Ever heard the saying, “Don’t believe everything you hear”? This couldn’t be more true when it comes to navigating today’s housing market. With so much misinformation swirling around, it’s crucial to have a reliable source to guide you.

By partnering with a real estate agent, you gain access to someone who can dispel common myths and provide reassurance grounded in research and facts. Here are a few common misconceptions they can help you debunk:

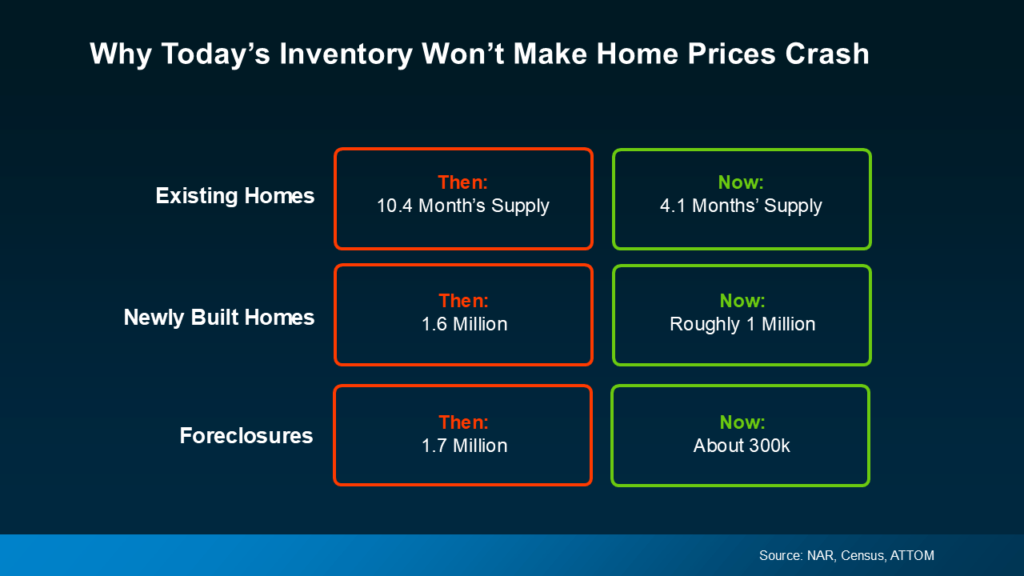

- “I’ll Get a Better Deal When Prices Crash” If you’re waiting for home prices to plummet, it’s important to reconsider. While prices do fluctuate depending on the local market, data from various sources consistently shows that a crash isn’t on the horizon. The situation in 2008, characterized by an oversupply of homes, led to a significant price drop. Today’s market is the opposite, with a shortage of available homes, creating a completely different scenario (see chart below):

So, if you’re holding out for a better deal, it’s important to understand that the data suggests a crash isn’t coming. Waiting might not yield the payoff you’re hoping for.

