There’s a unique financing option designed specifically for you as a healthcare professional: physician loans. These specialized loans cater to the specific needs of doctors, dentists, and other medical professionals, allowing you to secure your dream home with flexible terms and favorable conditions. In this post, you will explore the benefits and features of physician loans, helping you to navigate the home-buying process with confidence and ease. Understanding these loans can transform your journey towards owning a home tailored to your lifestyle and career demands.

What Are Physician Loans?

While navigating the complex world of home financing, physician loans offer a tailored solution designed specifically for medical professionals. These unique mortgage products cater to the financial situations often faced by doctors and dentists, allowing you to achieve your dream home without the typical barriers found in conventional loans.

Definition and Overview

What sets physician loans apart is their focus on the unique financial profiles of medical professionals. These loans are designed to accommodate high-debt-to-income ratios and the lengthy education period that often limits conventional financing options. As such, they provide an accessible path to homeownership for those in the medical field.

Key Features of Physician Loans

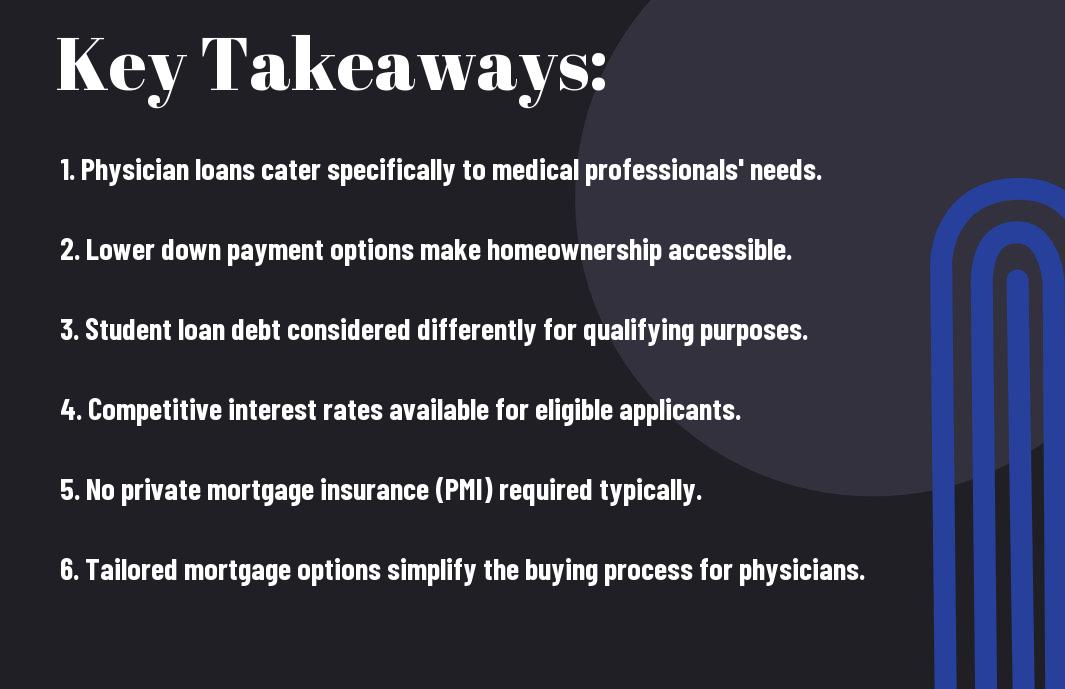

To help you understand why physician loans are advantageous, consider the following key features:

- No private mortgage insurance (PMI) required

- Low down payment options, often as low as 0% to 10%

- Flexible credit score requirements

- Higher loan limits tailored for high-value properties

- Consideration of future income and job offers

Recognizing these features can empower you to take advantage of this specialized loan type, making the homebuying process smoother and more accessible.

Features such as no PMI and low down payments make physician loans particularly appealing. You can enjoy the benefit of financing a home without the burden of additional fees, which can save you money. Furthermore, their flexible credit requirements recognize your unique circumstances, allowing you to qualify based on your future earning potential rather than just your current financial status.

- Customizable loan structures to fit your needs

- Ability to use gift funds for down payment

- Possible forgiveness of student loan debt in calculations

- Quick closing timelines ideal for busy professionals

- Access to tailored financial advice from experts

Recognizing these features ensures you are well-equipped to navigate your home financing options as a physician and unlock the doorway to your dream home.

Benefits of Physician Loans

Assuming you are a medical professional, physician loans offer outstanding advantages tailored to your unique financial situation. These loans address hurdles many healthcare professionals face, such as high student debt and limited savings, allowing you to secure a home without the usual limitations. With flexible options, these loans can make the dream of homeownership significantly more attainable, ensuring a smoother transition into your new life stage.

Low or No Down Payment Options

After entering the world of physician loans, you will find that many lenders provide low or even no down payment options. This feature is particularly beneficial for you, as it reduces the financial burden of upfront costs, allowing you to allocate more of your funds towards establishing your new home instead of tying them up in a hefty down payment.

Competitive Interest Rates

Across the board, physician loans often come with competitive interest rates that may be lower than traditional mortgage options. This aspect is an imperative factor to consider when evaluating your financing choices, as lower interest rates can lead to significant savings over the life of your loan.

It is vital to understand that competitive interest rates on physician loans can vary among lenders, but generally, these rates are designed to benefit medical professionals. By catering to your specific needs and financial circumstances, these loans allow you to secure favorable terms, ultimately resulting in a more manageable monthly payment and lower overall costs. This can be a significant advantage when planning your long-term financial goals, making homeownership more accessible and sustainable for you.

