Interest rates play a significant role in your financial journey as a physician, particularly when navigating doctor loans. Understanding how these rates and loan terms work can empower you to make informed decisions that best suit your unique situation. This guide will equip you with the knowledge you need, from deciphering interest rate structures to grasping loan term implications, ensuring you are better prepared to manage your investment in your future.

Understanding Interest Rates

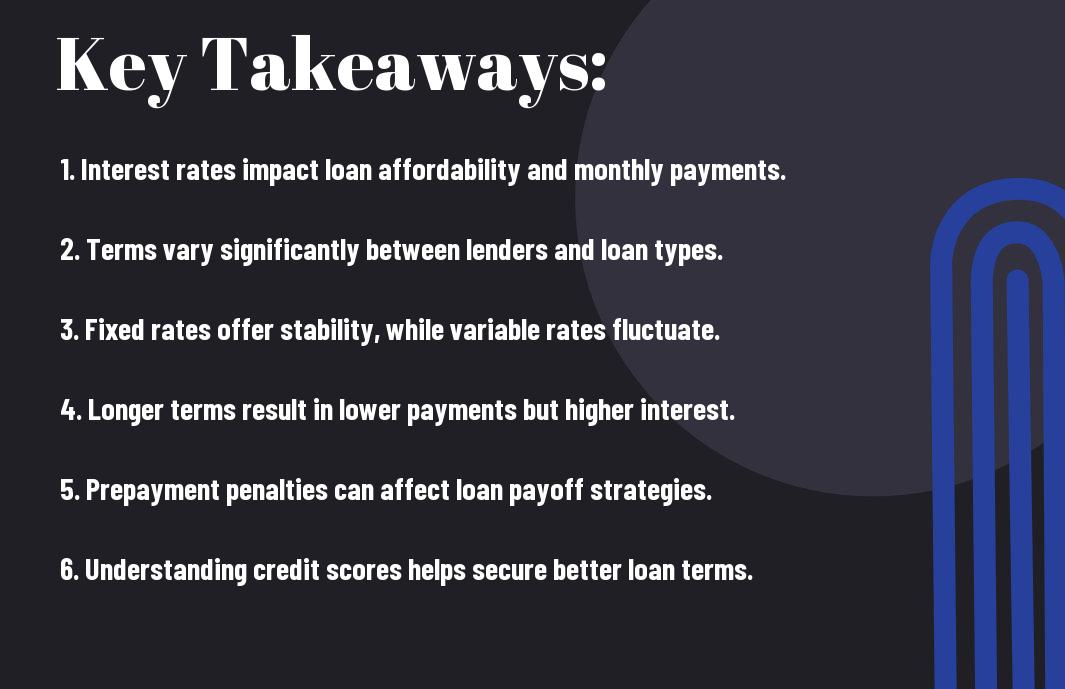

Before stepping into the complexities of doctor loans, it’s imperative to grasp the concept of interest rates. Interest rates determine the cost of borrowing money, impacting your monthly payments and overall financial commitment. A solid understanding of these rates can help you make informed decisions tailored to your unique financial situation.

Types of Interest Rates

Before you explore your loan options, it’s helpful to be familiar with the types of interest rates that may apply. Here are some common types:

- Fixed Rate

- Variable Rate

- Introductory Rate

- Annual Percentage Rate (APR)

- Simple vs. Compound Interest

This knowledge will empower you to choose the right loan that aligns with your financial goals.

| Type | Description |

| Fixed Rate | Interest rate remains constant throughout the loan term. |

| Variable Rate | Interest rate may fluctuate based on market conditions. |

| Introductory Rate | Lower interest offered for a limited time at the start. |

| APR | Total cost of borrowing, including fees and interest. |

| Simple Interest | Interest calculated only on the principal amount. |

Fixed vs Variable Rates

To make the best choice for your financial future, you need to understand fixed and variable rates. Fixed-rate loans offer stability, as your interest rate remains the same for the duration of the loan. In contrast, variable-rate loans can change over time, often leading to fluctuating monthly payments.

At the end of the day, the choice between fixed and variable rates depends on your risk tolerance and financial goals. If you prefer predictability and stability in your finances, a fixed rate might suit you better. On the other hand, if you’re open to fluctuations and possibly lower initial payments, a variable rate could be the right fit. Evaluate your financial landscape thoroughly to decide which option aligns with your needs.

Doctor Loans Explained

The world of doctor loans is tailored specifically for healthcare professionals, providing unique financial solutions to help you secure financing for your home. These loans take into consideration your potential income and educational debts, allowing you to achieve homeownership sooner than traditional mortgages might permit.

What are Doctor Loans?

An array of specialized loan programs, doctor loans are designed to meet the unique needs of medical professionals. These loans often come with favorable terms, such as higher loan limits and lower down payment requirements, making it easier for you to enter the housing market without the usual barriers.

Benefits of Doctor Loans

Besides the appealing financing options, doctor loans offer a myriad of advantages that can enhance your home buying experience. These include flexible underwriting standards, the ability to finance your mortgage without private mortgage insurance (PMI), and often, lower interest rates tailored to your specific career trajectory.

