Physician loans are tailored financial products designed to support you as a medical professional in achieving homeownership despite high student debt levels. Understanding the specific requirements and benefits of these loans is vital to maximize your chances of approval. In this guide, you’ll find valuable tips and insights on how to qualify for a physician loan, helping you navigate the financing process smoothly and efficiently. Whether you’re a resident or an established physician, this comprehensive resource will empower you to make informed decisions about your future home.

Understanding Physician Loans

While navigating the complex landscape of home financing, medical professionals often encounter unique opportunities tailored specifically for them. Physician loans are designed to assist you, as a physician, in achieving homeownership, recognizing the financial challenges that come with student debt and the often fluctuating earning potential during your training period. These loans bypass some traditional underwriting requirements, making it easier for you to secure a mortgage even if your financial situation may differ from conventional borrowers.

What is a Physician Loan?

One of the defining features of a physician loan is that it is a specialized mortgage product targeted at medical professionals, including residents, fellows, and attending physicians. These loans typically allow for a low down payment—often as low as zero to five percent—eliminating the need for private mortgage insurance (PMI). This can be particularly advantageous for you, especially if you have significant student loans affecting your debt-to-income ratio. By focusing on your future earning potential rather than your current financial situation, physician loans provide a more inclusive approach to home buying.

Benefits of Physician Loans

Clearly, one of the standout benefits of physician loans is the favorable lending terms, which often include lower interest rates and reduced fees compared to conventional loans. Additionally, you can frequently access higher limits for borrowing, allowing you to purchase a home that meets your needs without the constraints typically placed on first-time home buyers. The flexibility these loans offer is designed to accommodate your specific circumstances, particularly including longer repayment terms that can ease your financial burden.

A further advantage of physician loans is their ability to streamline the application process. With fewer documents required and a more forgiving stance on credit scores, lenders recognize the unique nature of your career and the lucrative positions that await you post-residency. By opting for a physician loan, you can focus more on your practice and less on the intricacies of the home buying process. This tailored support allows you to transition into homeownership seamlessly, enabling you to invest in your future while managing the demands of your medical career.

Qualifying Factors for Physician Loans

Clearly, understanding the specific qualifying factors for physician loans can significantly streamline your purchasing process. These loan programs often take into account various aspects of your financial profile that differ from conventional mortgage applications. Here are the key factors to be aware of:

- Income Assessment

- Credit Score Requirements

- Debt-to-Income Ratio

- Employment Status

The right understanding of these factors can help you navigate through loan options more efficiently and secure a loan that aligns with your financial goals.

Income Assessment

Physician loans often feature more flexible income assessment methods compared to traditional home loans. Lenders typically consider your future earning potential, especially if you are in residency or fellowship training. You might have a high debt-to-income ratio due to student loans; however, lenders may focus more on your projected salary after completing your training to determine eligibility.

Your qualifications as a medical professional can set you apart, allowing you to qualify for a higher loan amount despite a lack of extensive work history. Consequently, having a reliable job offer or contract from a healthcare facility can enhance your chances in this unique lending landscape.

Credit Score Requirements

With physician loans, credit score requirements usually differ from standard mortgage loans. Many lenders are inclined to work with you even if your credit score isn’t perfect, generally accepting scores as low as 700. However, a higher credit score can improve your chances of receiving a better interest rate and loan terms, which ultimately benefits your long-term financial outlook.

Understanding the intricacies of credit score requirements can help demystify the lending process. While a score above 700 is often advantageous, it’s imperative to focus on improving other financial areas, such as maintaining low credit card balances and paying bills on time. These strategies will not only enhance your credit score but also position you favorably in the eyes of lenders when applying for physician loans.

Tips for Strengthening Your Application

Keep in mind that a solid application can set you apart from others. Here are some tips to strengthen your application for a physician loan:

- Maintain a stable employment history.

- Provide comprehensive financial documentation.

- Be proactive in addressing any past credit issues.

- Show a clear plan for your future income trajectory.

Any attention to these details can enhance your chances of approval and potentially yield more favorable loan terms.

Documentation Needed

Needed documentation plays a pivotal role in the approval process for a physician loan. You should gather recent pay stubs, tax returns, and your residency or fellowship contract, which outlines your future earning potential. Lenders will often want to see proof of your assets and any additional income sources, such as bonuses or rental properties. Having these documents organized and ready when you apply will streamline the process and convey your preparedness.

