Homeownership is a significant milestone that can be both exciting and daunting, especially for physicians facing unique financial landscapes. This comprehensive guide will help you navigate physician loan programs tailored to your needs, highlighting the benefits and requirements you should consider. By understanding these specialized lending options, you can confidently take the next steps toward securing your dream home while managing your finances effectively. Let’s explore how to unlock your path to homeownership as a physician.

Types of Physician Loan Programs

While exploring your options for home financing, it’s vital to understand the various physician loan programs available to you. Each program has unique features and benefits tailored to meet the needs of medical professionals. Here are the primary types:

| Conventional Loans | Flexible terms with standard underwriting guidelines. |

| FHA Loans | Government-backed loans with lower down payment options. |

| VA Loans | Available to veterans and active-duty military with favorable terms. |

| USDA Loans | For rural properties with no down payment requirement. |

| State-specific Programs | Various programs tailored to local markets for professionals. |

Perceiving these options helps you select the best program for your financial situation.

Conventional Loans

You can choose conventional loans if you prefer flexibility in terms and are comfortable with the standard underwriting criteria. These loans typically require a higher credit score compared to other options, but they may provide more competitive interest rates, especially for those with strong financial profiles.

FHA Loans

While FHA loans can be a great choice for new homeowners, they do come with specific guidelines. The Federal Housing Administration backs these loans, allowing for lower down payments and more accessible borrowing for individuals with less-than-perfect credit.

Plus, FHA loans often have more lenient debt-to-income ratios, enabling you to qualify even if your current financial situation has some constraints, making homeownership more achievable for you.

VA Loans

With VA loans, you can benefit from exceptional financing options if you are a veteran or an active-duty service member. These loans often require no down payment and do not necessitate private mortgage insurance, making them an attractive choice for eligible borrowers.

Loans through the VA program also typically feature competitive interest rates and favorable terms, allowing you to save money upfront while investing in your future home. This option can be incredibly advantageous as you pursue homeownership and build your equity over time.

