Just because you are a medical professional with a solid income doesn’t mean your student loans won’t influence your mortgage application. Understanding how these loans affect your financial profile is crucial for navigating your doctor mortgage loan process. In this post, we will break down the implications of student loans on your application and provide you with tips to better prepare for securing your dream home. Get ready to take control of your financial future as you step into the world of homeownership.

Understanding Student Loans

While navigating your finances as a medical student, it’s vital to have a comprehensive understanding of student loans. These loans can significantly influence your overall debt and affect your ability to secure a doctor mortgage loan. Your strategies for handling these loans will ultimately shape your financial future and homeownership opportunities.

Types of Student Loans

Student loans primarily fall into two categories: federal and private. Each has unique features and repayment terms that you should consider when planning your financial strategy.

- Federal Direct Loans

- Federal Grad PLUS Loans

- Private Student Loans

- Income-Driven Repayment Loans

- Consolidation Loans

The different types of student loans can affect your financial planning significantly.

| Loan Type | Features |

| Federal Direct Loans | Low interest rates; fixed payments |

| Federal Grad PLUS Loans | Higher limits; credit check required |

| Private Student Loans | Variable rates; based on creditworthiness |

| Income-Driven Repayment Loans | Based on income; potential loan forgiveness |

| Consolidation Loans | Combines multiple loans; simplifies payments |

The Federal vs. Private Loan Landscape

Beside traditional cost considerations, it’s necessary to explore the differences between federal and private student loans. Federal loans typically offer favorable repayment terms, including income-driven repayment plans and potential for forgiveness. On the other hand, private loans may come with variable interest rates and less flexible repayment options, impacting your overall debt management.

Understanding these differences will help you evaluate your choices more thoroughly. Federal loans often provide benefits you won’t find with private lenders, such as deferment options and the possibility of student loan forgiveness. Be sure to weigh each loan’s terms to prioritize your financial health and your pathway to homeownership.

How Student Loans Affect Credit Scores

Now that you are aware of the implications of student loans, it’s important to understand how they affect your credit score. Student loans can have a dual impact on your credit profile: on one hand, they contribute to your credit history, but on the other hand, any missed payments may negatively affect your score, which is vital for your doctor mortgage loan application.

Loan Repayment Impact

The repayment status of your student loans plays a significant role in determining your credit score. Timely payments boost your score, as they demonstrate your reliability as a borrower. Conversely, missed or late payments can lead to a decline in your score, which may hinder your ability to secure favorable mortgage terms.

Credit Utilization Considerations

Scores are also influenced by your credit utilization ratio, which measures how much of your available credit you are using compared to your total credit limits. While student loans are considered installment loans and don’t directly impact credit utilization as credit cards do, your overall debt load can still affect your application. A high debt-to-income ratio may raise concerns for lenders.

Repayment of your student loans impacts both your credit score and overall financial health. It’s important to manage your repayment strategy effectively, as maintaining low balances and a reliable history of timely payments can show lenders you are responsible, even with a considerable amount of debt. Staying informed and proactive about your loans will enhance your credit score in the long run, ultimately benefiting your mortgage application.

Navigating the Doctor Mortgage Loan Process

It can be a daunting experience to navigate the doctor mortgage loan process, especially with the added factor of student loans. Understanding how these loans factor into your mortgage application will help you approach the lender with confidence, making it easier to secure the financing you need for your home. With the right preparation and insights, you can streamline your experience and focus on what truly matters—your career and your future.

What Lenders Look For

Process your application by addressing key factors lenders typically evaluate, including your income, credit score, and overall financial health. Since you may have a high debt-to-income ratio due to student loans, demonstrating a steady income from your medical career can strengthen your application. Lenders recognize that your earning potential is significant, so providing documentation of your employment and prospective salary can improve your standing.

Documentation and Disclosures

Beside presenting your income and credit score, you will need to gather necessary documentation and disclosures that lenders require. This may include personal identification, tax returns, pay stubs, and information about your student loans. Having your paperwork organized can expedite the approval process.

Further, lenders will typically require disclosures about your financial situation, including details surrounding your student loans. You may need to show how these loans fit into your overall debt obligations. Transparency about any repayment plans you are on can also be beneficial in securing favorable loan terms. Make sure to provide accurate and comprehensive documentation to avoid delays and enhance your chances of approval.

Strategies for Managing Student Debt

For managing your student debt effectively, consider implementing a combination of budgeting, prioritizing payments, and exploring various repayment options. It’s imperative to stay organized and proactive about your student loans, as this can positively influence your doctor mortgage loan application. Establishing a solid plan will not only help alleviate financial strain but can also improve your creditworthiness when the time comes to secure a mortgage.

Repayment Plans and Options

Across the student loan landscape, you will find a variety of repayment plans and options designed to fit different financial scenarios. From income-driven repayment plans to standard repayment options, it’s imperative to assess each choice based on your individual circumstances. Taking the time to select the right plan will impact your monthly obligations and, ultimately, your loan applications.

Refinancing: Pros and Cons

At the point of considering refinancing your student loans, it’s important to weigh the advantages against potential drawbacks. Refinancing can lower your interest rates and simplify payments, but it may also result in the loss of certain benefits, such as loan forgiveness programs. Understanding these trade-offs is vital in making an informed decision.

Pros and Cons of Refinancing

| Pros | Cons |

|---|---|

| Lower interest rates | Loss of federal loan benefits |

| Single monthly payment | Longer repayment period can lead to more interest |

| Potential for lower monthly payments | Eligibility for Public Service Loan Forgiveness may be lost |

| Improved credit score possibilities | New credit inquiries may temporarily impact credit score |

| Flexibility in choosing a lender | May require good credit to secure attractive rates |

Consequently, while refinancing can offer significant benefits such as reduced monthly payments and interest rates, it’s imperative to carefully consider the potential loss of protections associated with federal student loans. You should weigh your current financial situation against your long-term goals and the importance of any benefits you may forfeit. Consulting with a financial advisor may also provide clarity on whether refinancing is the right choice for you.

