Unlock the Door to Homeownership with Down Payment Assistance

In today’s housing market, rising home prices and fluctuating mortgage rates can make buying a home feel like a challenge. But here’s some good news: there are more resources than ever to help you make homeownership a reality.

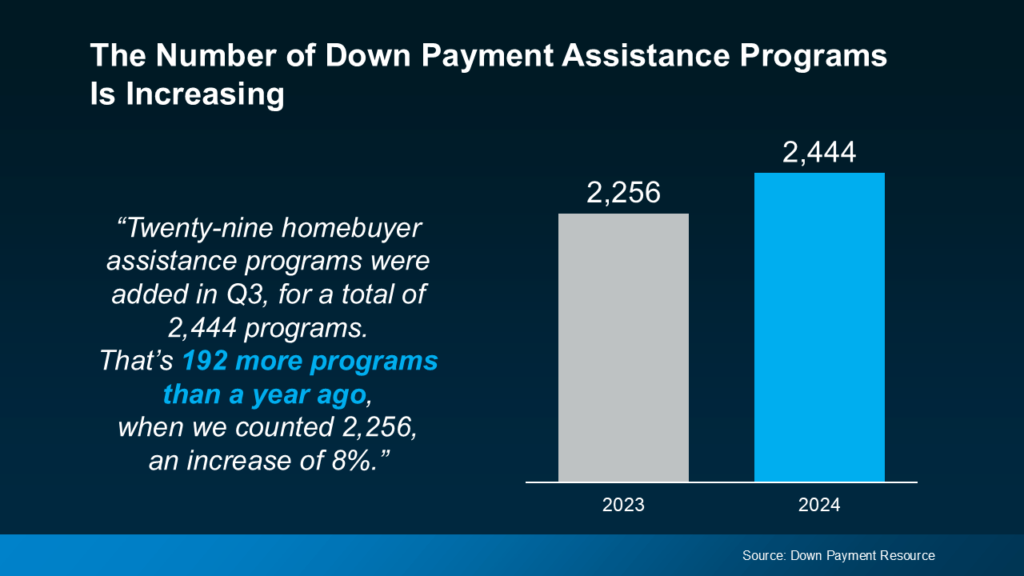

One key resource to explore is down payment assistance (DPA) programs. Over the past year, the number of these programs has grown significantly, offering more opportunities to ease the financial burden of buying a home.

Check out the graph below, based on data from Down Payment Resource, to see just how much these programs have expanded recently.

This could be the opportunity you’ve been waiting for to make your homeownership dream come true.

More Programs, More Opportunities: Unlock Your Path to Homeownership

What does the rise in down payment assistance (DPA) programs mean for you? Simply put, more programs equal more opportunities to achieve your homeownership dreams.

These programs offer significant support—often enough to make a real difference. As Rob Chrane, Founder and CEO of Down Payment Resource, explains:

“We are pleased to see a growing number of these programs, and think they are becoming a targeted way to help first-time and first-generation homebuyers struggling to save for a down payment get into a home they can afford. Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine receiving $17,000 toward your down payment. That kind of assistance could be the boost you need to move from dreaming about homeownership to making it a reality.

Expanded Eligibility for Broader Impact

The growth of DPA programs doesn’t just benefit first-time or first-generation buyers. Many new initiatives also focus on affordable housing, including options for manufactured and multi-family homes. This expansion means more people—and a wider variety of home types—can qualify for assistance, giving you greater flexibility to find the home that suits your needs.

Lean on the Experts for Guidance

With so many options, it’s crucial to connect with real estate and lending professionals who can guide you. According to The Mortgage Reports:

“The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out.”

Your loan officer or real estate agent will have the expertise to identify local programs and match you with the right resources to achieve your goals.

Bottom Line

The rise in down payment assistance programs makes now a great time to explore your options. With expert guidance and these expanded opportunities, your journey to homeownership may be closer than you think. Let’s work together to connect you with the programs that can help you make it happen!