In addition to standard income documentation, consider preparing letters of recommendation from mentors or supervisors in the medical field. While not always required, these letters can provide additional context about your professional reliability and commitment to your career, helping to solidify lender confidence in your ability to repay the loan.

Building Credit Before Applying

Credit is a fundamental aspect of your financial profile that lenders will scrutinize when evaluating your application. It’s important to take steps to ensure your credit score is in good standing before you begin the loan process. Start by reviewing your credit reports for any inaccuracies or errors that may negatively impact your score. Pay off any outstanding debts and keep your credit utilization ratio below 30% to showcase your financial responsibility.

It can also be beneficial to establish a robust credit history if you are early in your career or haven’t had a chance to build much credit yet. Consider obtaining a credit card and using it for small, manageable purchases, ensuring you pay off the balance each month. This practice not only demonstrates responsible credit usage but also can gradually improve your credit score over time.

Common Mistakes to Avoid

After you have decided to pursue a physician loan, being aware of common mistakes can save you time, money, and stress. Many medical professionals jump into the loan application process without adequately preparing, which can lead to unfavorable terms or even denial of the loan. By avoiding these pitfalls, you can improve your chances of securing the financing you need to purchase your dream home.

Overlooking Financial Readiness

Financial readiness is your starting point for applying for a physician loan. Many medical professionals underestimate their financial situation by neglecting to review their credit score, existing debts, and overall financial health before applying. Taking the time to assess these factors can help you understand where you stand and identify any necessary improvements. Paying down debt and ensuring timely bill payments can help improve your credit score, which is a significant factor in determining your eligibility for a loan.

Ignoring Lender Options

An crucial aspect of qualifying for a physician loan is exploring the various lender options available to you. Overlooking the differences in interest rates, loan terms, and specific physician loan features can result in choosing a lender that may not fit your financial goals. It’s vital to conduct thorough research and compare different lenders to find the best terms for your situation.

Common lenders can have varying requirements and benefits, so it pays to shop around. Some lenders may cater specifically to medical professionals, offering unique loan products tailored to physicians’ needs, such as no down payment or no private mortgage insurance (PMI). By examining your options, you can not only save money over the life of the loan but also secure a loan that aligns with your long-term financial strategy.

