration for many new doctors. Unlike conventional lenders, these programs typically allow you to qualify for a mortgage without penalizing you for your education debt, understanding that it’s a part of your investment in your future.

Student loan debt can make it difficult to qualify for a mortgage through traditional means, but physician loan programs often exclude monthly student loan payments from calculations of your debt-to-income ratio. This can significantly enhance your borrowing capacity, making it easier for you to achieve homeownership despite your educational financial obligations.

Eligibility Criteria

Now that you understand the advantages of physician loan programs, it’s crucial to explore the eligibility criteria. Typically, these programs cater exclusively to medical professionals such as residents, fellows, or practicing doctors. Lenders look at your educational background, professional standing, and income potential when assessing eligibility.

Types of Medical Professionals

Now, various medical professionals qualify for these loan programs. This includes:

- Physicians (MD/DO)

- Dentists

- Veterinarians

- Pharmacists

- Nurse Practitioners

Perceiving the qualifications needed can help ensure you’re adequately prepared for the application process.

| Criteria | Description |

| Professional Degree | Must be an MD, DO, DDS, DMD, or equivalent. |

| Residency Status | Residents and fellows are often eligible. |

| Employment Verification | Proof of current or future employment may be required. |

| Debt-to-Income Ratio | Lenders evaluate your ability to manage debt. |

| Geographical Limits | Eligibility may depend on the loan program’s location. |

Credit Score Requirements

Any physician loan program will typically have specific credit score requirements. Most lenders prefer a score of at least 680, but some programs may accommodate scores as low as 620. This flexibility is particularly beneficial for you as a new physician who may have student debt but limited credit history.

With many physician loan programs tailored for recent graduates, lenders understand that your credit history may not be lengthy. It’s crucial to maintain a strong credit profile to improve your chances of approval. You can achieve this by managing your existing debt, paying bills on time, and avoiding any new high-amount credit applications. Keeping tabs on your credit report is also advised, ensuring there are no errors that could affect your score. Understanding these requirements can greatly help you navigate the lending process more effectively.

Important Features to Consider

To make the most informed decision when choosing a physician loan program, you should evaluate specific features that align with your financial goals. These might include the loan limits, terms available, and the potential for interest rate adjustments. Selecting a loan that fits your unique situation can significantly impact your long-term financial health.

Loan Limits and Terms

After you assess your budget and financial needs, consider the loan limits and terms offered by different lenders. Many physician loan programs provide higher loan amounts and flexible terms tailored to your profession, which can help you secure the right financing for your home without a hefty down payment.

Adjustable vs. Fixed Rates

By weighing the pros and cons of adjustable and fixed-rate mortgages, you can find the option that suits your financial strategy best. Fixed rates provide stability, while adjustable rates can offer lower initial payments.

Understanding the difference between adjustable and fixed rates is imperative for your financial planning. Fixed-rate loans maintain the same interest rate throughout the loan term, ensuring predictable monthly payments. Conversely, adjustable-rate mortgages often start with a lower rate but can fluctuate over time, potentially leading to higher payments in the future. Assess your willingness to take on interest rate risks and your long-term plans to make the best choice for your financial future.

Navigating the Application Process

Keep in mind that navigating the application process for physician loan programs requires a strategic approach. Gathering the right information and understanding the steps can simplify your journey to homeownership. As a physician, you may have unique circumstances that lenders consider, so it’s necessary to be prepared with the necessary documentation and to communicate clearly with potential lenders.

Pre-Approval Steps

At the beginning of the application process, obtaining a pre-approval is a critical step. This involves researching lenders who offer physician loans and providing them with basic financial information. You’ll need to assess your credit score and determine your budget to ensure a smooth pre-approval process, which can ultimately enhance your negotiating power when you find the right property.

Documentation Required

Process your documentation with attention to detail as lenders will require specific information to evaluate your financial standing. Commonly needed documents include proof of income, tax returns, bank statements, and details about your employment status, especially if you are a recent graduate or in a residency program.

A comprehensive list of documentation will help streamline your application. Typically, lenders will ask for recent pay stubs, W-2 forms, and verification of student loans or other debts. Be prepared to provide a personal statement explaining your financial situation, especially if your income is variable due to being in residency. Having these documents organized and accessible will not only prevent delays but also instill confidence in lenders regarding your qualifications as a borrower.

Common Mistakes to Avoid

Once again, navigating physician loan programs comes with its challenges, and making mistakes can impact your financial future. Common mistakes include rushing into a decision without fully understanding the loan terms or not comparing multiple lenders. By being aware of these pitfalls, you can make informed choices and secure a better financial outcome for your career and personal life.

Underestimating Total Costs

By focusing solely on monthly payments, you might overlook the total costs associated with your loan. This includes fees such as origination, closing, and mortgage insurance, which can add up quickly and significantly affect your budget. Take the time to calculate these costs to avoid surprises down the line.

Ignoring Future Financial Goals

Avoid losing sight of your long-term financial goals while securing a physician loan. It’s easy to get caught up in immediate needs, like purchasing a home, but planning for your future is equally important. If your loan choice doesn’t align with your professional aspirations or other financial commitments, you could face challenges later on.

Goals need to be a fundamental part of your decision-making process. Consider how your physician loan will impact your ability to save for retirement, pay off student loans, or invest in other opportunities. By aligning your loan with your future financial aspirations, you can create a more stable and prosperous financial foundation. Ultimately, this alignment can lead to greater security and peace of mind as you progress in your medical career.

To wrap up

Conclusively, navigating physician loan programs can significantly enhance your path to homeownership. By understanding key benefits such as low down payment options and accommodating debt-to-income ratios, you can make an informed decision that aligns with your financial goals. When identifying a program, consider factors like interest rates, lender support, and terms that suit your unique situation. With the right guidance, you can leverage these programs effectively to secure your dream home while balancing your medical career demands.