Just as you dedicated years to mastering your medical profession, now it’s time to navigate the journey of homeownership with confidence. In this guide, you will discover the ins and outs of securing your first home using a physician loan, a financing option designed specifically for medical professionals like yourself. Whether you’re a resident or an established physician, understanding the unique benefits and steps involved will empower you to make informed decisions that align with your financial goals. Let’s look into how you can turn your homeownership dreams into reality.

Understanding Physician Loans

Your journey towards homeownership can benefit significantly from understanding physician loans. These specialized mortgage products are tailored for medical professionals, providing flexible terms to accommodate their unique financial situations, such as high student loan debt and fluctuating income during residency.

Types of Physician Loans

Physician loans come in various forms to align with your specific needs. Here are some types you might encounter:

- Conventional Physician Loans

- Jumbo Physician Loans

- VA Loans for Physicians

- FHA Loans for Medical Professionals

- Adjustable Rate Mortgage (ARM) Options

Thou will find a range of options suited for different stages of your medical career.

| Loan Type | Best For |

| Conventional Physician Loans | New physicians with good credit |

| Jumbo Physician Loans | High-value properties |

| VA Loans for Physicians | Eligible veterans or active duty |

| FHA Loans for Medical Professionals | Lower down payment options |

| Adjustment Rate Mortgage (ARM) | Flexible payments over time |

Key Features of Physician Loans

One notable aspect of physician loans are their key features, which set them apart from traditional loan products. These features can help you secure financing more easily as a medical professional.

- No or low down payment options

- No private mortgage insurance (PMI)

- High debt-to-income ratio allowances

- Flexible qualifying requirements

- Ability to finance closing costs

Any of these features can make a significant difference in your journey to owning a home.

Loans designed specifically for physicians often come with personalized benefits that can alleviate common financial hurdles. These might include:

- Competitive interest rates

- Specialized underwriting processes

- Consideration of future income potential

- No employment history required

- Ability to close before starting a job

Any financial products that cater to your profession can empower you to make informed decisions for achieving your homeownership goals.

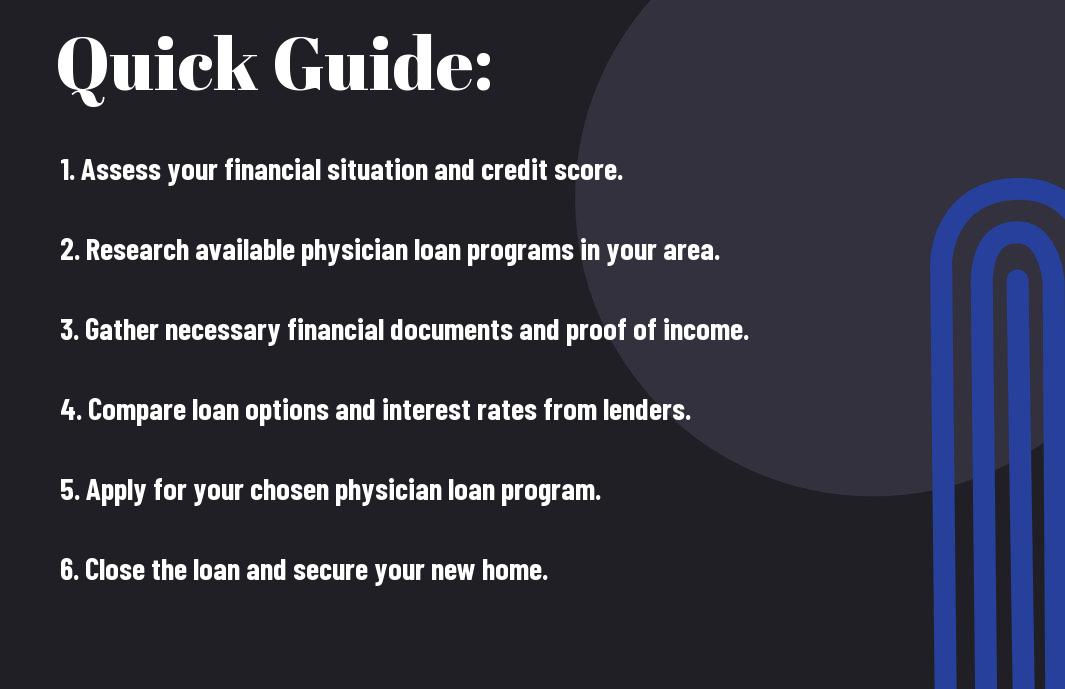

Step-by-Step Process to Secure a Physician Loan

While securing a physician loan may seem overwhelming, breaking it down into manageable steps can simplify the process. Follow the structured pathway outlined below to ensure a smooth journey towards your first home:

| Step | Description |

| Research Lenders | Identify lenders that specialize in physician loans and compare their offers. |

| Gather Documents | Collect necessary financial documents, including tax returns and income statements. |

| Submit Pre-Approval | Apply for pre-approval to get an estimate of how much you can borrow. |

| Find a Home | Start house hunting within your budget and desired location. |

| Finalize Application | Complete your loan application with the chosen lender. |

| Close on the Home | Review all paperwork and complete the closing process. |

Pre-Approval Steps

With the right preparation, obtaining pre-approval for your physician loan can set a solid foundation for your homebuying journey. Start by assessing your financial status, collecting necessary documentation, and reaching out to lenders that specialize in loans for physicians. They will guide you through the pre-approval process, helping you determine your budget and providing confidence as you begin searching for your ideal home.