But beyond just financial perks, doctor loans can streamline the application process and reduce the time it takes to close on a home. Given your unique financial situation as a physician, these loans cater to your needs, alleviating some of the stress that often comes with traditional loans. By providing you with options that consider your future earning potential, doctor loans are not just a practical choice but a strategic one for your financial journey.

Loan Terms to Consider

Not all loan terms are created equal, and understanding the various factors involved can help you make informed decisions. When considering doctor loans, you should pay close attention to terms such as loan duration and repayment options. Each aspect can significantly affect the overall cost and manageability of your loan, so it’s crucial to analyze what suits your financial situation best as a physician.

Loan Duration

Above all, the duration of your loan influences your monthly payments and the total interest you will pay over time. Generally, doctor loans can range from 10 to 30 years. A shorter duration may lead to higher monthly payments but lower total interest costs, while a longer duration offers lower payments but results in paying more in interest in the long run.

Repayment Options

Above all, understanding your repayment options can greatly impact your financial wellness. Many lenders offer various repayment structures, including interest-only payments for a specific period, which can be beneficial as you establish your medical career. Alternatively, more traditional repayment plans are available, allowing you to tackle both principal and interest from the outset.

Understanding your repayment options is vital to aligning your payments with your financial goals. You may also encounter options such as graduated repayment plans, which allow your payments to increase over time as your income is expected to grow. Exploring these various structures can help you select a repayment plan that aligns with your income trajectory as a physician and provides peace of mind as you initiate on your career.

The Importance of Credit Score

All physicians seeking doctor loans should understand the significance of their credit score. A strong credit score can unlock better financing options and lower interest rates, ultimately leading to substantial savings over the life of your loan. Lenders view a solid credit score as a sign of reliability, directly impacting the terms of your loans and your overall financial health.

How Credit Affects Loan Terms

With a higher credit score, you can secure more favorable loan terms, such as lower interest rates and reduced fees. Lenders assess your likelihood of repaying the loan based on your credit history. Therefore, a robust credit score can lead to significant savings and enhance your purchasing power when investing in a home or other assets.

Improving Your Credit Score

Across various avenues, you can enhance your credit score through diligent financial management. Regularly checking your credit report, addressing inaccuracies, and making timely payments on existing debts can have a positive impact. Additionally, keeping credit utilization low and diversifying your credit accounts can further bolster your score.

But improving your credit score takes time and consistent effort. Focus on creating a budget that allows you to pay off debts systematically. Establishing a payment schedule can help you stay organized and avoid missed payments. Engaging with a financial advisor may also provide tailored strategies to address your unique financial situation and improve your credit profile over time.

Common Mistakes to Avoid

Now that you are aware of doctor loans, it’s important to steer clear of some common pitfalls. Many physicians unknowingly make decisions that can impact their financial well-being. By learning about these mistakes, you can make informed choices that benefit your long-term financial health.

Misunderstanding Loan Terms

Across various loan options, misunderstandings about terms can lead to unfavorable conditions. It is crucial to familiarize yourself with all aspects of your loan, including interest rates, repayment schedules, and any additional fees. Being clear about these terms will empower you to select the most suitable loan for your situation.

Failing to Shop Around

Beside understanding loan terms, failing to shop around is another mistake many physicians make. It may seem easy to go with the first offer, but exploring multiple lenders can save you significant amounts over time.

It is beneficial for you to compare interest rates, loan terms, and overall costs from different lenders. Taking the time to gather multiple quotes allows you to identify the best deal, or even negotiate better terms with your preferred lender. Not only can shopping around save you money, but it also provides a broader understanding of what’s available in the market, ensuring you make the best choice for your financial future.

Strategies for Financing

Once again, approaching your financing options as a physician requires a strategic mindset. Understand that the type of loan you select can greatly impact your financial future. Doctor loans often provide favorable terms, but it is important to explore all available avenues, such as conventional loans, state or federal programs, and line-of-credit options. Assess your financial landscape to choose a strategy that aligns with your personal and professional goals.

Budgeting for Loan Payments

The key to managing your loan payments effectively is developing a solid budget. Start by outlining your monthly expenses, income, and existing debts to see where your loan payment will fit. Be realistic about your spending habits and consider creating a separate savings fund for unexpected expenses. This disciplined budgeting will help you stay on track and prevent financial stress.

Managing Debt Effectively

After securing financing, managing your debt is vital for maintaining a healthy financial profile. Focus on consolidating your loans where possible and prioritize high-interest debt to minimize costs. Make sure you’re also staying organized with payment deadlines and consider automating your payments to avoid late fees. Regularly reviewing your debt situation could uncover potential strategies for repayment that you hadn’t considered.

Budgeting effectively serves as a foundation for managing your debt. Take the time to review your expenses regularly, and adjust your budget as your financial situation changes. You may benefit from extra payments on higher-interest loans while maintaining minimum payments on lower-interest loans. This approach can accelerate your path toward being debt-free, allowing you to invest more into your future, like retirement or further education.

Final Words

On the whole, understanding interest rates and terms can empower you as a physician in your financial journey, particularly when it comes to securing doctor loans. By familiarizing yourself with how different interest rates affect your payments and the overall terms of your loan, you can make informed decisions that align with your long-term goals. Whether you are looking to buy a home or navigate your financial responsibilities, having a comprehensive grasp of these concepts will enhance your confidence and effectiveness in managing your financial future.