Case Studies

Despite the challenges student loans can pose, several case studies illustrate varying outcomes in doctor mortgage loan applications. Consider these examples:

- Case Study 1: A physician with $250,000 in student debt received approval for a $600,000 mortgage due to a stable income and a solid credit score.

- Case Study 2: A resident with $150,000 in loans faced initial rejection but secured a loan after demonstrating additional income sources.

- Case Study 3: A medical professional with $350,000 in debt was approved for a $750,000 loan by utilizing a specialized lender experienced with high debt-to-income ratios.

Successful Applications Despite Debt

About half of the applicants with significant student loans successfully secure doctor mortgage loans by effectively showcasing their income potential and financial management abilities.

Challenges Faced by Borrowers

Above all, many borrowers encounter hurdles related to their student loans, as lenders often scrutinize debt-to-income ratios closely.

For instance, a borrower with $300,000 in student loans may find their application complicated by high monthly debt payments, which can significantly impact their debt-to-income ratio. Despite having a promising salary as a physician, the lender might view the debt as a risk factor. In cases like this, understanding lender requirements and exploring options to improve your financial profile can make a considerable difference in securing approval for your mortgage loan.

Preparing for Your Mortgage Application

Not understanding the preparation steps for your mortgage application can lead to unnecessary challenges. Gather your financial documents, check your credit score, and create a budget to determine how much you can afford. Prepare to discuss your student loans and their impact on your financial situation, as lenders will closely evaluate how they factor into your overall debt-to-income ratio.

Pre-Approval Steps

On the path to securing your mortgage, obtaining pre-approval is an important step. This process involves submitting your financial documents to a lender for assessment, allowing you to understand your borrowing capacity. With pre-approval, you can confidently shop for homes within your budget while demonstrating to sellers that you are a serious buyer.

Key Financial Metrics to Monitor

Your financial health is key when applying for a mortgage, and several metrics will significantly influence your application. Focus on your credit score, debt-to-income ratio, and savings for a down payment, as these factors will help lenders assess your risk level and ability to manage monthly payments. An awareness of these metrics can empower you to present a stronger application.

Hence, it is important to regularly review your credit score, as a higher score can increase your chances of securing favorable mortgage terms. Monitor your debt-to-income ratio, aiming for 36% or lower, which demonstrates your ability to manage monthly debts, including student loans. Additionally, accumulating at least 20% of the home’s price for a down payment can significantly reduce your mortgage insurance costs and improve your overall financial standing. Understanding and actively managing these financial metrics will not only streamline your mortgage application process but also enhance your prospects for favorable loan terms.

Summing up

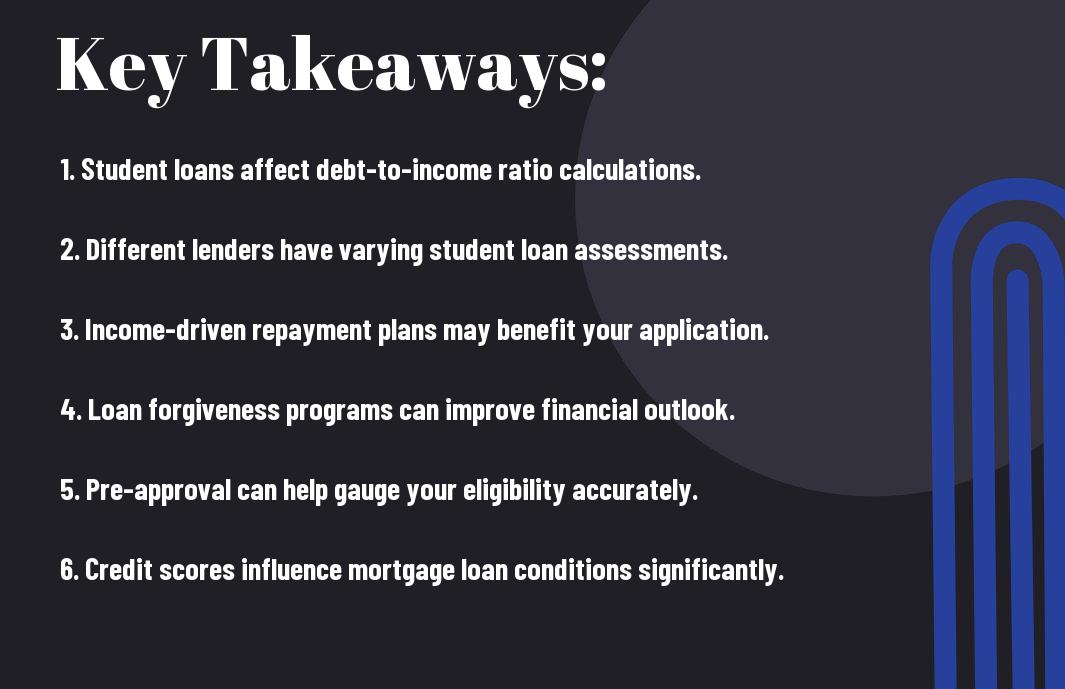

Now that you understand the impact of student loans on your doctor mortgage loan application, you can navigate the process with more confidence. Your student debt will be assessed alongside your income and overall financial profile, influencing your eligibility and interest rates. By proactively managing your loans and knowing what lenders prioritize, you can better prepare for your application. This knowledge will empower you to make informed decisions that support your journey to homeownership as a medical professional.