If you’re considering selling your home, you’re likely curious about the potential costs involved. The truth is, the total cost can vary based on several factors—such as the offer you accept, whether you assist with your buyer’s closing costs, the repairs you decide to make, and more.

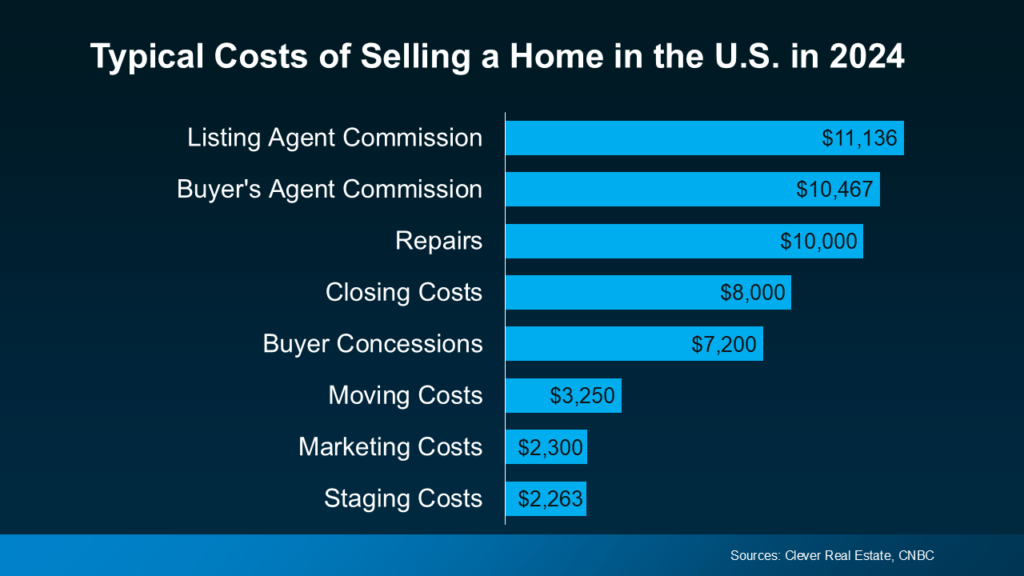

To give you a clearer idea of what to expect, here’s a breakdown of some common expenses you should prepare for (see graph below):

But Here’s the Upside: You’ve Built Equity

While selling your house does come with costs, there’s good news: Most homeowners today have a significant amount of equity built up. This equity can help offset the selling costs and, in many cases, leave you with a substantial profit. Chances are, you’re in the same boat. Not only can this help cover those expenses quickly, but you might also have enough left over to put toward your next home.

Now, let’s break down some of the costs mentioned earlier so you can better understand where your money’s going—and how you might save along the way.

Closing Costs and Commission

These are the expenses you’ll cover at the closing table to finalize the sale. As a seller, you’ll have your own closing costs, and you may even offer to cover some of the buyer’s costs as an incentive. Here’s how U.S. News Real Estate explains it:

“Closing costs are fees paid to finalize the transaction and transfer ownership of the home to the buyer . . . Sellers can expect to pay 2% to 4% of the sale price of the home in fees and taxes on top of the agent commission. Based on the national median home sale price, this means that closing costs for sellers in 2023 range from $7,740 to $15,480.”

Keep in mind that taxes vary by state, and agent commissions depend on your agreement. Also, the numbers in the chart above are estimates, not exact figures. On the bright side, if you’ve been paying property taxes or escrow as part of your mortgage, you might receive a credit at closing that can help reduce some of these costs.

Pre-Listing Inspections and Repairs

Some sellers opt for a pre-listing inspection to get ahead of potential issues that may arise during the buyer’s inspection. Knowing what repairs could be requested allows you to address them before listing, which helps make your home more attractive right from the start.

Not keen on a pre-listing inspection? No worries—your agent can guide you. They’ll offer advice on simple cosmetic repairs, paint colors, and other updates that are most likely to yield a solid return on investment.

Home Staging

With more homes on the market, making your property stand out is key. Staging—whether physical or virtual—can help your home shine. According to Bankrate:

“Home sellers typically spend between $782 and $2,817 on staging, but costs can vary.”

If you’d prefer to save on staging, your agent can help you enhance your home’s appeal by suggesting simple changes, such as rearranging furniture to create a better flow or removing personal items to make the space feel more neutral and welcoming.

Why Working with an Agent Matters

If you’re looking to save on costs, be mindful of where you cut back. Skipping optional steps like staging or a pre-listing inspection is one thing, but working without a professional agent? That’s a gamble you don’t want to take.

An agent is your go-to expert for the entire selling process. They’ll provide personalized advice, help you decide which repairs are worth doing, and craft a marketing strategy to highlight your home’s strengths. This can lead to a higher sale price and a smoother transaction overall.

Bottom Line

Curious about what selling your home might cost and how to maximize your equity? Let’s chat and walk through it together, step by step.