Finalizing Your Loan Application

For the finalization of your loan application, you will need to provide your lender with comprehensive information about your finances and the home you are purchasing. After your pre-approval, you will formally apply for the loan, submitting any additional required documentation. Keep an open line of communication with your lender to ensure that all information is accurate and complete. This step will pave the way for the eventual closing of your loan.

It’s crucial to pay attention to detail during the finalization of your loan application, as any discrepancies can cause delays. Ensure that all documentation is up to date and accurate to streamline the underwriting process. Your lender may request additional information or clarification, so be proactive in responding to any inquiries. By maintaining organization and clear communication, you will enhance the likelihood of a smooth approval process and swift closing on your new home.

Factors to Consider Before Applying

One of the vital steps in securing a physician loan is to assess various factors that can impact your application. Consider the following:

- Your income stability

- Your student loan debt

- The down payment required

- The local housing market

Thou should weigh these aspects carefully to ensure a smooth application process.

Financial Readiness

There’s a significant importance in determining your financial readiness before applying for a physician loan. Take stock of your monthly expenses, existing debts, and savings. Having a clear understanding of your financial landscape will help you budget appropriately and demonstrate to lenders that you are prepared to take on a mortgage.

Credit Score Implications

Consider how your credit score impacts your eligibility for a physician loan. A healthy credit score can lead to better interest rates and lower monthly payments.

To strengthen your application, be proactive about checking your credit score well before applying. Make sure your credit report is accurate by disputing any discrepancies. Even minor improvements in your score can yield significant benefits in loan terms. Keeping your credit utilization low and paying bills on time will further enhance your financial standing, making you a more attractive candidate for lenders.

Tips for Successfully Obtaining a Physician Loan

For a seamless experience with your physician loan, keep these tips in mind:

- Gather all necessary financial documents.

- Check your credit score ahead of time.

- Inform lenders you are a physician to access specific benefits.

- Collaborate with a knowledgeable mortgage broker.

This will enhance your prospects of a successful loan application.

Finding the Right Lender

The process of finding the right lender involves researching institutions that specialize in physician loans. Look for lenders who have a solid understanding of your unique financial situation and can offer competitive interest rates. Don’t hesitate to ask fellow physicians for recommendations and read online reviews.

Negotiating Terms

Loan negotiations can significantly impact your mortgage terms and total payments. Be prepared to discuss interest rates, loan duration, and any associated fees—don’t shy away from asking for better rates or favorable terms.

This step may lead to significant savings over time. Engaging in open discussions with your lender about their offerings can reveal options you might not have considered. You may also want to inquire about any special programs or incentives exclusively available for physicians, as these could further enhance your loan’s terms. Don’t hesitate to challenge offers based on your research and financial standing.

Pros and Cons of Physician Loans

Many aspiring homeowners in the medical field are considering physician loans as a financing option. While these loans provide unique advantages tailored to medical professionals, they also come with certain drawbacks. Below is a breakdown of the pros and cons to help you make an informed decision.

| Advantages | Potential Disadvantages |

|---|---|

| Low or no down payment required | Higher interest rates compared to conventional loans |

| Flexible qualifying criteria | Loan limits may be lower than conventional options |

| No private mortgage insurance (PMI) | Additional fees and costs may apply |

| Designed specifically for medical professionals | Limited lender options |

| Fast closing processes | Potential for higher debt-to-income ratios |

Advantages

There’s a range of significant advantages that come with physician loans. They often feature little to no down payment requirements, enabling you to finance your home without depleting your savings. Additionally, these loans typically have more flexible qualifying criteria tailored to your unique financial circumstances as a medical professional.

Potential Disadvantages

Little-known details can sometimes overshadow the benefits of physician loans. While these loans are advantageous for many, there are potential downsides that you should be aware of before deciding.

Potential drawbacks include higher interest rates than conventional loans, which can increase the overall cost of your mortgage. Additionally, some lenders may impose fees that can offset the benefits of zero down payments. The limitations on loan amounts might restrict your choices in purchasing a home, especially in high-cost areas. Furthermore, not all lenders offer physician loans, which can narrow your options when seeking the best mortgage solution for your needs.

To wrap up

Hence, securing your first home with a physician loan is an achievable goal with the right approach. By understanding the unique benefits of these loans and following each step—from researching lenders to finalizing your purchase—you can navigate the process confidently. Being well-informed about the terms and conditions will empower you to make decisions that align with your financial situation. With diligence and preparation, you’re on your way to owning a home that suits your needs and lifestyle.