Is a Housing Market Crash Really Looming? Here’s Why You Shouldn’t Worry

Lately, there’s been a lot of talk about the economy, with some whispers about a potential recession. It’s understandable if that kind of buzz has you concerned about a possible housing market crash. But don’t stress — the reality is far from doom and gloom. The current housing market simply isn’t built for a crash.

In fact, as real estate expert Michele Lerner explains:

“A housing market crash happens when home values drop sharply, usually caused by either too little demand or too many homes flooding the market.”

With that in mind, let’s dive into two key reasons why a crash isn’t likely any time soon.

1. Demand for Homes Far Exceeds Supply

One major factor behind the 2008 housing crash was an oversupply of homes. Fast forward to today, and the market looks completely different.

A balanced market typically has a six-month supply of homes — enough to match buyer demand without tipping the scale in favor of either buyers or sellers. Anything above that means supply is outpacing demand, and anything below it means there are more buyers than homes available.

If you look at the latest data from the National Association of Realtors (NAR), you’ll see that we’re firmly in a seller’s market, with demand continuing to outstrip supply.

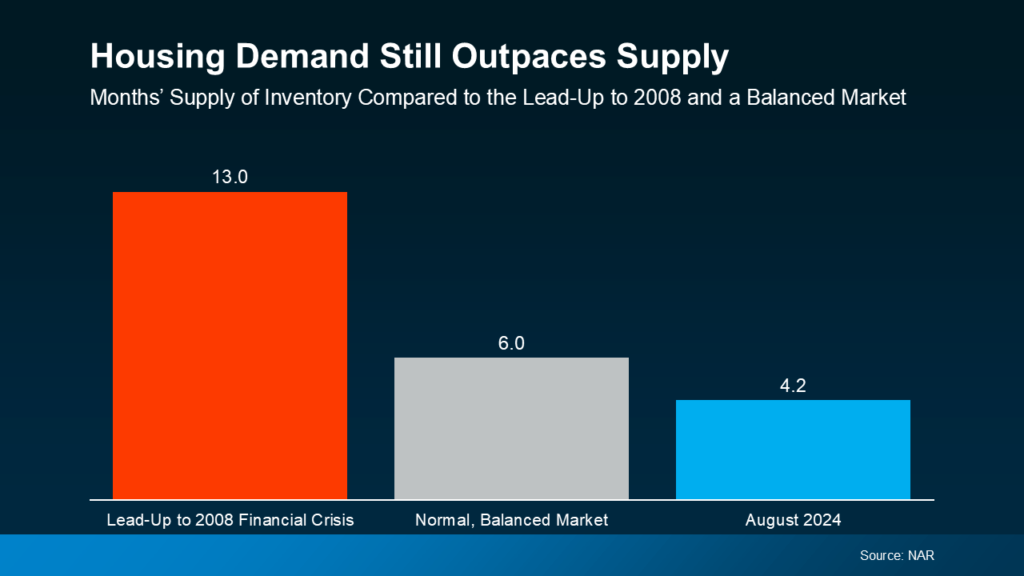

Housing Supply: A Snapshot of Then vs. Now

The graph below highlights housing supply across three key periods.

- The red bar shows there were a staggering 13 months of supply just before the 2008 housing crisis—an oversupply that contributed to the market’s collapse.

- The gray bar represents a balanced market, where a six-month supply keeps things stable.

- The blue bar represents today’s situation: only 4.2 months of supply.

What does this mean? Simply put, there are more buyers than available homes right now. When demand outpaces supply, home prices tend to remain steady or increase, which is the opposite of what happens during a market crash.

It’s worth noting that inventory levels can vary by region. Some areas might be more balanced, and a few could have a slight oversupply that may influence local pricing. However, the majority of markets are still facing a shortage of homes.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), puts it:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. But with the current supply shortage, the likelihood of a 30% price drop is extremely low.”

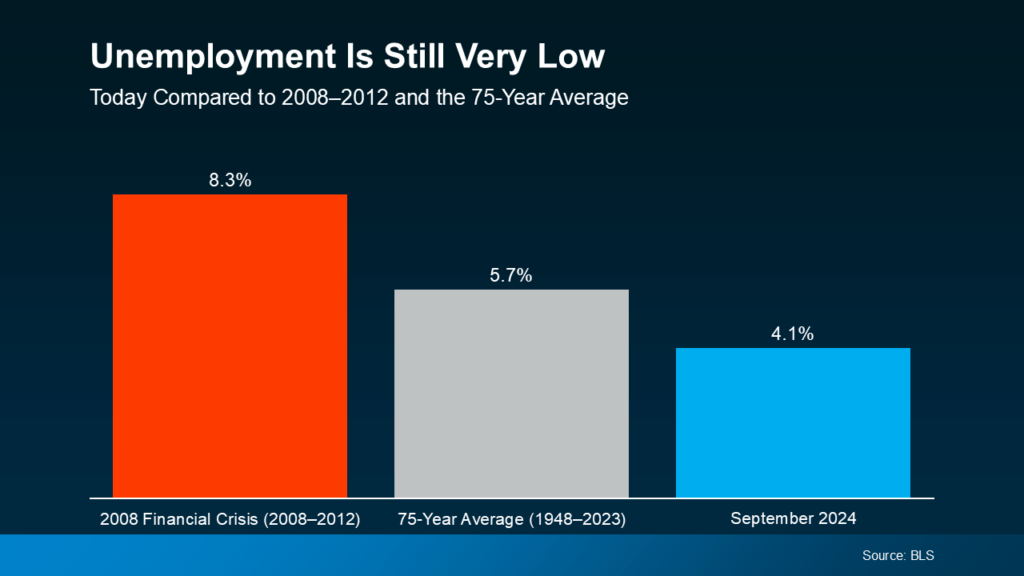

2. Low Unemployment Helps Stabilize the Market

During the 2008 crisis, high unemployment led many people to struggle with their mortgage payments, resulting in a wave of foreclosures and forced home sales. That’s not the case today. The job market is much more stable, as shown in the graph below.

Unemployment Rates: Then vs. Now

The graph below illustrates unemployment during three distinct periods:

- The red bar shows the unemployment rate during the 2008 financial crisis, which spiked to 8.3%.

- The gray bar represents the 75-year average, which sits at 5.7%.

- The blue bar highlights today’s unemployment rate, much lower at just 4.1%.

Right now, people are working, earning steady incomes, and staying on top of their mortgage payments. This is a major reason why the foreclosure crisis we saw in 2008 isn’t likely to repeat. Plus, with so many people employed, more potential buyers are entering the market, helping to keep home prices stable or even rising.

Why Today’s Housing Market is Stronger Than in 2008

It’s understandable to feel uneasy when you hear talk of a possible recession. But here’s the good news: the housing market today is far healthier than it was during the last crisis. As Rick Sharga, Founder and CEO of CJ Patrick Company, puts it:

“Everything about today’s housing market dynamics is completely different from the conditions that led to the 2008 crash.”

Demand still far exceeds supply, and unemployment remains low—two critical factors that support the current strength of the market and prevent a major downturn.

Bottom Line

The housing market is in much better shape than it was in 2008. However, remember that real estate trends can vary by location. Staying informed about your local market is key.