Eligibility Criteria for Physician Loans

Once again, it’s important to understand the eligibility criteria for physician loans. These specialized loan programs are designed to accommodate the unique financial situation of medical professionals. Lenders typically look for evidence of your medical degree, residency status, and your potentially high earning capacity, making it easier for you to secure financing without a significant down payment.

Professional Qualifications

Eligibility for a physician loan primarily hinges on your professional qualifications. This means you’ll need to provide documentation proving that you are a medical doctor, dentist, or another qualified healthcare professional. Having a stable employment contract or proof of future employment can help strengthen your application, making it easier for you to achieve your homeownership goals.

Financial Considerations

Against conventional loan options, physician loans take into account your financial standing in a different light. Given your training and future income potential, these loans frequently offer more favorable terms, such as lower down payments and reduced debt-to-income ratios.

To leverage this opportunity fully, you’ll need to demonstrate your ability to manage financial commitments effectively. Lenders will review your income projections, any existing debts, and your credit score. It’s advisable to maintain a strong financial profile, as this can significantly enhance your chances of qualifying for a better loan package that suits your circumstances.

Types of Physician Loans

Now, you can explore different types of physician loans designed specifically for medical professionals. Understanding these options helps you choose the right loan for your financial situation:

| Loan Type | Description |

|---|---|

| Conventional Loans | Standard mortgages typically requiring higher credit scores and down payments. |

| Specialty Loans | Loans tailored for physicians, often with flexible terms and reduced requirements. |

| Fixed-Rate Loans | Loans with a constant interest rate throughout the term, ensuring predictable payments. |

| Adjustable-Rate Loans | Loans with interest rates that may change over time based on market conditions. |

| Interest-Only Loans | Loans where you pay only the interest for a certain period before principal payments begin. |

The key to selecting the best loan type is understanding how they align with your financial goals and lifestyle.

Conventional vs. Specialty Loans

An necessary distinction is between conventional and specialty loans. Conventional loans adhere to standard mortgage guidelines, requiring solid credit and a down payment, while specialty loans cater specifically to physicians, offering terms that accommodate your unique financial challenges, such as lower down payments and deferment options.

Fixed-Rate vs. Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) can provide lower initial interest rates, which might appeal to you if you’re looking to save on monthly payments at first. However, be cautious, as your rate could rise over time.

In fact, fixed-rate mortgages provide stability since your interest rate remains constant throughout the loan term, making it easier for you to budget. On the other hand, ARMs may start lower but can lead to higher payments as rates fluctuate. Choosing between them depends on your financial situation and how long you plan to stay in the home; ensuring you select the best option for your needs is necessary.

The Application Process

Not every lender understands the unique financial situations that physicians face. When applying for a physician loan, it’s necessary to find a lender experienced in working with medical professionals. The process typically involves filling out a loan application, providing necessary documentation, and potentially undergoing a credit check. Each lender may have different steps, so you should ensure you follow their specific guidelines closely to streamline your application.

Documentation Required

Required documentation typically includes your medical degree, proof of residency, recent pay stubs, tax returns, and a valid government-issued ID. You should also prepare documents that highlight your employment offer or contract if you’re just starting out. Having these documents organized can facilitate a smoother application process and help assure lenders of your financial stability.

Tips for a Successful Application

On your path to securing a physician loan, being well-prepared can make a significant difference. You should consider implementing these strategies:

- Check your credit score beforehand and address any discrepancies.

- Gather all necessary documentation prior to applying.

- Work on establishing a solid financial history.

- Consult with a lender experienced in physician loans for guidance.

After applying, be proactive in communication with your lender to ensure everything is moving toward approval.

For instance, ensuring you communicate openly with your lender can significantly influence your application’s outcome. You should consider these additional tips:

- Ask questions if there are aspects of the loan process you don’t understand.

- Be prepared to provide additional information as requested.

- Stay organized and maintain records of all correspondence with your lender.

- Seek advice from colleagues who have successfully navigated the process.

After your application is submitted, you will feel more confident knowing you’ve taken proactive steps toward securing your loan.

Common Misconceptions

For many aspiring homeowners, physician loans can often be shrouded in misunderstandings. These misconceptions may hinder you from taking advantage of a financing option specifically designed for your profession. It’s vital to separate fact from fiction so you can make informed decisions about your home buying journey.

Myths About Physician Loans

Among the most common myths surrounding physician loans is the belief that they are only available for certain specialties. Many assume that these loans come with exorbitantly high interest rates or that you must have an established credit history. These misconceptions can deter you from exploring this beneficial financial option while you navigate your path to homeownership.

Clarifying the Truth

An understanding of the realities behind physician loans can empower you as a buyer. It’s important to know that these loans are generally accessible to a wide range of medical professionals, not just those in specific specialties. Additionally, interest rates can be competitive, and flexible terms are often offered, making it easier for you to secure financing despite limited credit history or student loan debt.

With a clearer picture of physician loans, you can confidently pursue your dream home. The reality is that many lenders understand the unique trajectory of your career and are willing to provide favorable terms, such as low or no down payment options. This tailored approach is designed to help you overcome financial hurdles, allowing you to focus on what truly matters: finding the perfect place to call home.

To wrap up

Drawing together the insights on physician loans, you can see how these tailored financial options can serve as a valuable resource in your journey to homeownership. With benefits such as lower down payments and exclusive mortgage terms, you can make your dream home a reality without the traditional barriers. Understanding these loans empowers you to navigate the housing market confidently, ensuring you choose what best fits your financial and personal aspirations. Invest in this knowledge, and you’ll be well on your way to securing the perfect home for your needs.