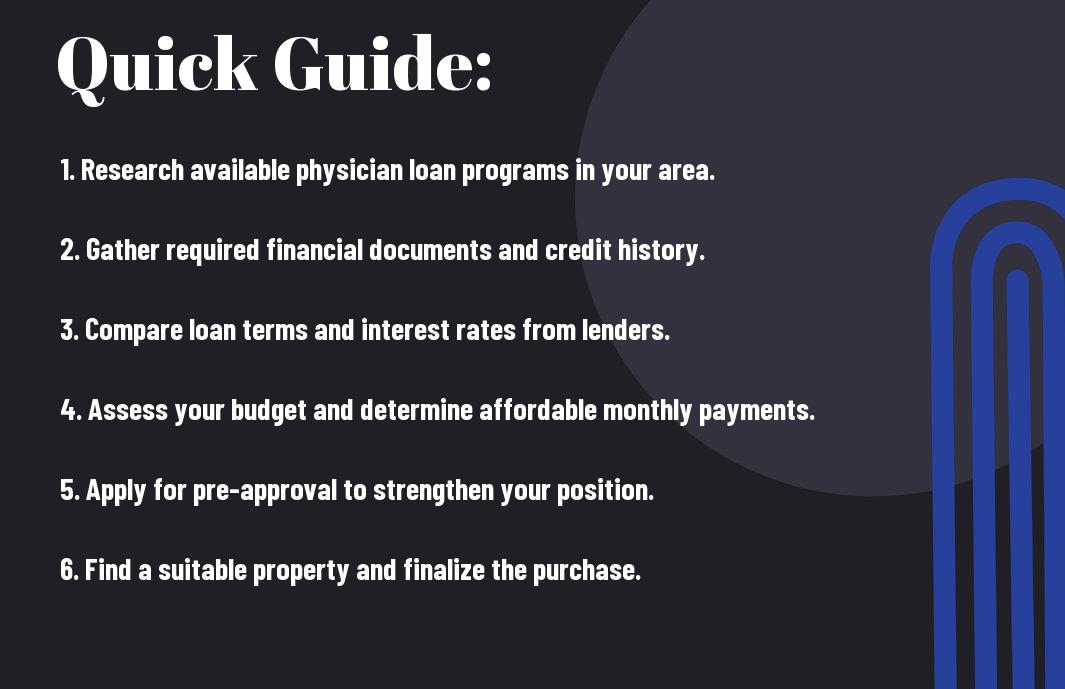

Step-by-Step Process to Apply for a Physician Loan

If you’re considering a physician loan, it helps to understand the step-by-step process. Below is a streamlined guide to help you navigate your application effectively.

Application Process

| Step | Description |

|---|---|

| Step 1 | Research lender options and compare terms. |

| Step 2 | Gather necessary documents for pre-approval. |

| Step 3 | Submit your application for pre-approval. |

| Step 4 | Provide additional documentation as requested. |

| Step 5 | Close on your loan and finalize the purchase. |

Pre-Approval

To begin, getting pre-approved is crucial to determine how much you can borrow. This process requires you to submit basic financial information to your lender.

Documentation Required

Any reputable lender will ask for specific documents to assess your financial profile before approving your loan.

Understanding the documentation typically required includes proof of income, such as your recent pay stubs or tax returns, student loan information, and details about any existing debts. Additionally, lenders may request a copy of your medical license and employment contract. Being organized and prepared with these documents can simplify your application process significantly.

Closing the Loan

On reaching the closing phase, you will finalize the details and sign the necessary paperwork to secure your mortgage.

It’s crucial to review all closing documents carefully and ensure that you understand your obligations and terms of the loan. Closing typically involves paying closing costs, which can be negotiated or rolled into the loan depending on your lender’s policies. Following these steps diligently will pave the way for homeownership.

Key Factors to Consider When Choosing a Loan

Despite the variety of physician loan programs available, selecting the right one involves careful consideration of several key factors. Take the time to evaluate the following:

- Interest rates

- Loan limits

- Lender requirements

Recognizing these aspects can lead you to a loan that suits your financial needs and goals.

Interest Rates

You should closely examine interest rates when choosing a physician loan, as they can significantly affect your monthly payments and overall repayment costs. A lower interest rate can save you thousands over the life of the loan, making it important to compare offers from multiple lenders.

Loan Limits

To make informed decisions about your financing options, you need to understand the loan limits associated with physician loan programs. These limits dictate the maximum amount you can borrow, which can vary based on the lender and your financial situation.

For instance, some lenders offer higher loan limits tailored specifically for physicians, recognizing their potential for future earnings. This accommodation allows you to purchase homes in markets where conventional financing may fall short. Adjusting your expectations based on these limits ensures you target properties you can realistically afford.

Lender Requirements

Requirements can differ significantly between lenders, influencing your eligibility for various loan programs. Factors may include your credit score, debt-to-income ratio, and employment history, all of which play a role in the lending decision.

When you apply for a physician loan, be prepared to provide documentation that demonstrates your financial stability and professional qualifications. Understanding these lender-specific requirements can streamline your application process, increasing your chances of securing favorable terms.

Tips for Successful Homeownership with a Physician Loan

Not all homeownership journeys are the same, especially with a physician loan. To help ensure your success, consider these tips:

- Maintain a clear understanding of your financial health.

- Stay on top of your credit score.

- Communicate openly with your lender about your financial situation.

- Be mindful of your spending habits.

- Plan for unexpected expenses that may arise.

Assume that these strategies will enhance your ability to navigate homeownership confidently.

Building Your Credit

Physician loans often come with lower credit requirements, but building a solid credit history is still vital. Regularly check your credit report for errors and make timely payments on existing debts. Even small changes, like reducing your credit card balances and avoiding new debt, can improve your credit score over time.