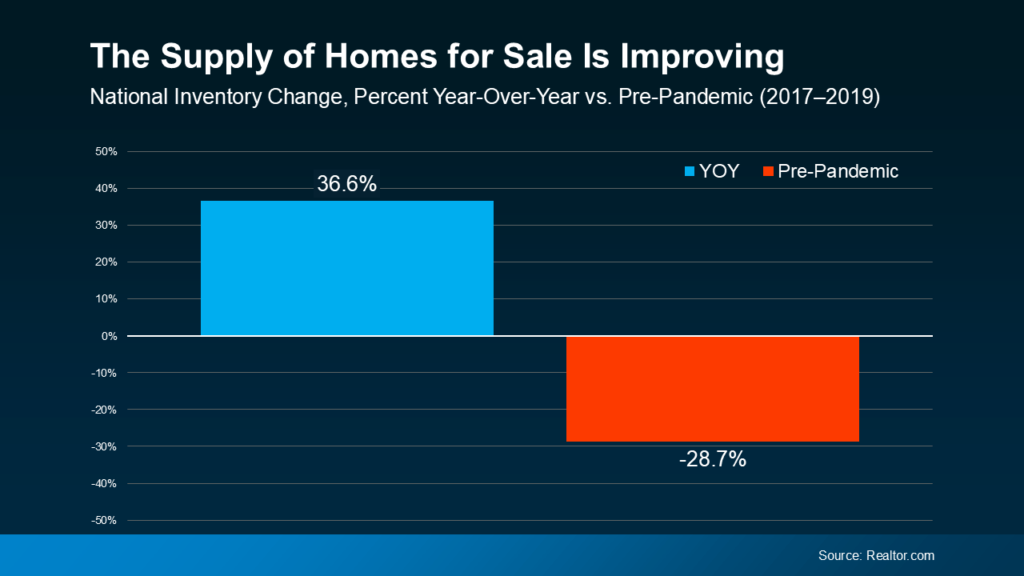

- “I Won’t Be Able To Find Anything To Buy” If the fear of not finding the right home is keeping you from making a move, it might be time to consult with a knowledgeable real estate agent. Over the past year, the inventory of homes for sale has increased. According to data from Realtor.com, while there are still fewer homes available compared to a typical year like 2019, inventory levels have risen compared to this time last year (see graph below):

If you’re still thinking about the media buzz during the pandemic regarding record-low housing supply, you can relax a bit. While the market hasn’t fully returned to normal, inventory is trending in a healthier direction. With more options becoming available, you can finally set aside this outdated myth—finding a home won’t feel nearly as daunting as before.

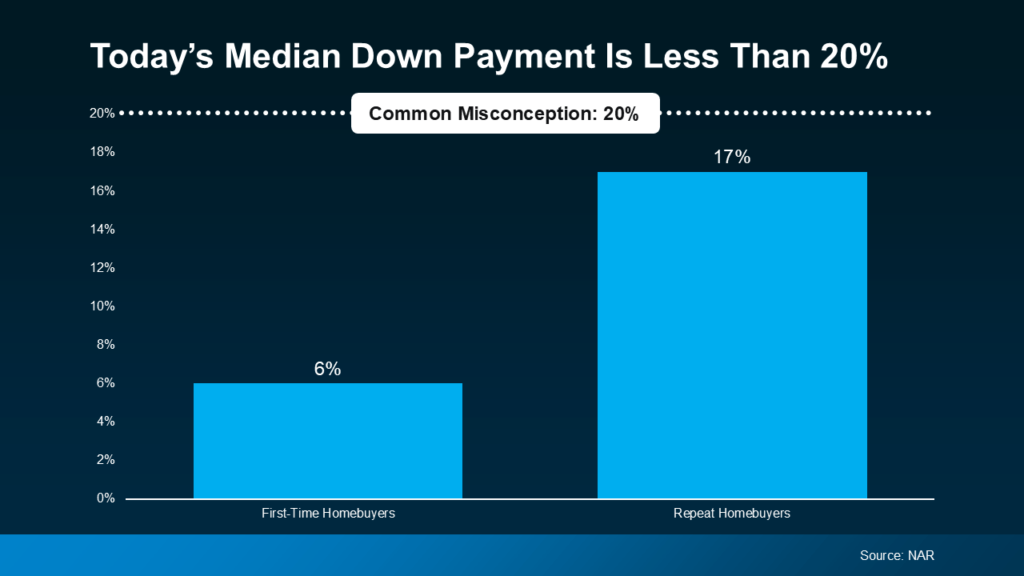

“I Have To Wait Until I Have Enough for a 20% Down Payment” Many believe that a 20% down payment is necessary to buy a home. This misconception is surprisingly common; according to Fannie Mae:

“Approximately 90% of consumers overstate or don’t know the minimum required down payment for a typical mortgage.”

Data from the National Association of Realtors (NAR) reveals that the average homebuyer is putting down far less than you might think (see graph below):

First-time homebuyers are typically putting down just 6%, much lower than the widely believed 20%. If you’re concerned about repeat buyers putting down closer to 20%, remember, this is often because they’re leveraging the equity built up in their current home for a larger down payment on their next one.

The reality is, unless required by your loan type or lender, you don’t need to put 20% down. Many buyers contribute far less, and depending on your mortgage, you might only need to put down 3.5% or even 0%. So, if you’re a first-time buyer, the amount you need for a down payment is likely much less than you think.

The Agent’s Role in Busting Myths

If you’ve put your plans on hold because of these common myths, it’s time to reach out to a trusted real estate agent. An experienced agent can provide data and facts to dispel any misconceptions that might be holding you back.

Bottom Line

If you’re unsure about what you’ve heard or read, let’s connect. You deserve someone you can trust to provide accurate information.