Deciding whether to rent or buy a home? One critical factor to consider is how much owning a home can impact your net worth over time.

Every three years, the Federal Reserve Board releases the Survey of Consumer Finances (SCF), a comprehensive report on the financial health of American households. This report consistently reveals a striking wealth gap between homeowners and renters.

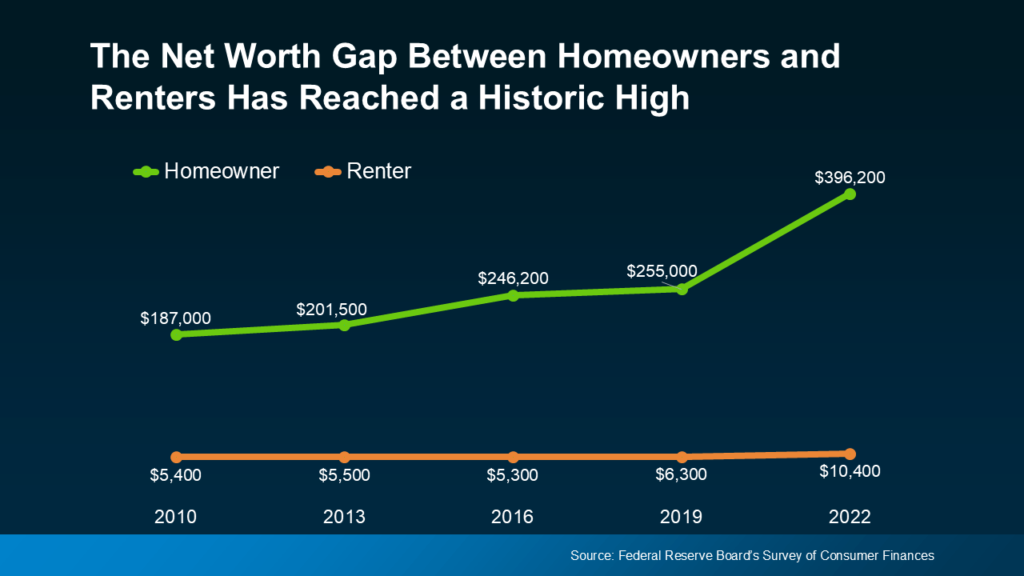

On average, homeowners have nearly 40 times the net worth of renters. Take a look at the graph below to see just how impactful homeownership can be on building wealth.

Why Homeowner Wealth Is So High

In the previous edition of the report, the average homeowner’s net worth was approximately $255,000, compared to just $6,300 for the average renter—a substantial gap. However, in the latest update, this difference has widened even further as homeowner wealth continues to climb (see the graph below):

Why Homeowner Wealth Has Surged

As noted in the SCF report:

“…the 2019-2022 growth in median net worth was the largest three-year increase over the history of the modern SCF, more than double the next-largest one on record.”

A key factor driving this wealth growth for homeowners is home equity. Equity is the difference between your home’s current value and what you owe on your mortgage. It builds over time as you pay down your mortgage and as your property value appreciates.

In recent years, home prices have increased significantly, largely due to a shortage of available homes amid high demand. This imbalance pushed prices up rapidly, leading to faster equity growth and a significant boost in net worth for homeowners.

If you’re weighing the decision to rent or buy, here’s an important point: While inventory has increased slightly this year, demand still outweighs supply in most areas. That’s why experts predict home prices will continue rising nationally next year, though at a more moderate pace.

While this doesn’t mirror the rapid appreciation seen during the pandemic, it still presents an opportunity for equity growth if you decide to buy now. As Ksenia Potapov, Economist at First American, explains:

“Despite the risk of volatility in the housing market, homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.”

Of course, prices and available inventory vary by location. A trusted local real estate agent can provide you with market-specific insights and guide you on the other financial and lifestyle benefits of owning a home. As Bankrate advises:

“Deciding between renting and buying a home isn’t just about cost — it’s a decision that involves long-term financial strategies and personal circumstances. Speaking with a local real estate agent who knows your market can help you weigh your options and make a more informed choice.”

Bottom Line

If you’re considering buying versus renting, remember that, over time, owning a home can significantly grow your wealth. And if homeownership feels out of reach right now, let’s connect to explore options that could make it possible for you.