What to Expect: A Look Toward 2025

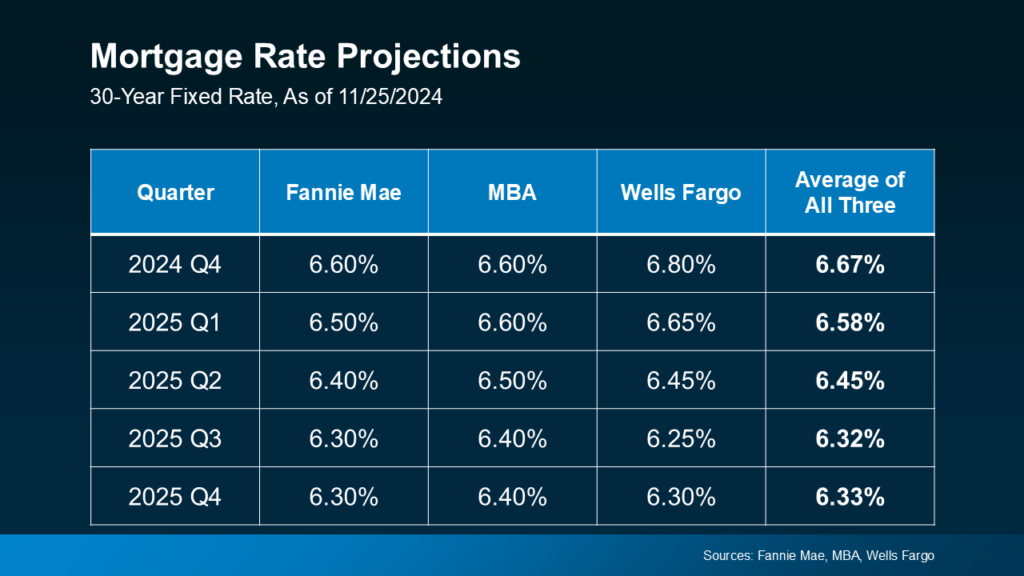

Recent forecasts indicate that mortgage rates could begin to stabilize in the coming year. After a period of volatility and uncertainty, experts anticipate a gradual easing, bringing rates down from their current highs.

Here’s what the latest projections suggest:

(Include graph or visual aid here)

Stay tuned as we continue to track trends and keep you informed about shifts in the mortgage landscape. For now, it’s reassuring to know that relief may be on the horizon.

Expert Insights on Mortgage Rates: What to Watch

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“While mortgage rates remain elevated, they are expected to stabilize.”

But when, and by how much, is harder to pin down.

The Key Factors Shaping Mortgage Rates

Forecasting mortgage rates is one of the most complex challenges in the housing market. Rates depend on several dynamic factors, making them a moving target. While a slight decrease is expected, ongoing economic shifts will keep things unpredictable. Here are the top factors likely to influence the future of mortgage rates:

Inflation

- Cooling inflation could ease pressure on rates.

- Persistently high inflation, however, may keep rates elevated.

Unemployment Rate

- A shifting unemployment rate affects the Federal Reserve’s policy decisions. While the Fed doesn’t directly set mortgage rates, their actions influence the broader financial market.

Government Policies

- With a new administration taking office in January, changes to fiscal and monetary policies could sway market conditions, indirectly impacting rates.

What You Can Do Now

Since rates remain uncertain, timing the market isn’t the best strategy. Instead, focus on what you can control:

- Boost Your Credit Score: A higher score can help you secure better loan terms.

- Save for Your Down Payment: Building a solid financial foundation puts you in a stronger position.

- Automate Your Savings: Consistent saving adds up and makes the process seamless.

Finally, stay informed. Connect with a trusted real estate agent and lender to get the latest updates and personalized advice.

Bottom Line

If you’re planning a move or looking to buy, staying informed is key. Let’s connect so you can better understand how today’s shifting rates impact your home-buying journey. Together, we’ll create a plan that works for your goal.