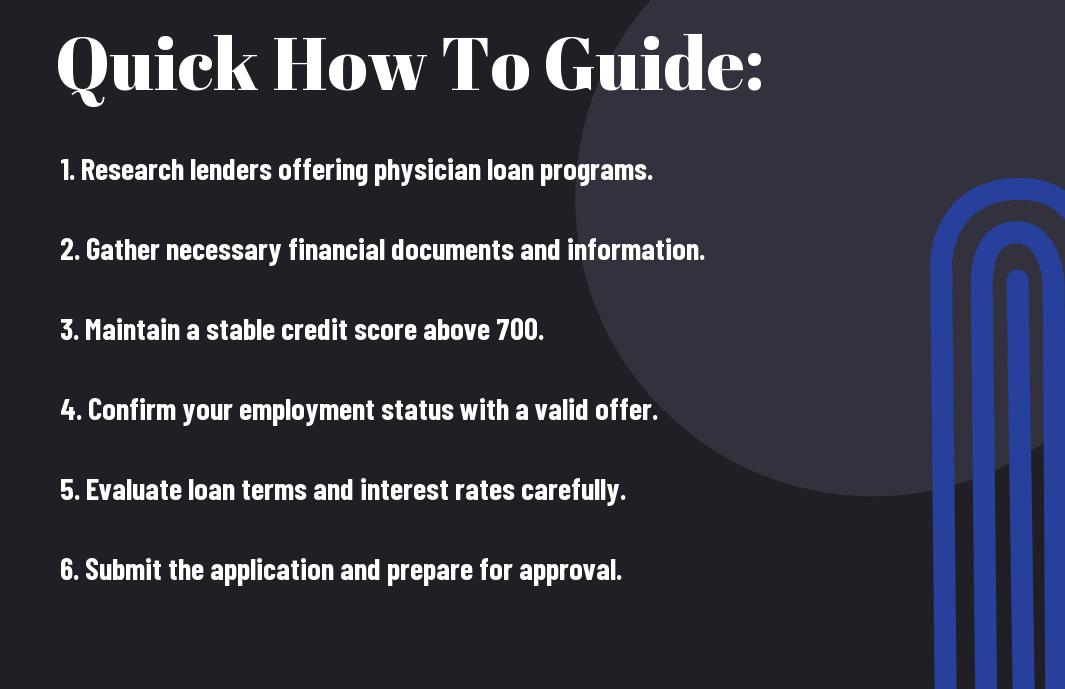

Steps to Apply for a Physician Loan

Despite the complexities often associated with securing a mortgage, applying for a physician loan can be a streamlined process when you take the right steps. These loans are specifically tailored for medical professionals, making it easier for you to navigate the lending landscape. The first step is to gather all necessary documentation, which typically includes proof of income, a copy of your medical license, and your credit report. Additionally, you’ll want to assess your financial situation, including your savings and debt-to-income ratio, to better understand how much you can afford before you begin shopping around for a lender.

Researching Lenders

Steps to researching lenders include looking for institutions that specifically offer physician loans. Many banks and credit unions recognize the earning potential of medical professionals and provide unique terms like no down payment or reduced mortgage insurance costs. Make a list of potential lenders and investigate their rates, fees, and customer reviews to find the best fit for your financial needs.

It’s also beneficial to speak with other medical professionals in your network about their experiences with various lenders. Their first-hand insights can guide you toward reputable institutions that provide favorable terms and have a strong understanding of the physician loan product.

Submitting Your Application

To submit your application for a physician loan, you will typically begin with an online application form provided by the lender of your choice. After filling out personal information, including your employment details and financial situation, you will need to supply documentation supporting your application, such as proof of income, tax returns, and details about your student loans if applicable. Taking your time to ensure that all paperwork is accurate and complete can significantly expedite the approval process.

Understanding the submission process is vital to ensuring a smooth experience. After submitting your application, the lender will review your information and may ask for additional documentation or clarification on certain points. Stay proactive during this period by regularly checking in with your lender and being prepared to provide any requested information promptly. Clear communication can help prevent delays and keep your loan process on track.

Preparing for Homeownership

To ensure a smooth transition into homeownership as a medical professional, it is vital to prepare effectively. One such key component of your preparation is developing a clear financial plan. Owning a home comes with various costs that extend beyond the mortgage payment, and understanding these can help you avoid unpleasant surprises. In addition to your down payment, you should factor in expenses such as property taxes, homeowners insurance, maintenance costs, and potential homeowner association fees. Establishing a comprehensive budget that encompasses these ongoing expenses will ensure that you remain financially stable in your new home.

Budgeting for Ongoing Expenses

The key to successful budgeting is accurately predicting and accounting for all costs associated with homeownership. Begin by assessing your current financial situation, including your income, expenses, and savings. Allocate funds for regular bills, and consider setting aside a reserve for unexpected repairs or maintenance. A good rule of thumb is to aim for 1% to 3% of your home’s purchase price each year for maintenance. This proactive approach allows you to maintain your property efficiently, supporting its value over time while also reducing stress related to unexpected costs.

Understanding the Market

Preparing to buy a home also involves gaining a solid understanding of the real estate market in your desired area. Researching current housing trends, local neighborhoods, and average listing prices enables you to make informed decisions. You may want to engage with local real estate agents or attend open houses to gain direct insights into the market dynamics. This knowledge allows you to recognize a good deal when you see one and helps you develop a more realistic perspective on what you can afford based on your budget and needs.

It is vital to stay updated on factors that can influence the real estate market, such as economic indicators, interest rates, and neighborhood developments. Understanding these elements can not only shape your buying strategy but also give you a better grasp of potential resale value down the road. By keeping a pulse on the market, you position yourself to make informed decisions, ensuring that your investment is aligned with both your current and future needs.

To Wrap Up

Upon reflecting on the steps to qualify for a physician loan, you can see that understanding your financial landscape and preparing accordingly is important. As a medical professional, it is likely that your income potential is high, but your debt-to-income ratio may also be impacted by your student loans. Thus, focusing on improving your credit score, gathering the necessary documentation, and seeking lenders who specialize in physician loans will significantly enhance your chances of securing favorable terms. Keep in mind that each lender may have specific requirements, so it’s wise to shop around and find the one that fits your unique situation best.

By taking these proactive steps, you can position yourself to benefit from the offerings available to you as a medical professional. Engaging with financial advisors or mortgage specialists familiar with the nuances of physician loans can further streamline the process, ensuring you navigate it with confidence and clarity. Ultimately, being informed and prepared is the key to making the best financial decision for your future, enabling you to focus on your passion for medicine while enjoying homeownership.