Understanding Debt-to-Income Ratio

If you’re considering a physician loan, it’s vital to comprehend your debt-to-income (DTI) ratio. This ratio measures how much of your monthly income goes towards debt repayments. Lenders typically prefer a DTI ratio below 43%, as it indicates a better capacity to manage additional expenses associated with homeownership.

Loan officers use your DTI ratio to assess your financial health. A lower DTI signifies that you have more disposable income available after covering debts, making you a more attractive borrower. To improve your DTI, you might pay off debts or increase your income, which could strengthen your home loan application.

Setting a Budget

Now that you’re considering a physician loan, establishing a budget is the foundation for responsible homeownership. Create a detailed budget that factors in all your monthly expenses, including mortgage payments, insurance, maintenance, and utilities. By analyzing your cash flow, you can ensure that homeownership remains a manageable and enjoyable experience.

Budgeting effectively involves distinguishing between wants and needs. Allocate funds for vital expenses first, then look at your discretionary spending. By planning carefully and setting realistic limits, you can create a sustainable financial lifestyle that accommodates both your personal and professional commitments.

Pros and Cons of Physician Loan Programs

After exploring physician loan programs, it’s crucial to weigh the benefits and drawbacks. Understanding the pros and cons can help you make an informed decision as you consider your options for homeownership.

Pros and Cons

| Pros | Cons |

|---|---|

| Low or no down payment | Higher interest rates |

| No private mortgage insurance (PMI) | Limited lender options |

| Flexible debt-to-income ratios | Stricter documentation requirements |

| Designed for recent graduates | Potential for higher overall costs |

| Potential to buy in competitive markets | May not be available for all specialties |

Advantages

Some benefits of physician loan programs include minimal down payment options and the absence of private mortgage insurance (PMI). This financial flexibility allows you to enter the housing market sooner, making homeownership more accessible. Additionally, these programs often cater to your unique situation as a new physician, considering your income potential rather than your current financial obligations.

Disadvantages

Assuming you choose a physician loan program, you should be aware of potential downsides. The most significant drawbacks are higher interest rates and limited lender options, which may impact your overall financial situation over time.

With higher interest rates, while you may save upfront with a lower down payment, you could end up paying more in interest throughout the life of the loan. Additionally, the limited availability of lenders offering these programs may constrain your choices, making it difficult to find the most favorable terms. Carefully evaluating these factors against the advantages will help you determine the best path for your homeownership journey.

Common Questions About Physician Loan Programs

Now that you’re considering a physician loan program, you likely have several questions. Understanding how these specialized loans work can help you make informed decisions about your future homeownership. In this section, we will address some common queries, including eligibility criteria and loan repayment terms, ensuring you have all the information needed to navigate your options effectively.

Eligibility Criteria

Physician loan programs typically cater to individuals in medical professions, including physicians, dentists, and pharmacists. To qualify, you often need to provide proof of your occupation, which may include a medical degree, residency paperwork, or a valid medical license. Lenders may also consider factors like your credit score, debt-to-income ratio, and employment history to determine your eligibility.

Loan Repayment Terms

Loan repayment terms for physician loans are generally designed to accommodate your unique financial situation. This may include longer repayment periods and lower down payment requirements, allowing for a more manageable financial commitment as you transition into your career.

Understanding the loan repayment terms can empower you to align your payments with your budget. Many physician loan programs offer flexible repayment options, such as fixed or adjustable rates, and some may allow for deferment during residency. This flexibility can provide you with peace of mind as you start your practice while managing student loans and other expenses. Be sure to review each program’s specific terms to find the best fit for your financial goals.

Summing up

As a reminder, understanding physician loan programs can significantly enhance your path to homeownership. These specialized loans cater to your unique financial situation, empowering you to secure your dream home without compromising your professional goals. By leveraging the benefits of these programs—like low down payments and favorable terms—you can navigate the real estate landscape with confidence. Your journey towards homeownership is within reach, and the knowledge you’ve gained here will serve as a valuable resource as you take the next steps in your financial future.